We know that hedge funds generate strong, risk-adjusted returns over the long run, therefore imitating the picks that they are collectively bullish on can be a profitable strategy for retail investors. With billions of dollars in assets, smart money investors have to conduct complex analyses, spend many resources and use tools that are not always available for the general crowd. This doesn’t mean that they don’t have occasional colossal losses; they do (like Peltz’s recent General Electric losses). However, it is still good idea to keep an eye on hedge fund activity. With this in mind, as the current round of 13F filings has just ended, let’s examine the smart money sentiment towards Iteris Inc (NASDAQ:ITI).

Is Iteris Inc (NASDAQ:ITI) a bargain? Investors who are in the know are taking a bearish view. The number of bullish hedge fund bets decreased by 2 in recent months. Our calculations also showed that ITI isn’t among the 30 most popular stocks among hedge funds.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

We’re going to take a look at the new hedge fund action surrounding Iteris Inc (NYSEAMEX:ITI).

Hedge fund activity in Iteris Inc (NASDAQ:ITI)

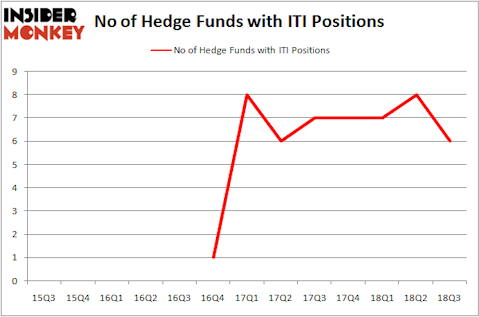

At the end of the third quarter, a total of 6 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -25% from the previous quarter. The graph below displays the number of hedge funds with bullish position in ITI over the last 13 quarters. With hedgies’ sentiment swirling, there exists an “upper tier” of notable hedge fund managers who were increasing their holdings considerably (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Chuck Royce’s Royce & Associates has the biggest position in Iteris Inc (NASDAQ:ITI), worth close to $6.5 million, accounting for less than 0.1%% of its total 13F portfolio. The second largest stake is held by Renaissance Technologies, managed by Jim Simons, which holds a $3.1 million position; less than 0.1%% of its 13F portfolio is allocated to the stock. Some other professional money managers that are bullish comprise Philip Hempleman’s Ardsley Partners, Frederick DiSanto’s Ancora Advisors and Adam Usdan’s Trellus Management Company.

Judging by the fact that Iteris Inc (NASDAQ:ITI) has faced bearish sentiment from hedge fund managers, it’s safe to say that there is a sect of fund managers that elected to cut their full holdings heading into Q3. Intriguingly, Charles Frumberg’s Emancipation Capital sold off the largest investment of the 700 funds tracked by Insider Monkey, totaling about $0.2 million in stock, and Jay Petschek and Steven Major’s Corsair Capital Management was right behind this move, as the fund sold off about $0.1 million worth. These moves are interesting, as aggregate hedge fund interest fell by 2 funds heading into Q3.

Let’s go over hedge fund activity in other stocks similar to Iteris Inc (NASDAQ:ITI). These stocks are The Eastern Company (NASDAQ:EML), Invuity, Inc. (NASDAQ:IVTY), Vuzix Corporation (NASDAQ:VUZI), and Akoustis Technologies, Inc. (NASDAQ:AKTS). This group of stocks’ market valuations are closest to ITI’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EML | 7 | 41064 | 0 |

| IVTY | 12 | 41213 | 5 |

| VUZI | 2 | 800 | -1 |

| AKTS | 4 | 3884 | 1 |

| Average | 6.25 | 21740 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 6.25 hedge funds with bullish positions and the average amount invested in these stocks was $22 million. That figure was $13 million in ITI’s case. Invuity, Inc. (NASDAQ:IVTY) is the most popular stock in this table. On the other hand Vuzix Corporation (NASDAQ:VUZI) is the least popular one with only 2 bullish hedge fund positions. Iteris Inc (NASDAQ:ITI) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard IVTY might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.