The Insider Monkey team has completed processing the quarterly 13F filings for the June quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge fund investors experienced strong gains on the back of a strong market performance, which certainly propelled them to adjust their equity holdings so as to maintain the desired risk profile. As a result, the relevancy of these public filings and their content is indisputable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards Wynn Resorts, Limited (NASDAQ:WYNN).

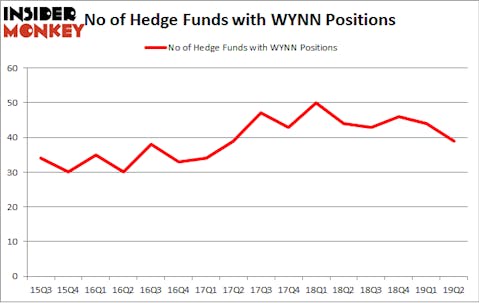

Is Wynn Resorts, Limited (NASDAQ:WYNN) going to take off soon? Prominent investors are taking a pessimistic view. The number of long hedge fund bets shrunk by 5 in recent months. Our calculations also showed that WYNN isn’t among the 30 most popular stocks among hedge funds. WYNN was in 39 hedge funds’ portfolios at the end of June. There were 44 hedge funds in our database with WYNN positions at the end of the previous quarter.

According to most shareholders, hedge funds are viewed as slow, old financial vehicles of yesteryear. While there are greater than 8000 funds trading today, Our experts choose to focus on the upper echelon of this club, approximately 750 funds. These hedge fund managers oversee the majority of all hedge funds’ total capital, and by tracking their unrivaled stock picks, Insider Monkey has identified a number of investment strategies that have historically defeated the S&P 500 index. Insider Monkey’s flagship hedge fund strategy outrun the S&P 500 index by around 5 percentage points per year since its inception in May 2014. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 25.7% since February 2017 (through September 30th) even though the market was up more than 33% during the same period. We just shared a list of 10 short targets in our latest quarterly update .

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s take a look at the fresh hedge fund action surrounding Wynn Resorts, Limited (NASDAQ:WYNN).

What does smart money think about Wynn Resorts, Limited (NASDAQ:WYNN)?

Heading into the third quarter of 2019, a total of 39 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -11% from the first quarter of 2019. Below, you can check out the change in hedge fund sentiment towards WYNN over the last 16 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists a select group of key hedge fund managers who were boosting their holdings meaningfully (or already accumulated large positions).

Among these funds, Lone Pine Capital held the most valuable stake in Wynn Resorts, Limited (NASDAQ:WYNN), which was worth $670.4 million at the end of the second quarter. On the second spot was Egerton Capital Limited which amassed $432.4 million worth of shares. Moreover, OZ Management, Citadel Investment Group, and OZ Management were also bullish on Wynn Resorts, Limited (NASDAQ:WYNN), allocating a large percentage of their portfolios to this stock.

Because Wynn Resorts, Limited (NASDAQ:WYNN) has faced bearish sentiment from the entirety of the hedge funds we track, it’s safe to say that there exists a select few hedgies that elected to cut their entire stakes last quarter. It’s worth mentioning that Bain Capital’s Brookside Capital said goodbye to the biggest position of all the hedgies monitored by Insider Monkey, comprising about $36.3 million in stock. John Khoury’s fund, Long Pond Capital, also cut its stock, about $26.7 million worth. These moves are interesting, as total hedge fund interest fell by 5 funds last quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Wynn Resorts, Limited (NASDAQ:WYNN) but similarly valued. We will take a look at Invitation Homes Inc. (NYSE:INVH), Live Nation Entertainment, Inc. (NYSE:LYV), Icahn Enterprises LP (NASDAQ:IEP), and Huntington Bancshares Incorporated (NASDAQ:HBAN). This group of stocks’ market valuations resemble WYNN’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| INVH | 31 | 684813 | 7 |

| LYV | 39 | 980822 | 0 |

| IEP | 5 | 13553559 | 0 |

| HBAN | 23 | 67157 | -5 |

| Average | 24.5 | 3821588 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 24.5 hedge funds with bullish positions and the average amount invested in these stocks was $3822 million. That figure was $1944 million in WYNN’s case. Live Nation Entertainment, Inc. (NYSE:LYV) is the most popular stock in this table. On the other hand Icahn Enterprises LP (NASDAQ:IEP) is the least popular one with only 5 bullish hedge fund positions. Wynn Resorts, Limited (NASDAQ:WYNN) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately WYNN wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on WYNN were disappointed as the stock returned -11.5% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks (view the video below) among hedge funds as many of these stocks already outperformed the market so far this year.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.