At Insider Monkey, we pore over the filings of nearly 750 top investment firms every quarter, a process we have now completed for the latest reporting period. The data we’ve gathered as a result gives us access to a wealth of collective knowledge based on these firms’ portfolio holdings as of September 30. In this article, we will use that wealth of knowledge to determine whether or not Asanko Gold Inc (NYSE:AKG) makes for a good investment right now.

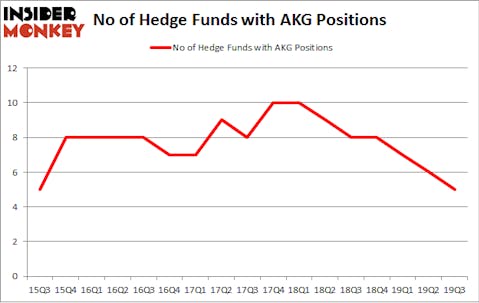

Asanko Gold Inc (NYSE:AKG) has experienced a decrease in hedge fund interest lately. Our calculations also showed that AKG isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the eyes of most market participants, hedge funds are assumed to be worthless, old financial vehicles of the past. While there are more than 8000 funds with their doors open at present, We look at the moguls of this club, approximately 750 funds. Most estimates calculate that this group of people shepherd bulk of the hedge fund industry’s total capital, and by paying attention to their first-class picks, Insider Monkey has brought to light a number of investment strategies that have historically defeated the broader indices. Insider Monkey’s flagship short hedge fund strategy surpassed the S&P 500 short ETFs by around 20 percentage points a year since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

John Overdeck of Two Sigma Advisors

We leave no stone unturned when looking for the next great investment idea. For example Discover is offering this insane cashback card, so we look into shorting the stock. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We even check out this option genius’ weekly trade ideas. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock already gained 20 percent. Keeping this in mind let’s check out the recent hedge fund action regarding Asanko Gold Inc (NYSE:AKG).

Hedge fund activity in Asanko Gold Inc (NYSE:AKG)

At the end of the third quarter, a total of 5 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -17% from one quarter earlier. On the other hand, there were a total of 8 hedge funds with a bullish position in AKG a year ago. With hedgies’ positions undergoing their usual ebb and flow, there exists a few noteworthy hedge fund managers who were upping their holdings meaningfully (or already accumulated large positions).

The largest stake in Asanko Gold Inc (NYSE:AKG) was held by Sun Valley Gold, which reported holding $22.6 million worth of stock at the end of September. It was followed by Renaissance Technologies with a $5.1 million position. Other investors bullish on the company included Millennium Management, Citadel Investment Group, and Two Sigma Advisors. In terms of the portfolio weights assigned to each position Sun Valley Gold allocated the biggest weight to Asanko Gold Inc (NYSE:AKG), around 6.22% of its 13F portfolio. Renaissance Technologies is also relatively very bullish on the stock, setting aside 0.0043 percent of its 13F equity portfolio to AKG.

Due to the fact that Asanko Gold Inc (NYSE:AKG) has witnessed bearish sentiment from hedge fund managers, we can see that there were a few funds that slashed their full holdings in the third quarter. It’s worth mentioning that Paul Tudor Jones’s Tudor Investment Corp sold off the largest stake of all the hedgies watched by Insider Monkey, worth close to $0 million in call options. Ken Griffin’s fund, Citadel Investment Group, also dropped its call options, about $0 million worth. These moves are intriguing to say the least, as total hedge fund interest fell by 1 funds in the third quarter.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Asanko Gold Inc (NYSE:AKG) but similarly valued. These stocks are Chiasma Inc (NASDAQ:CHMA), KalVista Pharmaceuticals, Inc. (NASDAQ:KALV), Viveve Medical, Inc. (NASDAQ:VIVE), and Stealth BioTherapeutics Corp (NASDAQ:MITO). This group of stocks’ market caps are similar to AKG’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CHMA | 11 | 52816 | 4 |

| KALV | 15 | 59982 | 0 |

| VIVE | 1 | 3 | -2 |

| MITO | 2 | 2539 | 0 |

| Average | 7.25 | 28835 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 7.25 hedge funds with bullish positions and the average amount invested in these stocks was $29 million. That figure was $28 million in AKG’s case. KalVista Pharmaceuticals, Inc. (NASDAQ:KALV) is the most popular stock in this table. On the other hand Viveve Medical, Inc. (NASDAQ:VIVE) is the least popular one with only 1 bullish hedge fund positions. Asanko Gold Inc (NYSE:AKG) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Unfortunately AKG wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); AKG investors were disappointed as the stock returned -5.5% during the first two months of the fourth quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market in Q4.

Disclosure: None. This article was originally published at Insider Monkey.