The successful funds run by legendary investors such as Dan Loeb and David Tepper make hundreds of millions of dollars for themselves and their investors by spending enormous resources doing research on small cap stocks that big investment banks don’t follow. Because of their pay structures, they have strong incentive to do the research necessary to beat the market. That’s why we pay close attention to what they think in small cap stocks. In this article, we take a closer look at Yelp Inc (NYSE:YELP) from the perspective of those successful funds.

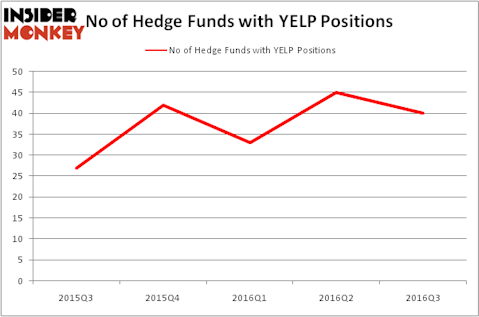

Yelp Inc (NYSE:YELP) investors should be aware of a decrease in support from the world’s most successful money managers lately. YELP was in 40 hedge funds’ portfolios at the end of September. There were 45 hedge funds in our database with YELP positions at the end of the previous quarter. At the end of this article we will also compare YELP to other stocks including The Hanover Insurance Group, Inc. (NYSE:THG), Catalent Inc (NYSE:CTLT), and Cedar Fair, L.P. (NYSE:FUN) to get a better sense of its popularity.

Follow Yelp Inc (NYSE:YELP)

Follow Yelp Inc (NYSE:YELP)

Receive real-time insider trading and news alerts

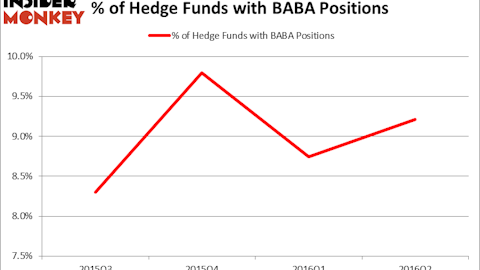

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

Hedge fund activity in Yelp Inc (NYSE:YELP)

At the end of the third quarter, a total of 40 of the hedge funds tracked by Insider Monkey were long this stock, down by 11% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards YELP over the last 5 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few noteworthy hedge fund managers who were upping their stakes considerably (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Tybourne Capital Management, led by Eashwar Krishnan, holds the number one position in Yelp Inc (NYSE:YELP). Tybourne Capital Management has a $182.3 million position in the stock, comprising 9.1% of its 13F portfolio. The second largest stake is held by D E Shaw, which holds a $122.5 million position. Other hedge funds and institutional investors with similar optimism consist of David Einhorn’s Greenlight Capital, Adam Wolfberg and Steven Landry’s EastBay Asset Management and Christopher Lord’s Criterion Capital. We should note that two of these hedge funds (Tybourne Capital Management and EastBay Asset Management) are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.