As we already know from media reports and hedge fund investor letters, hedge funds delivered their best returns in a decade. Most investors who decided to stick with hedge funds after a rough 2018 recouped their losses by the end of the fourth quarter of 2019. A significant number of hedge funds continued their strong performance in 2020 and 2021 as well. We get to see hedge funds’ thoughts towards the market and individual stocks by aggregating their quarterly portfolio movements and reading their investor letters. In this article, we will particularly take a look at what hedge funds think about Sculptor Capital Management, Inc. (NYSE:SCU).

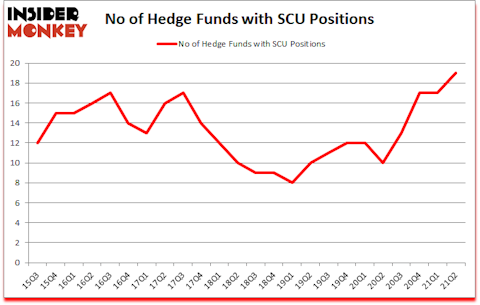

Is Sculptor Capital Management, Inc. (NYSE:SCU) the right pick for your portfolio? Hedge funds were in an optimistic mood. The number of long hedge fund bets inched up by 2 in recent months. Sculptor Capital Management, Inc. (NYSE:SCU) was in 19 hedge funds’ portfolios at the end of the second quarter of 2021. The all time high for this statistic was previously 17. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. Our calculations also showed that SCU isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings). There were 17 hedge funds in our database with SCU holdings at the end of March.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that a select group of hedge fund holdings outperformed the S&P 500 ETFs by 79 percentage points since March 2017 (see the details here). That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Robert Pohly of Samlyn Capital

Now let’s check out the latest hedge fund action regarding Sculptor Capital Management, Inc. (NYSE:SCU).

Do Hedge Funds Think SCU Is A Good Stock To Buy Now?

Heading into the third quarter of 2021, a total of 19 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 12% from the first quarter of 2020. On the other hand, there were a total of 10 hedge funds with a bullish position in SCU a year ago. With hedgies’ positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were upping their stakes considerably (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Samlyn Capital, managed by Robert Pohly, holds the most valuable position in Sculptor Capital Management, Inc. (NYSE:SCU). Samlyn Capital has a $38 million position in the stock, comprising 0.6% of its 13F portfolio. Sitting at the No. 2 spot is Toscafund Asset Management, led by Martin Hughes, holding a $15.4 million position; 17.8% of its 13F portfolio is allocated to the stock. Remaining peers that hold long positions encompass Crispin Odey’s Odey Asset Management Group, Allan Teh’s Kamunting Street Capital and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital. In terms of the portfolio weights assigned to each position Toscafund Asset Management allocated the biggest weight to Sculptor Capital Management, Inc. (NYSE:SCU), around 17.77% of its 13F portfolio. Kamunting Street Capital is also relatively very bullish on the stock, earmarking 3.32 percent of its 13F equity portfolio to SCU.

Consequently, specific money managers have jumped into Sculptor Capital Management, Inc. (NYSE:SCU) headfirst. Renaissance Technologies, created the biggest position in Sculptor Capital Management, Inc. (NYSE:SCU). Renaissance Technologies had $1.3 million invested in the company at the end of the quarter. Michael Gelband’s ExodusPoint Capital also initiated a $0.3 million position during the quarter.

Let’s now take a look at hedge fund activity in other stocks similar to Sculptor Capital Management, Inc. (NYSE:SCU). We will take a look at Cytokinetics, Inc. (NASDAQ:CYTK), Franchise Group, Inc. (NASDAQ:FRG), Uniqure NV (NASDAQ:QURE), Kosmos Energy Ltd (NYSE:KOS), FARO Technologies, Inc. (NASDAQ:FARO), Extreme Networks, Inc (NASDAQ:EXTR), and Houghton Mifflin Harcourt Co (NASDAQ:HMHC). This group of stocks’ market values are closest to SCU’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CYTK | 31 | 419836 | 2 |

| FRG | 19 | 93555 | 2 |

| QURE | 28 | 302552 | 3 |

| KOS | 17 | 71037 | 9 |

| FARO | 13 | 169071 | -1 |

| EXTR | 20 | 158359 | -5 |

| HMHC | 21 | 206768 | -4 |

| Average | 21.3 | 203025 | 0.9 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21.3 hedge funds with bullish positions and the average amount invested in these stocks was $203 million. That figure was $101 million in SCU’s case. Cytokinetics, Inc. (NASDAQ:CYTK) is the most popular stock in this table. On the other hand FARO Technologies, Inc. (NASDAQ:FARO) is the least popular one with only 13 bullish hedge fund positions. Sculptor Capital Management, Inc. (NYSE:SCU) is not the least popular stock in this group but hedge fund interest is still below average. Our overall hedge fund sentiment score for SCU is 53.7. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 24% in 2021 through October 22nd and still beat the market by 1.6 percentage points. A small number of hedge funds were also right about betting on SCU as the stock returned 3.4% since the end of the second quarter (through 10/22) and outperformed the market by an even larger margin.

Follow Sculptor Capital Management Inc. (NYSE:SCU)

Follow Sculptor Capital Management Inc. (NYSE:SCU)

Receive real-time insider trading and news alerts

Suggested Articles:

- 25 best places to live in the u.s. for families

- 10 Best Volatile Stocks to Buy

- 20 Cities with Most Illegal Immigrants

Disclosure: None. This article was originally published at Insider Monkey.