“October lived up to its scary reputation—the S&P 500 falling in the month by the largest amount in the last 40 years, the only worse Octobers being ’08 and the Crash of ’87. For perspective, there have been only 5 occasions in those 40 years when the S&P 500 declined by greater than 20% from peak to trough. Other than the ’87 Crash, all were during recessions. There were 17 other instances, over the same time frame, when the market fell by over 10% but less than 20%. Furthermore, this is the 18th correction of 5% or more since the current bull market started in March ’09. Corrections are the norm. They can be healthy as they often undo market complacency—overbought levels—potentially allowing the market to base and move even higher.” This is how Trapeze Asset Management summarized the recent market moves in its investor letter. We pay attention to what hedge funds are doing in a particular stock before considering a potential investment because it works for us. So let’s take a glance at the smart money sentiment towards one of the stocks hedge funds invest in.

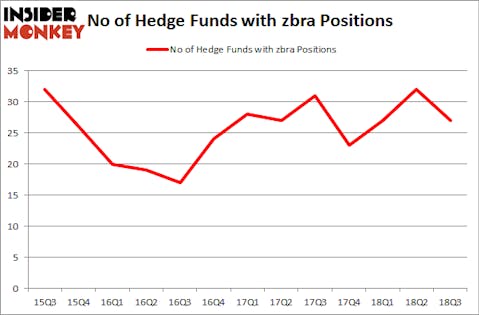

Is Zebra Technologies Corporation (NASDAQ:ZBRA) an exceptional investment right now? Money managers are taking a pessimistic view. The number of bullish hedge fund positions were cut by 5 lately. Our calculations also showed that zbra isn’t among the 30 most popular stocks among hedge funds. ZBRA was in 27 hedge funds’ portfolios at the end of September. There were 32 hedge funds in our database with ZBRA positions at the end of the previous quarter.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Let’s analyze the fresh hedge fund action regarding Zebra Technologies Corporation (NASDAQ:ZBRA).

How are hedge funds trading Zebra Technologies Corporation (NASDAQ:ZBRA)?

At the end of the third quarter, a total of 27 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -16% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards ZBRA over the last 13 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Ariel Investments, managed by John W. Rogers, holds the number one position in Zebra Technologies Corporation (NASDAQ:ZBRA). Ariel Investments has a $183.7 million position in the stock, comprising 2% of its 13F portfolio. The second most bullish fund manager is Makaira Partners, managed by Thomas Bancroft, which holds a $133.2 million position; 13.9% of its 13F portfolio is allocated to the stock. Some other hedge funds and institutional investors that are bullish include Principal Global Investors’s Columbus Circle Investors, Edward Goodnow’s Goodnow Investment Group and Cliff Asness’s AQR Capital Management.

Seeing as Zebra Technologies Corporation (NASDAQ:ZBRA) has faced falling interest from the entirety of the hedge funds we track, logic holds that there is a sect of hedge funds who were dropping their entire stakes by the end of the third quarter. At the top of the heap, Robert Joseph Caruso’s Select Equity Group said goodbye to the largest investment of all the hedgies watched by Insider Monkey, worth about $53.8 million in stock, and George Hall’s Clinton Group was right behind this move, as the fund dropped about $5.1 million worth. These bearish behaviors are interesting, as aggregate hedge fund interest dropped by 5 funds by the end of the third quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Zebra Technologies Corporation (NASDAQ:ZBRA) but similarly valued. These stocks are Avery Dennison Corporation (NYSE:AVY), Tyler Technologies, Inc. (NYSE:TYL), Shaw Communications Inc (NYSE:SJR), and Coty Inc (NYSE:COTY). This group of stocks’ market values match ZBRA’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AVY | 29 | 462957 | 3 |

| TYL | 22 | 752257 | 2 |

| SJR | 16 | 200046 | 3 |

| COTY | 24 | 286361 | 10 |

| Average | 22.75 | 425405 | 4.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22.75 hedge funds with bullish positions and the average amount invested in these stocks was $425 million. That figure was $893 million in ZBRA’s case. Avery Dennison Corporation (NYSE:AVY) is the most popular stock in this table. On the other hand Shaw Communications Inc (NYSE:SJR) is the least popular one with only 16 bullish hedge fund positions. Zebra Technologies Corporation (NASDAQ:ZBRA) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard AVY might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.