As we already know from media reports and hedge fund investor letters, many hedge funds lost money in October, blaming macroeconomic conditions and unpredictable events that hit several sectors, with healthcare among them. Nevertheless, most investors decided to stick to their bullish theses and their long-term focus allows us to profit from the recent declines. In particular, let’s take a look at what hedge funds think about Cenovus Energy Inc (NYSE:CVE) in this article.

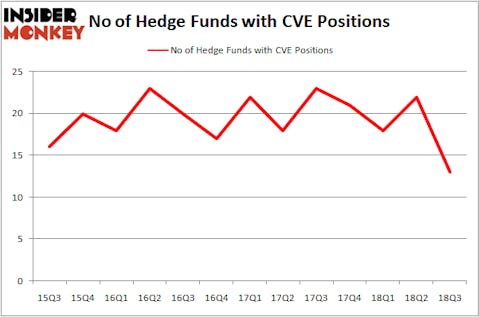

Cenovus Energy Inc (NYSE:CVE) investors should pay attention to a decrease in hedge fund sentiment recently. Our calculations also showed that CVE isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to go over the recent hedge fund action surrounding Cenovus Energy Inc (NYSE:CVE).

How are hedge funds trading Cenovus Energy Inc (NYSE:CVE)?

Heading into the fourth quarter of 2018, a total of 13 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -41% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in CVE over the last 13 quarters. With the smart money’s capital changing hands, there exists a few noteworthy hedge fund managers who were upping their stakes meaningfully (or already accumulated large positions).

More specifically, Pzena Investment Management was the largest shareholder of Cenovus Energy Inc (NYSE:CVE), with a stake worth $198.6 million reported as of the end of September. Trailing Pzena Investment Management was Luminus Management, which amassed a stake valued at $78.4 million. D E Shaw, Point72 Asset Management, and Citadel Investment Group were also very fond of the stock, giving the stock large weights in their portfolios.

Seeing as Cenovus Energy Inc (NYSE:CVE) has experienced declining sentiment from the entirety of the hedge funds we track, we can see that there were a few hedgies who were dropping their full holdings last quarter. Interestingly, Jonathon Jacobson’s Highfields Capital Management cut the largest investment of the “upper crust” of funds monitored by Insider Monkey, valued at about $161.7 million in stock. Alex Snow’s fund, Lansdowne Partners, also sold off its stock, about $44.7 million worth. These bearish behaviors are interesting, as aggregate hedge fund interest was cut by 9 funds last quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Cenovus Energy Inc (NYSE:CVE) but similarly valued. These stocks are HEICO Corporation (NYSE:HEI), HollyFrontier Corporation (NYSE:HFC), Seattle Genetics, Inc. (NASDAQ:SGEN), and Teleflex Incorporated (NYSE:TFX). This group of stocks’ market values resemble CVE’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HEI | 30 | 866787 | 10 |

| HFC | 26 | 627597 | 1 |

| SGEN | 15 | 4295030 | -3 |

| TFX | 17 | 728223 | -11 |

| Average | 22 | 1629409 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22 hedge funds with bullish positions and the average amount invested in these stocks was $1.63 billion. That figure was $394 million in CVE’s case. HEICO Corporation (NYSE:HEI) is the most popular stock in this table. On the other hand Seattle Genetics, Inc. (NASDAQ:SGEN) is the least popular one with only 15 bullish hedge fund positions. Compared to these stocks Cenovus Energy Inc (NYSE:CVE) is even less popular than SGEN. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None. This article was originally published at Insider Monkey.