Hedge funds run by legendary names like Nelson Peltz and David Tepper make billions of dollars a year for themselves and their super-rich accredited investors (you’ve got to have a minimum of $1 million liquid to invest in a hedge fund) by spending enormous resources on analyzing and uncovering data about small-cap stocks that the big brokerage houses don’t follow. Small caps are where they can generate significant out-performance. These stocks have been on a tear since the end of June, outperforming large-cap index funds by more than 10 percentage points. That’s why we pay special attention to hedge fund activity in these stocks.

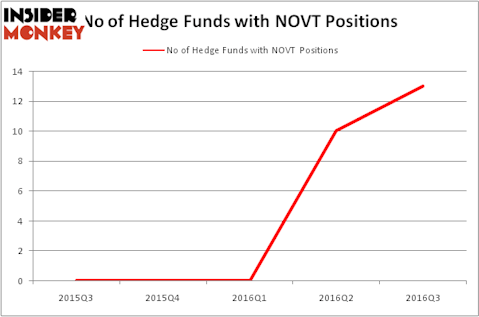

Novanta Inc (USA) (NASDAQ:NOVT) was in 13 hedge funds’ portfolios at the end of September. NOVT shareholders have witnessed an increase in hedge fund interest recently. There were 10 hedge funds in our database with NOVT positions at the end of the previous quarter. At the end of this article we will also compare NOVT to other stocks including Altisource Portfolio Solutions S.A. (NASDAQ:ASPS), Mechel OAO (ADR) (NYSE:MTL), and H&E Equipment Services, Inc. (NASDAQ:HEES) to get a better sense of its popularity.

Follow Novanta Inc (NASDAQ:NOVT)

Follow Novanta Inc (NASDAQ:NOVT)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

Mykola Komarovskyy/Shutterstock.com

How have hedgies been trading Novanta Inc (USA) (NASDAQ:NOVT)?

At Q3’s end, a total of 13 of the hedge funds tracked by Insider Monkey were long this stock, a 30% surge from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards NOVT over the last 5 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists a select group of key hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Cove Street Capital, led by Jeffrey Bronchick, holds the most valuable position in Novanta Inc (USA) (NASDAQ:NOVT). Cove Street Capital has a $21.8 million position in the stock, comprising 2.4% of its 13F portfolio. Coming in second is Royce & Associates, led by Chuck Royce, holding a $19.6 million position. Other members of the smart money that hold long positions include Jim Simons’ Renaissance Technologies, Paul Hondros’s AlphaOne Capital Partners, and Charles Paquelet’s Skylands Capital. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.