In this article you are going to find out whether hedge funds think EnerSys (NYSE:ENS) is a good investment right now. We like to check what the smart money thinks first before doing extensive research on a given stock. Although there have been several high profile failed hedge fund picks, the consensus picks among hedge fund investors have historically outperformed the market after adjusting for known risk attributes. It’s not surprising given that hedge funds have access to better information and more resources to predict the winners in the stock market.

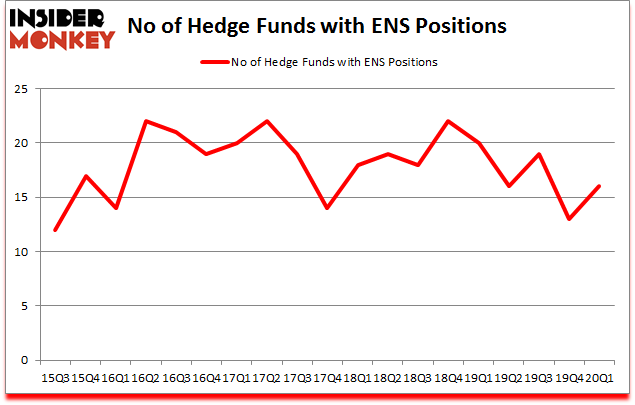

EnerSys (NYSE:ENS) was in 16 hedge funds’ portfolios at the end of March. ENS investors should pay attention to an increase in hedge fund interest in recent months. There were 13 hedge funds in our database with ENS holdings at the end of the previous quarter. Our calculations also showed that ENS isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

To the average investor there are numerous signals shareholders have at their disposal to analyze stocks. A pair of the best signals are hedge fund and insider trading activity. We have shown that, historically, those who follow the best picks of the elite fund managers can trounce their index-focused peers by a very impressive margin (see the details here).

Matthew Hulsizer of PEAK6 Capital

At Insider Monkey we scour multiple sources to uncover the next great investment idea. For example, we take a look at lists like the 10 best imported beer in 2020 to identify emerging trends that are likely to lead to 1000% gains in the coming years. We interview hedge fund managers and ask them about their best ideas. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. For example we are checking out stocks recommended/scorned by legendary Bill Miller. Our best call in 2020 was shorting the market when the S&P 500 was trading at 3150 in February after realizing the coronavirus pandemic’s significance before most investors. Now we’re going to view the recent hedge fund action regarding EnerSys (NYSE:ENS).

What have hedge funds been doing with EnerSys (NYSE:ENS)?

At the end of the first quarter, a total of 16 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 23% from the fourth quarter of 2019. The graph below displays the number of hedge funds with bullish position in ENS over the last 18 quarters. With hedge funds’ capital changing hands, there exists a few key hedge fund managers who were increasing their holdings substantially (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Encompass Capital Advisors, managed by Todd J. Kantor, holds the largest position in EnerSys (NYSE:ENS). Encompass Capital Advisors has a $24.5 million position in the stock, comprising 2.6% of its 13F portfolio. On Encompass Capital Advisors’s heels is ACK Asset Management, led by Richard S. Meisenberg, holding a $18.1 million position; the fund has 9% of its 13F portfolio invested in the stock. Other professional money managers that are bullish encompass David MacKnight’s One Fin Capital Management, Israel Englander’s Millennium Management and Chuck Royce’s Royce & Associates. In terms of the portfolio weights assigned to each position ACK Asset Management allocated the biggest weight to EnerSys (NYSE:ENS), around 9.02% of its 13F portfolio. One Fin Capital Management is also relatively very bullish on the stock, setting aside 7.28 percent of its 13F equity portfolio to ENS.

With a general bullishness amongst the heavyweights, key hedge funds were leading the bulls’ herd. Encompass Capital Advisors, managed by Todd J. Kantor, established the largest position in EnerSys (NYSE:ENS). Encompass Capital Advisors had $24.5 million invested in the company at the end of the quarter. Matthew Hulsizer’s PEAK6 Capital Management also made a $0.7 million investment in the stock during the quarter. The other funds with new positions in the stock are Hoon Kim’s Quantinno Capital, Mike Vranos’s Ellington, and D. E. Shaw’s D E Shaw.

Let’s also examine hedge fund activity in other stocks similar to EnerSys (NYSE:ENS). We will take a look at Arena Pharmaceuticals, Inc. (NASDAQ:ARNA), Uniqure NV (NASDAQ:QURE), BEST Inc. (NYSE:BEST), and New Residential Investment Corp (NYSE:NRZ). This group of stocks’ market caps are similar to ENS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ARNA | 36 | 362670 | 3 |

| QURE | 44 | 642438 | 0 |

| BEST | 6 | 10173 | -4 |

| NRZ | 23 | 27836 | 0 |

| Average | 27.25 | 260779 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 27.25 hedge funds with bullish positions and the average amount invested in these stocks was $261 million. That figure was $81 million in ENS’s case. Uniqure NV (NASDAQ:QURE) is the most popular stock in this table. On the other hand BEST Inc. (NYSE:BEST) is the least popular one with only 6 bullish hedge fund positions. EnerSys (NYSE:ENS) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 13.3% in 2020 through June 25th but beat the market by 16.8 percentage points. A small number of hedge funds were also right about betting on ENS, though not to the same extent, as the stock returned 23.5% during the second quarter and outperformed the market.

Follow Enersys (NYSE:ENS)

Follow Enersys (NYSE:ENS)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.