Hedge funds and other investment firms that we track manage billions of dollars of their wealthy clients’ money, and needless to say, they are painstakingly thorough when analyzing where to invest this money, as their own wealth depends on it. Regardless of the various methods used by elite investors like David Tepper and Dan Loeb, the resources they expend are second-to-none. This is especially valuable when it comes to small-cap stocks, which is where they generate their strongest outperformance, as their resources give them a huge edge when it comes to studying these stocks compared to the average investor, which is why we intently follow their activity in the small-cap space.

Meta Financial Group Inc. (NASDAQ:CASH) has seen a decrease in activity from the world’s largest hedge funds in recent months. Our calculations also showed that cash isn’t among the 30 most popular stocks among hedge funds.

Today there are tons of gauges stock traders can use to appraise their stock investments. A pair of the less utilized gauges are hedge fund and insider trading sentiment. We have shown that, historically, those who follow the best picks of the best money managers can beat the S&P 500 by a superb margin (see the details here).

Let’s take a look at the new hedge fund action regarding Meta Financial Group Inc. (NASDAQ:CASH).

Hedge fund activity in Meta Financial Group Inc. (NASDAQ:CASH)

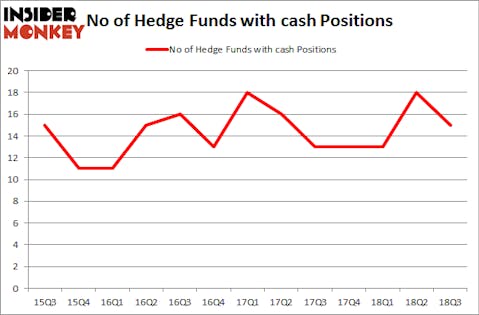

At Q3’s end, a total of 15 of the hedge funds tracked by Insider Monkey were long this stock, a change of -17% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards CASH over the last 13 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists an “upper tier” of key hedge fund managers who were upping their stakes meaningfully (or already accumulated large positions).

The largest stake in Meta Financial Group Inc. (NASDAQ:CASH) was held by Nantahala Capital Management, which reported holding $44.6 million worth of stock at the end of September. It was followed by Second Curve Capital with a $24.1 million position. Other investors bullish on the company included Harvest Capital Strategies, Driehaus Capital, and Hawk Ridge Management.

Since Meta Financial Group Inc. (NASDAQ:CASH) has faced falling interest from the aggregate hedge fund industry, we can see that there lies a certain “tier” of money managers who were dropping their positions entirely by the end of the third quarter. Intriguingly, John Osterweis’s Osterweis Capital Management dumped the largest stake of all the hedgies followed by Insider Monkey, comprising close to $4.8 million in stock, and Jamie Mendola’s Pacific Grove Capital was right behind this move, as the fund dropped about $4.4 million worth. These moves are interesting, as aggregate hedge fund interest was cut by 3 funds by the end of the third quarter.

Let’s go over hedge fund activity in other stocks similar to Meta Financial Group Inc. (NASDAQ:CASH). These stocks are Nuveen Credit Strategies Income Fund (NYSE:JQC), NV5 Global, Inc. (NASDAQ:NVEE), PJT Partners Inc (NYSE:PJT), and Quad/Graphics, Inc. (NYSE:QUAD). This group of stocks’ market values are closest to CASH’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| JQC | 5 | 71933 | -2 |

| NVEE | 13 | 54179 | 5 |

| PJT | 17 | 135029 | 2 |

| QUAD | 13 | 29317 | 1 |

| Average | 12 | 72615 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12 hedge funds with bullish positions and the average amount invested in these stocks was $73 million. That figure was $106 million in CASH’s case. PJT Partners Inc (NYSE:PJT) is the most popular stock in this table. On the other hand Nuveen Credit Strategies Income Fund (NYSE:JQC) is the least popular one with only 5 bullish hedge fund positions. Meta Financial Group Inc. (NASDAQ:CASH) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard PJT might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.