Insider Monkey has processed numerous 13F filings of hedge funds and successful value investors to create an extensive database of hedge fund holdings. The 13F filings show the hedge funds’ and successful investors’ positions as of the end of the second quarter. You can find articles about an individual hedge fund’s trades on numerous financial news websites. However, in this article we will take a look at their collective moves over the last 6 years and analyze what the smart money thinks of Nokia Corporation (NYSE:NOK) based on that data.

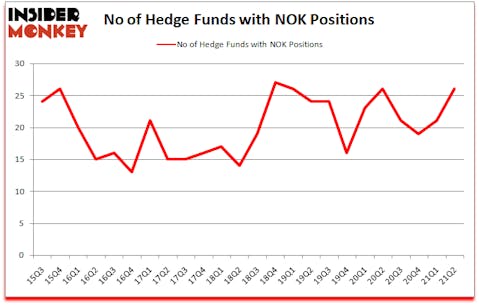

Nokia Corporation (NYSE:NOK) was in 26 hedge funds’ portfolios at the end of the second quarter of 2021. The all time high for this statistic is 27. NOK investors should pay attention to an increase in hedge fund sentiment in recent months. There were 21 hedge funds in our database with NOK positions at the end of the first quarter. Our calculations also showed that NOK isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings).

To the average investor there are dozens of indicators stock traders put to use to grade publicly traded companies. Two of the most underrated indicators are hedge fund and insider trading sentiment. Our researchers have shown that, historically, those who follow the top picks of the best money managers can outpace the S&P 500 by a superb margin (see the details here). Also, our monthly newsletter’s portfolio of long stock picks returned 185.4% since March 2017 (through August 2021) and beat the S&P 500 Index by more than 79 percentage points. You can download a sample issue of this newsletter on our website.

Peter Rathjens of Arrowstreet Capital

Keeping this in mind let’s analyze the fresh hedge fund action regarding Nokia Corporation (NYSE:NOK).

Do Hedge Funds Think NOK Is A Good Stock To Buy Now?

At Q2’s end, a total of 26 of the hedge funds tracked by Insider Monkey were long this stock, a change of 24% from one quarter earlier. By comparison, 26 hedge funds held shares or bullish call options in NOK a year ago. With hedge funds’ capital changing hands, there exists an “upper tier” of noteworthy hedge fund managers who were adding to their stakes substantially (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, holds the biggest position in Nokia Corporation (NYSE:NOK). Arrowstreet Capital has a $133.2 million position in the stock, comprising 0.2% of its 13F portfolio. The second most bullish fund manager is Millennium Management, led by Israel Englander, holding a $108.2 million position; 0.1% of its 13F portfolio is allocated to the stock. Other hedge funds and institutional investors with similar optimism contain D. E. Shaw’s D E Shaw, Ken Griffin’s Citadel Investment Group and Ben Levine, Andrew Manuel and Stefan Renold’s LMR Partners. In terms of the portfolio weights assigned to each position Cavalry Asset Management allocated the biggest weight to Nokia Corporation (NYSE:NOK), around 2.4% of its 13F portfolio. Mondrian Capital is also relatively very bullish on the stock, designating 1.44 percent of its 13F equity portfolio to NOK.

Consequently, key hedge funds have jumped into Nokia Corporation (NYSE:NOK) headfirst. Cavalry Asset Management, managed by John Hurley, initiated the most outsized position in Nokia Corporation (NYSE:NOK). Cavalry Asset Management had $22.1 million invested in the company at the end of the quarter. Vikram Kumar’s Kuvari Partners also initiated a $3 million position during the quarter. The other funds with brand new NOK positions are Warren Lammert’s Granite Point Capital, Israel Englander’s Millennium Management, and Ran Pang’s Quantamental Technologies.

Let’s go over hedge fund activity in other stocks similar to Nokia Corporation (NYSE:NOK). We will take a look at Nasdaq, Inc. (NASDAQ:NDAQ), Fastenal Company (NASDAQ:FAST), Willis Towers Watson Public Limited Company (NASDAQ:WLTW), Zscaler, Inc. (NASDAQ:ZS), McKesson Corporation (NYSE:MCK), Old Dominion Freight Line, Inc. (NASDAQ:ODFL), and ViacomCBS Inc. (NASDAQ:VIAC). This group of stocks’ market values match NOK’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NDAQ | 23 | 191757 | 1 |

| FAST | 25 | 650046 | 1 |

| WLTW | 70 | 5594291 | 4 |

| ZS | 38 | 1102517 | 4 |

| MCK | 51 | 2314668 | 0 |

| ODFL | 47 | 673076 | 7 |

| VIAC | 71 | 1872050 | -18 |

| Average | 46.4 | 1771201 | -0.1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 46.4 hedge funds with bullish positions and the average amount invested in these stocks was $1771 million. That figure was $494 million in NOK’s case. ViacomCBS Inc. (NASDAQ:VIAC) is the most popular stock in this table. On the other hand Nasdaq, Inc. (NASDAQ:NDAQ) is the least popular one with only 23 bullish hedge fund positions. Nokia Corporation (NYSE:NOK) is not the least popular stock in this group but hedge fund interest is still below average. Our overall hedge fund sentiment score for NOK is 42. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 24.9% in 2021 through October 15th and still beat the market by 4.5 percentage points. A small number of hedge funds were also right about betting on NOK as the stock returned 10.9% since the end of the second quarter (through 10/15) and outperformed the market by an even larger margin.

Follow Nokia Corp (NYSE:NOK)

Follow Nokia Corp (NYSE:NOK)

Receive real-time insider trading and news alerts

Suggested Articles:

- 25 Most Climate-Resilient Cities in the US

- 20 Best Countries To Invest In Real Estate

- 30 Most Expensive Cities in the US

Disclosure: None. This article was originally published at Insider Monkey.