You probably know from experience that there is not as much information on small-cap companies as there is on large companies. Of course, this makes it really hard and difficult for individual investors to make proper and accurate analysis of certain small-cap companies. However, well-known and successful hedge fund investors like Carl Icahn and George Soros hold the necessary resources and abilities to conduct an extensive stock analysis on small-cap stocks, which enable them to make millions of dollars by identifying potential winners within the small-cap galaxy of stocks. This represents the main reason why Insider Monkey takes notice of the hedge fund activity in these overlooked stocks.

Hill International Inc (NYSE:HIL) has seen a decrease in activity from the world’s largest hedge funds of late. HIL was in 8 hedge funds’ portfolios at the end of September. There were 9 hedge funds in our database with HIL positions at the end of the previous quarter. At the end of this article we will also compare HIL to other stocks including Exa Corp (NASDAQ:EXA), KongZhong Corporation(ADR) (NASDAQ:KZ), and Orchid Island Capital Inc (NYSE:ORC) to get a better sense of its popularity.

Follow Hill International Inc. (NYSE:HIL)

Follow Hill International Inc. (NYSE:HIL)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

24Novembers/Shutterstock.com

Now, we’re going to check out the fresh action regarding Hill International Inc (NYSE:HIL).

What does the smart money think about Hill International Inc (NYSE:HIL)?

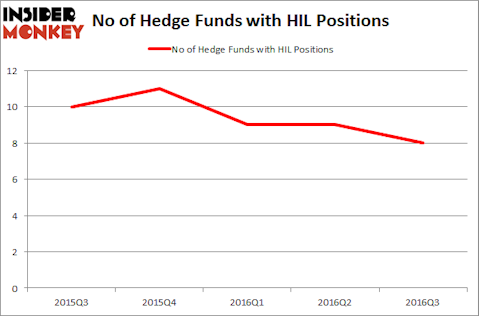

Heading into the fourth quarter of 2016, a total of 8 of the hedge funds tracked by Insider Monkey held long positions in this stock, a decline of 11% from the previous quarter. The graph below displays the number of hedge funds with bullish position in HIL over the last 5 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Bulldog Investors, led by Phillip Goldstein, Andrew Dakos and Steven Samuels, holds the most valuable position in Hill International Inc (NYSE:HIL). According to regulatory filings, the fund has a $17.9 million position in the stock, comprising 4% of its 13F portfolio. The second most bullish fund manager is Rutabaga Capital Management, led by Peter Schliemann, holding a $7.1 million position; 1.4% of its 13F portfolio is allocated to the stock. Other professional money managers with similar optimism comprise Renaissance Technologies, one of the largest hedge funds in the world, Arnaud Ajdler’s Engine Capital and Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital. We should note that Engine Capital is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

We view hedge fund activity in the Hill International Inc (NYSE:HIL) stock unfavorable, but in this case there was only a single hedge fund selling its entire position: Algert Coldiron Investors. One hedge fund selling its entire position doesn’t always imply a bearish intent. Theoretically a hedge fund may decide to sell a promising position in order to invest the proceeds in a more promising idea. However, we don’t think this is the case in this case because none of the 700+ hedge funds tracked by Insider Monkey identified HIL as a viable investment and initiated a position in the stock.

Let’s now review hedge fund activity in other stocks similar to Hill International Inc (NYSE:HIL). We will take a look at Exa Corp (NASDAQ:EXA), KongZhong Corporation (ADR) (NASDAQ:KZ), Orchid Island Capital Inc (NYSE:ORC), and Immersion Corporation (NASDAQ:IMMR). All of these stocks’ market caps are closest to HIL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EXA | 6 | 22085 | 3 |

| KZ | 3 | 6615 | 0 |

| ORC | 4 | 9936 | 4 |

| IMMR | 14 | 101608 | -6 |

As you can see these stocks had an average of 7 hedge funds with bullish positions and the average amount invested in these stocks was $35 million. That figure was $30 million in HIL’s case. Immersion Corporation (NASDAQ:IMMR) is the most popular stock in this table. On the other hand KongZhong Corporation (ADR) (NASDAQ:KZ) is the least popular one with only 3 bullish hedge fund positions. Hill International Inc (NYSE:HIL) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard IMMR might be a better candidate to consider taking a long position in.

Disclosure: None