The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We have processed the filings of the more than 873 world-class investment firms that we track and now have access to the collective wisdom contained in these filings, which are based on their June 30th holdings, data that is available nowhere else. Should you consider iRobot Corporation (NASDAQ:IRBT) for your portfolio? We’ll look to this invaluable collective wisdom for the answer.

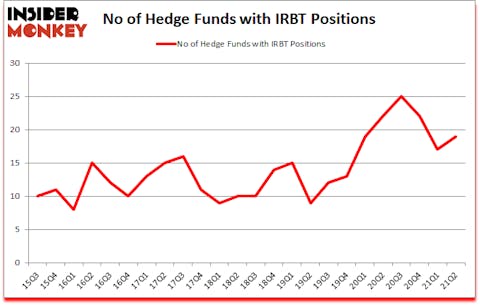

Is iRobot Corporation (NASDAQ:IRBT) a healthy stock for your portfolio? Money managers were getting more bullish. The number of bullish hedge fund positions improved by 2 lately. iRobot Corporation (NASDAQ:IRBT) was in 19 hedge funds’ portfolios at the end of June. The all time high for this statistic is 25. Our calculations also showed that IRBT isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings).

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Hedge funds have more than $3.5 trillion in assets under management, so you can’t expect their entire portfolios to beat the market by large margins. Our research was able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by more than 79 percentage points since March 2017 (see the details here). So you can still find a lot of gems by following hedge funds’ moves today.

Matthew Hulsizer of PEAK6 Capital

Now let’s take a gander at the new hedge fund action surrounding iRobot Corporation (NASDAQ:IRBT).

Do Hedge Funds Think IRBT Is A Good Stock To Buy Now?

At Q2’s end, a total of 19 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 12% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards IRBT over the last 24 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were boosting their holdings meaningfully (or already accumulated large positions).

Among these funds, Citadel Investment Group held the most valuable stake in iRobot Corporation (NASDAQ:IRBT), which was worth $21.8 million at the end of the second quarter. On the second spot was Citadel Investment Group which amassed $16.9 million worth of shares. PEAK6 Capital Management, Millennium Management, and D E Shaw were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Algert Global allocated the biggest weight to iRobot Corporation (NASDAQ:IRBT), around 0.09% of its 13F portfolio. Tudor Investment Corp is also relatively very bullish on the stock, designating 0.08 percent of its 13F equity portfolio to IRBT.

As one would reasonably expect, key hedge funds were breaking ground themselves. Bridgewater Associates, managed by Ray Dalio, created the biggest position in iRobot Corporation (NASDAQ:IRBT). Bridgewater Associates had $4.7 million invested in the company at the end of the quarter. Paul Tudor Jones’s Tudor Investment Corp also initiated a $4.1 million position during the quarter. The other funds with brand new IRBT positions are Ryan Tolkin (CIO)’s Schonfeld Strategic Advisors and Prem Watsa’s Fairfax Financial Holdings.

Let’s check out hedge fund activity in other stocks similar to iRobot Corporation (NASDAQ:IRBT). We will take a look at Plexus Corp. (NASDAQ:PLXS), Allscripts Healthcare Solutions Inc (NASDAQ:MDRX), MYT Netherlands Parent B.V. (NYSE:MYTE), Cadence Bancorporation (NYSE:CADE), JELD-WEN Holding, Inc. (NYSE:JELD), First Interstate Bancsystem Inc (NASDAQ:FIBK), and Mednax Inc. (NYSE:MD). This group of stocks’ market caps are similar to IRBT’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PLXS | 17 | 73363 | 3 |

| MDRX | 23 | 296119 | -1 |

| MYTE | 18 | 139088 | 0 |

| CADE | 25 | 161340 | -2 |

| JELD | 23 | 274466 | -4 |

| FIBK | 12 | 24090 | -2 |

| MD | 19 | 346888 | 8 |

| Average | 19.6 | 187908 | 0.3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19.6 hedge funds with bullish positions and the average amount invested in these stocks was $188 million. That figure was $63 million in IRBT’s case. Cadence Bancorporation (NYSE:CADE) is the most popular stock in this table. On the other hand First Interstate Bancsystem Inc (NASDAQ:FIBK) is the least popular one with only 12 bullish hedge fund positions. iRobot Corporation (NASDAQ:IRBT) is not the least popular stock in this group but hedge fund interest is still below average. Our overall hedge fund sentiment score for IRBT is 56.7. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 24% in 2021 through October 22nd and surpassed the market again by 1.6 percentage points. Unfortunately IRBT wasn’t nearly as popular as these 5 stocks (hedge fund sentiment was quite bearish); IRBT investors were disappointed as the stock returned -14.5% since the end of June (through 10/22) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as most of these stocks already outperformed the market in 2021.

Follow Irobot Corp (NASDAQ:IRBT)

Follow Irobot Corp (NASDAQ:IRBT)

Receive real-time insider trading and news alerts

Suggested Articles:

- 10 Best Silver Stocks To Buy

- 13 Biggest Gay Pride Parades in the World

- 10 Companies That Will Benefit From Global Warming

Disclosure: None. This article was originally published at Insider Monkey.