During the first half of the fourth quarter the Russell 2000 ETF (IWM) lagged the larger S&P 500 ETF (SPY) by about 4 percentage points as investors worried over the possible ramifications of rising interest rates. The hedge funds and institutional investors we track typically invest more in smaller-cap stocks than an average investor (i.e. only 298 S&P 500 constituents were among the 500 most popular stocks among hedge funds), and we have seen data that shows those funds paring back their overall exposure. Those funds cutting positions in small-caps is one reason why volatility has increased. In the following paragraphs, we take a closer look at what hedge funds and prominent investors think of Beazer Homes USA, Inc. (NYSE:BZH) and see how the stock is affected by the recent hedge fund activity.

Beazer Homes USA, Inc. (NYSE:BZH) investors should be aware of a decrease in activity from the world’s largest hedge funds lately. Our calculations also showed that bzh isn’t among the 30 most popular stocks among hedge funds.

In the 21st century investor’s toolkit there are a lot of indicators shareholders put to use to analyze publicly traded companies. A couple of the best indicators are hedge fund and insider trading sentiment. We have shown that, historically, those who follow the best picks of the top hedge fund managers can beat their index-focused peers by a superb margin (see the details here).

Let’s check out the recent hedge fund action regarding Beazer Homes USA, Inc. (NYSE:BZH).

Hedge fund activity in Beazer Homes USA, Inc. (NYSE:BZH)

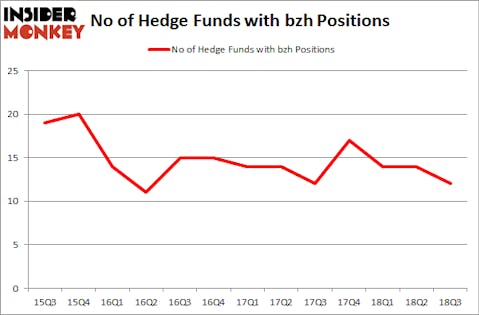

At the end of the third quarter, a total of 12 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -14% from the previous quarter. The graph below displays the number of hedge funds with bullish position in BZH over the last 13 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists an “upper tier” of notable hedge fund managers who were adding to their stakes meaningfully (or already accumulated large positions).

More specifically, Royce & Associates was the largest shareholder of Beazer Homes USA, Inc. (NYSE:BZH), with a stake worth $11.6 million reported as of the end of September. Trailing Royce & Associates was Millennium Management, which amassed a stake valued at $6.8 million. Vertex One Asset Management, Citadel Investment Group, and Whitebox Advisors were also very fond of the stock, giving the stock large weights in their portfolios.

Because Beazer Homes USA, Inc. (NYSE:BZH) has faced declining sentiment from the aggregate hedge fund industry, we can see that there lies a certain “tier” of hedgies that decided to sell off their full holdings heading into Q3. It’s worth mentioning that Peter Muller’s PDT Partners said goodbye to the largest position of the 700 funds tracked by Insider Monkey, comprising about $2.2 million in stock. John Overdeck and David Siegel’s fund, Two Sigma Advisors, also dropped its stock, about $0.6 million worth. These bearish behaviors are interesting, as total hedge fund interest fell by 2 funds heading into Q3.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Beazer Homes USA, Inc. (NYSE:BZH) but similarly valued. These stocks are Clementia Pharmaceuticals Inc. (NASDAQ:CMTA), Landcadia Holdings, Inc. (NASDAQ:LCAHU), Preformed Line Products Company (NASDAQ:PLPC), and Loop Industries, Inc. (NASDAQ:LOOP). This group of stocks’ market values resemble BZH’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CMTA | 10 | 159761 | -1 |

| LCAHU | 20 | 172318 | 2 |

| PLPC | 7 | 43442 | 3 |

| LOOP | 1 | 1627 | 0 |

| Average | 9.5 | 94287 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 9.5 hedge funds with bullish positions and the average amount invested in these stocks was $94 million. That figure was $35 million in BZH’s case. Landcadia Holdings, Inc. (NASDAQ:LCAHU) is the most popular stock in this table. On the other hand Loop Industries, Inc. (NASDAQ:LOOP) is the least popular one with only 1 bullish hedge fund positions. Beazer Homes USA, Inc. (NYSE:BZH) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard LCAHU might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.