In this article we will take a look at whether hedge funds think FTI Consulting, Inc. (NYSE:FCN) is a good investment right now. We check hedge fund and billionaire investor sentiment before delving into hours of research. Hedge funds spend millions of dollars on Ivy League graduates, unconventional data sources, expert networks, and get tips from investment bankers and industry insiders. Sure they sometimes fail miserably, but their consensus stock picks historically outperformed the market after adjusting for known risk factors.

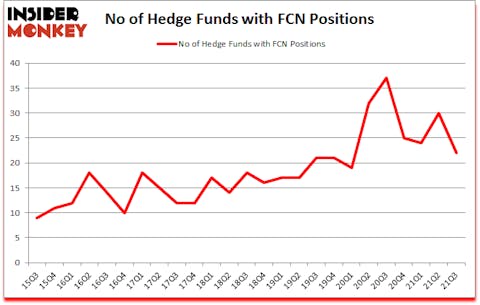

Is FTI Consulting, Inc. (NYSE:FCN) a buy right now? The smart money was reducing their bets on the stock. The number of bullish hedge fund positions went down by 8 lately. FTI Consulting, Inc. (NYSE:FCN) was in 22 hedge funds’ portfolios at the end of September. The all time high for this statistic is 37. Our calculations also showed that FCN isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings).

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium prices have more than doubled over the past year, so we go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. With all of this in mind let’s take a look at the recent hedge fund action regarding FTI Consulting, Inc. (NYSE:FCN).

Do Hedge Funds Think FCN Is A Good Stock To Buy Now?

Heading into the fourth quarter of 2021, a total of 22 of the hedge funds tracked by Insider Monkey were long this stock, a change of -27% from the previous quarter. By comparison, 37 hedge funds held shares or bullish call options in FCN a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Seth Rosen’s Nitorum Capital has the biggest position in FTI Consulting, Inc. (NYSE:FCN), worth close to $60.6 million, corresponding to 2.9% of its total 13F portfolio. Coming in second is Renaissance Technologies, which holds a $42.9 million position; 0.1% of its 13F portfolio is allocated to the company. Some other professional money managers that are bullish comprise Bruce Emery’s Greenvale Capital, Angela Aldrich’s Bayberry Capital Partners and Noam Gottesman’s GLG Partners. In terms of the portfolio weights assigned to each position Bayberry Capital Partners allocated the biggest weight to FTI Consulting, Inc. (NYSE:FCN), around 6.29% of its 13F portfolio. Greenvale Capital is also relatively very bullish on the stock, setting aside 4.43 percent of its 13F equity portfolio to FCN.

Seeing as FTI Consulting, Inc. (NYSE:FCN) has faced falling interest from hedge fund managers, logic holds that there lies a certain “tier” of fund managers that decided to sell off their full holdings last quarter. Interestingly, John Overdeck and David Siegel’s Two Sigma Advisors said goodbye to the largest investment of the 750 funds watched by Insider Monkey, comprising about $39.1 million in stock, and Ken Griffin’s Citadel Investment Group was right behind this move, as the fund sold off about $23.7 million worth. These moves are interesting, as aggregate hedge fund interest dropped by 8 funds last quarter.

Let’s now take a look at hedge fund activity in other stocks similar to FTI Consulting, Inc. (NYSE:FCN). We will take a look at Ryman Hospitality Properties, Inc. (NYSE:RHP), Abcam plc (NASDAQ:ABCM), Flywire Corporation (NASDAQ:FLYW), Wintrust Financial Corporation (NASDAQ:WTFC), Matterport Inc. (NASDAQ:MTTR), Highwoods Properties Inc (NYSE:HIW), and Jamf Holding Corp. (NASDAQ:JAMF). This group of stocks’ market caps are similar to FCN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RHP | 21 | 263293 | -1 |

| ABCM | 4 | 29225 | 0 |

| FLYW | 8 | 285282 | 8 |

| WTFC | 18 | 221422 | 0 |

| MTTR | 22 | 371582 | 22 |

| HIW | 19 | 100996 | 5 |

| JAMF | 23 | 2301880 | 4 |

| Average | 16.4 | 510526 | 5.4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.4 hedge funds with bullish positions and the average amount invested in these stocks was $511 million. That figure was $242 million in FCN’s case. Jamf Holding Corp. (NASDAQ:JAMF) is the most popular stock in this table. On the other hand Abcam plc (NASDAQ:ABCM) is the least popular one with only 4 bullish hedge fund positions. FTI Consulting, Inc. (NYSE:FCN) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for FCN is 62.2. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 29.6% in 2021 and still beat the market by 3.6 percentage points. Hedge funds were also right about betting on FCN as the stock returned 13.9% since the end of Q3 (through 12/31) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Fti Consulting Inc (NYSE:FCN)

Follow Fti Consulting Inc (NYSE:FCN)

Receive real-time insider trading and news alerts

Suggested Articles:

- Billionaire Julian Robertson On Interest Rates and His Top Stock Picks For 2021

- 15 Biggest Manufacturing Companies In The World

- 10 Best Retail Stocks To Buy Now

Disclosure: None. This article was originally published at Insider Monkey.