We at Insider Monkey have gone over 752 13F filings that hedge funds and prominent investors are required to file by the SEC The 13F filings show the funds’ and investors’ portfolio positions as of September 30th. In this article, we look at what those funds think of HollyFrontier Corporation (NYSE:HFC) based on that data.

HollyFrontier Corporation (NYSE:HFC) investors should pay attention to an increase in hedge fund interest of late. Our calculations also showed that HFC isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

To the average investor there are a multitude of tools shareholders employ to analyze publicly traded companies. A duo of the most useful tools are hedge fund and insider trading sentiment. Our researchers have shown that, historically, those who follow the top picks of the elite fund managers can trounce the S&P 500 by a very impressive margin (see the details here).

John Overdeck of Two Sigma Advisors

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. We’re going to review the fresh hedge fund action regarding HollyFrontier Corporation (NYSE:HFC).

How are hedge funds trading HollyFrontier Corporation (NYSE:HFC)?

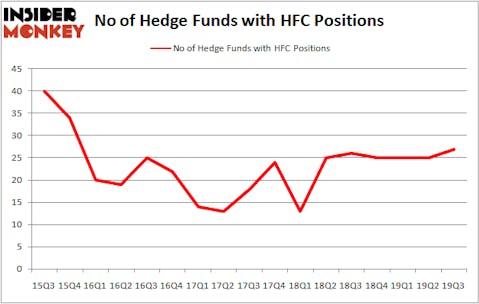

Heading into the fourth quarter of 2019, a total of 27 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 8% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in HFC over the last 17 quarters. With hedgies’ sentiment swirling, there exists an “upper tier” of notable hedge fund managers who were upping their holdings significantly (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, AQR Capital Management, managed by Cliff Asness, holds the most valuable position in HollyFrontier Corporation (NYSE:HFC). AQR Capital Management has a $182.6 million position in the stock, comprising 0.2% of its 13F portfolio. On AQR Capital Management’s heels is Citadel Investment Group, led by Ken Griffin, holding a $75.9 million position; less than 0.1%% of its 13F portfolio is allocated to the company. Remaining members of the smart money with similar optimism include David E. Shaw’s D E Shaw, John Overdeck and David Siegel’s Two Sigma Advisors and Todd J. Kantor’s Encompass Capital Advisors. In terms of the portfolio weights assigned to each position Encompass Capital Advisors allocated the biggest weight to HollyFrontier Corporation (NYSE:HFC), around 2.89% of its portfolio. SIR Capital Management is also relatively very bullish on the stock, setting aside 1.39 percent of its 13F equity portfolio to HFC.

With a general bullishness amongst the heavyweights, key money managers were breaking ground themselves. PDT Partners, managed by Peter Muller, initiated the most outsized position in HollyFrontier Corporation (NYSE:HFC). PDT Partners had $11.5 million invested in the company at the end of the quarter. Donald Sussman’s Paloma Partners also made a $4 million investment in the stock during the quarter. The other funds with brand new HFC positions are Steve Pattyn’s Yaupon Capital, Peter Algert and Kevin Coldiron’s Algert Coldiron Investors, and Mike Vranos’s Ellington.

Let’s go over hedge fund activity in other stocks similar to HollyFrontier Corporation (NYSE:HFC). These stocks are Kimco Realty Corp (NYSE:KIM), AGNC Investment Corp. (NASDAQ:AGNC), MGM Growth Properties LLC (NYSE:MGP), and Fair Isaac Corporation (NYSE:FICO). This group of stocks’ market valuations are closest to HFC’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| KIM | 11 | 100029 | -8 |

| AGNC | 15 | 126937 | -8 |

| MGP | 18 | 307511 | 4 |

| FICO | 40 | 873383 | 6 |

| Average | 21 | 351965 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21 hedge funds with bullish positions and the average amount invested in these stocks was $352 million. That figure was $544 million in HFC’s case. Fair Isaac Corporation (NYSE:FICO) is the most popular stock in this table. On the other hand Kimco Realty Corp (NYSE:KIM) is the least popular one with only 11 bullish hedge fund positions. HollyFrontier Corporation (NYSE:HFC) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Unfortunately HFC wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on HFC were disappointed as the stock returned -3.3% during the fourth quarter (through the end of November) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Disclosure: None. This article was originally published at Insider Monkey.