While the market driven by short-term sentiment influenced by the accomodative interest rate environment in the US, increasing oil prices and deteriorating expectations towards the resolution of the trade war with China, many smart money investors kept their cautious approach regarding the current bull run in the third quarter and hedging or reducing many of their long positions. Some fund managers are betting on Dow hitting 40,000 to generate strong returns. However, as we know, big investors usually buy stocks with strong fundamentals that can deliver gains both in bull and bear markets, which is why we believe we can profit from imitating them. In this article, we are going to take a look at the smart money sentiment surrounding Gaming and Leisure Properties Inc (NASDAQ:GLPI).

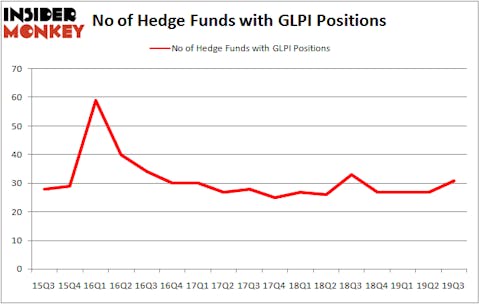

Gaming and Leisure Properties Inc (NASDAQ:GLPI) shareholders have witnessed an increase in support from the world’s most elite money managers recently. Our calculations also showed that GLPI isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the 21st century investor’s toolkit there are plenty of indicators investors can use to appraise their holdings. A duo of the less utilized indicators are hedge fund and insider trading indicators. We have shown that, historically, those who follow the best picks of the elite investment managers can beat their index-focused peers by a healthy margin (see the details here).

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. We’re going to take a look at the new hedge fund action encompassing Gaming and Leisure Properties Inc (NASDAQ:GLPI).

How have hedgies been trading Gaming and Leisure Properties Inc (NASDAQ:GLPI)?

At Q3’s end, a total of 31 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 15% from the second quarter of 2019. By comparison, 33 hedge funds held shares or bullish call options in GLPI a year ago. With hedge funds’ capital changing hands, there exists a few key hedge fund managers who were boosting their holdings significantly (or already accumulated large positions).

Among these funds, Renaissance Technologies held the most valuable stake in Gaming and Leisure Properties Inc (NASDAQ:GLPI), which was worth $281.8 million at the end of the third quarter. On the second spot was Gates Capital Management which amassed $117.9 million worth of shares. Citadel Investment Group, Cardinal Capital, and Echo Street Capital Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Covalent Capital Partners allocated the biggest weight to Gaming and Leisure Properties Inc (NASDAQ:GLPI), around 12.57% of its portfolio. Land & Buildings Investment Management is also relatively very bullish on the stock, dishing out 6.22 percent of its 13F equity portfolio to GLPI.

As aggregate interest increased, key money managers have been driving this bullishness. Ancora Advisors, managed by Frederick DiSanto, created the biggest position in Gaming and Leisure Properties Inc (NASDAQ:GLPI). Ancora Advisors had $3.9 million invested in the company at the end of the quarter. Paul Marshall and Ian Wace’s Marshall Wace also made a $1.5 million investment in the stock during the quarter. The following funds were also among the new GLPI investors: Michael Gelband’s ExodusPoint Capital, Matthew Tewksbury’s Stevens Capital Management, and Noam Gottesman’s GLG Partners.

Let’s now review hedge fund activity in other stocks similar to Gaming and Leisure Properties Inc (NASDAQ:GLPI). We will take a look at National Oilwell Varco, Inc. (NYSE:NOV), Under Armour Inc (NYSE:UA), News Corp (NASDAQ:NWSA), and Coupa Software Incorporated (NASDAQ:COUP). This group of stocks’ market values are closest to GLPI’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NOV | 23 | 894471 | 1 |

| UA | 32 | 921157 | -6 |

| NWSA | 30 | 428964 | 7 |

| COUP | 55 | 2562874 | -2 |

| Average | 35 | 1201867 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 35 hedge funds with bullish positions and the average amount invested in these stocks was $1202 million. That figure was $773 million in GLPI’s case. Coupa Software Incorporated (NASDAQ:COUP) is the most popular stock in this table. On the other hand National Oilwell Varco, Inc. (NYSE:NOV) is the least popular one with only 23 bullish hedge fund positions. Gaming and Leisure Properties Inc (NASDAQ:GLPI) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. A small number of hedge funds were also right about betting on GLPI, though not to the same extent, as the stock returned 10.4% during the first two months of the fourth quarter and outperformed the market.

Disclosure: None. This article was originally published at Insider Monkey.