Many investors, including Paul Tudor Jones or Stan Druckenmiller, have been saying for a while now that the current market is overvalued due to a low interest rate environment that leads to companies swapping their equity for debt and focusing mostly on short-term performance such as beating the quarterly earnings estimates. In the fourth quarter, many investors lost money due to unpredictable events such as the sudden increase in long-term interest rates and unintended consequences of the trade war with China. Nevertheless, many of the stocks that tanked in the third quarter still sport strong fundamentals and their decline was more related to the general market sentiment rather than their individual performance and hedge funds kept their bullish stance. In this article we will find out how hedge fund sentiment to American Axle & Manufacturing Holdings, Inc. (NYSE:AXL) changed recently.

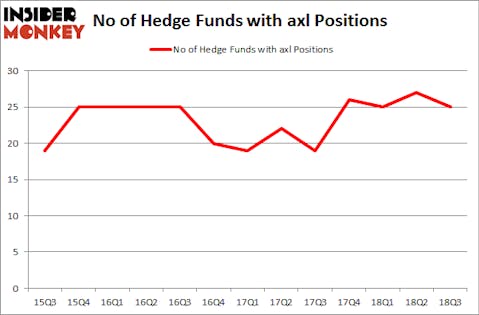

American Axle & Manufacturing Holdings, Inc. (NYSE:AXL) was in 25 hedge funds’ portfolios at the end of September. AXL shareholders have witnessed a decrease in support from the world’s most elite money managers recently. There were 27 hedge funds in our database with AXL holdings at the end of the previous quarter. Our calculations also showed that axl isn’t among the 30 most popular stocks among hedge funds.

Today there are plenty of signals stock market investors use to assess stocks. A duo of the most innovative signals are hedge fund and insider trading sentiment. We have shown that, historically, those who follow the top picks of the top hedge fund managers can beat the broader indices by a very impressive amount (see the details here).

We’re going to view the latest hedge fund action surrounding American Axle & Manufacturing Holdings, Inc. (NYSE:AXL).

Hedge fund activity in American Axle & Manufacturing Holdings, Inc. (NYSE:AXL)

At Q3’s end, a total of 25 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -7% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards AXL over the last 13 quarters. With hedgies’ capital changing hands, there exists an “upper tier” of key hedge fund managers who were boosting their holdings considerably (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Robert Polak’s Anchor Bolt Capital has the largest position in American Axle & Manufacturing Holdings, Inc. (NYSE:AXL), worth close to $61.2 million, comprising 3.1% of its total 13F portfolio. The second largest stake is held by Citadel Investment Group, led by Ken Griffin, holding a $28.8 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Other hedge funds and institutional investors that hold long positions consist of Robert Polak’s Anchor Bolt Capital, Phill Gross and Robert Atchinson’s Adage Capital Management and Chuck Royce’s Royce & Associates.

Seeing as American Axle & Manufacturing Holdings, Inc. (NYSE:AXL) has faced a decline in interest from the entirety of the hedge funds we track, it’s easy to see that there lies a certain “tier” of hedgies that slashed their positions entirely last quarter. It’s worth mentioning that Anand Parekh’s Alyeska Investment Group dropped the biggest position of the 700 funds tracked by Insider Monkey, worth an estimated $6.9 million in stock. Jim Simons’s fund, Renaissance Technologies, also said goodbye to its stock, about $6.1 million worth. These bearish behaviors are important to note, as total hedge fund interest dropped by 2 funds last quarter.

Let’s now review hedge fund activity in other stocks similar to American Axle & Manufacturing Holdings, Inc. (NYSE:AXL). We will take a look at Ferro Corporation (NYSE:FOE), Franks International NV (NYSE:FI), Pattern Energy Group Inc (NASDAQ:PEGI), and Chesapeake Lodging Trust (NYSE:CHSP). This group of stocks’ market valuations match AXL’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FOE | 18 | 291059 | 3 |

| FI | 11 | 39270 | 6 |

| PEGI | 9 | 23059 | 1 |

| CHSP | 9 | 9673 | 1 |

| Average | 11.75 | 90765 | 2.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11.75 hedge funds with bullish positions and the average amount invested in these stocks was $91 million. That figure was $231 million in AXL’s case. Ferro Corporation (NYSE:FOE) is the most popular stock in this table. On the other hand Pattern Energy Group Inc (NASDAQ:PEGI) is the least popular one with only 9 bullish hedge fund positions. Compared to these stocks American Axle & Manufacturing Holdings, Inc. (NYSE:AXL) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.