“October lived up to its scary reputation—the S&P 500 falling in the month by the largest amount in the last 40 years, the only worse Octobers being ’08 and the Crash of ’87. For perspective, there have been only 5 occasions in those 40 years when the S&P 500 declined by greater than 20% from peak to trough. Other than the ’87 Crash, all were during recessions. There were 17 other instances, over the same time frame, when the market fell by over 10% but less than 20%. Furthermore, this is the 18th correction of 5% or more since the current bull market started in March ’09. Corrections are the norm. They can be healthy as they often undo market complacency—overbought levels—potentially allowing the market to base and move even higher.” This is how Trapeze Asset Management summarized the recent market moves in its investor letter. We pay attention to what hedge funds are doing in a particular stock before considering a potential investment because it works for us. So let’s take a glance at the smart money sentiment towards one of the stocks hedge funds invest in.

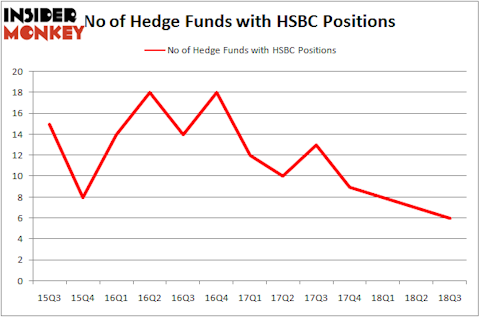

HSBC Holdings plc (NYSE:HSBC) investors should be aware of a decrease in hedge fund sentiment in recent months. HSBC was in 6 hedge funds’ portfolios at the end of the third quarter of 2018. There were 7 hedge funds in our database with HSBC positions at the end of the previous quarter. Our calculations also showed that HSBC isn’t among the 30 most popular stocks among hedge funds.

At the moment there are a lot of metrics shareholders can use to assess publicly traded companies. Some of the less known metrics are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can beat their index-focused peers by a superb amount (see the details here).

We’re going to take a look at the key hedge fund action regarding HSBC Holdings plc (NYSE:HSBC).

How have hedgies been trading HSBC Holdings plc (NYSE:HSBC)?

At the end of the third quarter, a total of 6 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -14% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in HSBC over the last 13 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in HSBC Holdings plc (NYSE:HSBC) was held by Fisher Asset Management, which reported holding $691.8 million worth of stock at the end of September. It was followed by Renaissance Technologies with a $16.9 million position. Other investors bullish on the company included Citadel Investment Group, Manatuck Hill Partners, and PEAK6 Capital Management.

Since HSBC Holdings plc (NYSE:HSBC) has experienced bearish sentiment from the aggregate hedge fund industry, it’s easy to see that there exists a select few hedge funds that decided to sell off their full holdings in the third quarter. At the top of the heap, Ken Griffin’s Citadel Investment Group said goodbye to the largest investment of the 700 funds followed by Insider Monkey, valued at about $1.2 million in stock, and Matthew Tewksbury’s Stevens Capital Management was right behind this move, as the fund said goodbye to about $0.4 million worth. These bearish behaviors are important to note, as total hedge fund interest was cut by 1 funds in the third quarter.

Let’s also examine hedge fund activity in other stocks similar to HSBC Holdings plc (NYSE:HSBC). We will take a look at The Walt Disney Company (NYSE:DIS), Anheuser-Busch InBev SA/NV (NYSE:BUD), NVIDIA Corporation (NASDAQ:NVDA), and TOTAL S.A. (NYSE:TOT). This group of stocks’ market values resemble HSBC’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DIS | 63 | 4911677 | 11 |

| BUD | 20 | 1613876 | -1 |

| NVDA | 56 | 4087785 | -1 |

| TOT | 13 | 1101532 | 0 |

| Average | 38 | 2928718 | 2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 38 hedge funds with bullish positions and the average amount invested in these stocks was $2.93 billion. That figure was $716 million in HSBC’s case. The Walt Disney Company (NYSE:DIS) is the most popular stock in this table. On the other hand TOTAL S.A. (NYSE:TOT) is the least popular one with only 13 bullish hedge fund positions. Compared to these stocks HSBC Holdings plc (NYSE:HSBC) is even less popular than TOT. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None. This article was originally published at Insider Monkey.