We at Insider Monkey have gone over 700 13F filings that hedge funds and prominent investors are required to file by the SEC. The 13F filings show the funds’ and investors’ portfolio positions as of September 30th. In this article we look at what those investors think of GW Pharmaceuticals plc (NASDAQ:GWPH).

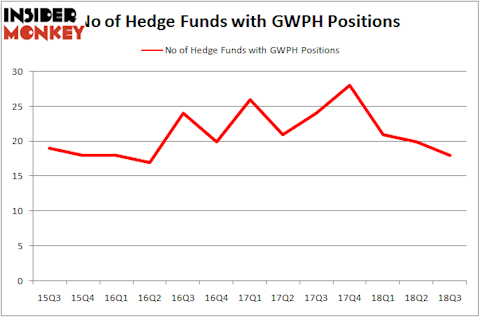

GW Pharmaceuticals plc (NASDAQ:GWPH) was in 18 hedge funds’ portfolios at the end of the third quarter of 2018. GWPH has experienced a decrease in enthusiasm from smart money of late. There were 20 hedge funds in our database with GWPH holdings at the end of the previous quarter. Our calculations also showed that GWPH isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools stock traders can use to appraise stocks. A duo of the most useful tools are hedge fund and insider trading moves. We have shown that, historically, those who follow the best picks of the top fund managers can trounce the broader indices by a very impressive amount (see the details here).

We’re going to view the latest hedge fund action regarding GW Pharmaceuticals plc (NASDAQ:GWPH).

How are hedge funds trading GW Pharmaceuticals plc (NASDAQ:GWPH)?

At the end of the third quarter, a total of 18 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -10% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in GWPH over the last 13 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists an “upper tier” of notable hedge fund managers who were adding to their stakes significantly (or already accumulated large positions).

The largest stake in GW Pharmaceuticals plc (NASDAQ:GWPH) was held by Scopia Capital, which reported holding $256.9 million worth of stock at the end of September. It was followed by Citadel Investment Group with a $159.9 million position. Other investors bullish on the company included Rock Springs Capital Management, Baker Bros. Advisors, and Citadel Investment Group.

Judging by the fact that GW Pharmaceuticals plc (NASDAQ:GWPH) has witnessed falling interest from the smart money, it’s easy to see that there exists a select few fund managers that slashed their full holdings by the end of the third quarter. At the top of the heap, Mitchell Blutt’s Consonance Capital Management cut the biggest position of the 700 funds watched by Insider Monkey, comprising an estimated $50.8 million in stock, and Jason Karp’s Tourbillon Capital Partners was right behind this move, as the fund dumped about $9.9 million worth. These transactions are important to note, as total hedge fund interest dropped by 2 funds by the end of the third quarter.

Let’s also examine hedge fund activity in other stocks similar to GW Pharmaceuticals plc (NASDAQ:GWPH). We will take a look at Zscaler, Inc. (NASDAQ:ZS), Toll Brothers Inc (NYSE:TOL), NovoCure Limited (NASDAQ:NVCR), and nVent Electric plc (NYSE:NVT). This group of stocks’ market caps are similar to GWPH’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ZS | 28 | 183815 | 10 |

| TOL | 32 | 511675 | 13 |

| NVCR | 20 | 284799 | 3 |

| NVT | 29 | 1208395 | 5 |

| Average | 27.25 | 547171 | 7.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 27.25 hedge funds with bullish positions and the average amount invested in these stocks was $547 million. That figure was $626 million in GWPH’s case. Toll Brothers Inc (NYSE:TOL) is the most popular stock in this table. On the other hand NovoCure Limited (NASDAQ:NVCR) is the least popular one with only 20 bullish hedge fund positions. Compared to these stocks GW Pharmaceuticals plc (NASDAQ:GWPH) is even less popular than NVCR. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None. This article was originally published at Insider Monkey.