The 800+ hedge funds and famous money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the second quarter, which unveil their equity positions as of June 30th. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund portfolios. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards Welltower Inc. (NYSE:WELL).

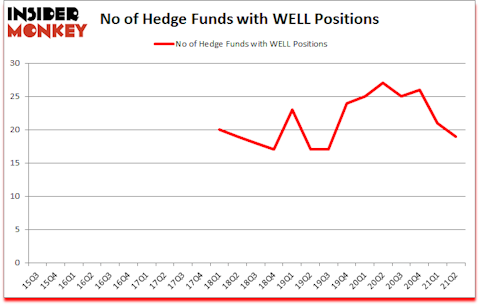

Is Welltower Inc. (NYSE:WELL) a bargain? The best stock pickers were in a pessimistic mood. The number of bullish hedge fund positions dropped by 2 lately. Welltower Inc. (NYSE:WELL) was in 19 hedge funds’ portfolios at the end of June. The all time high for this statistic is 27. Our calculations also showed that WELL isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings). There were 21 hedge funds in our database with WELL holdings at the end of March.

In the 21st century investor’s toolkit there are a lot of signals stock market investors can use to evaluate stocks. A pair of the most innovative signals are hedge fund and insider trading signals. Our researchers have shown that, historically, those who follow the top picks of the best investment managers can outperform their index-focused peers by a solid margin (see the details here). Also, our monthly newsletter’s portfolio of long stock picks returned 185.4% since March 2017 (through August 2021) and beat the S&P 500 Index by more than 79 percentage points. You can download a sample issue of this newsletter on our website.

With all of this in mind we’re going to take a gander at the new hedge fund action surrounding Welltower Inc. (NYSE:WELL).

Do Hedge Funds Think WELL Is A Good Stock To Buy Now?

At Q2’s end, a total of 19 of the hedge funds tracked by Insider Monkey were long this stock, a change of -10% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards WELL over the last 24 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists a select group of key hedge fund managers who were increasing their stakes considerably (or already accumulated large positions).

More specifically, Zimmer Partners was the largest shareholder of Welltower Inc. (NYSE:WELL), with a stake worth $227.5 million reported as of the end of June. Trailing Zimmer Partners was Adage Capital Management, which amassed a stake valued at $37.5 million. Healthcor Management LP, Clough Capital Partners, and Impax Asset Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Hill Winds Capital allocated the biggest weight to Welltower Inc. (NYSE:WELL), around 3.44% of its 13F portfolio. Zimmer Partners is also relatively very bullish on the stock, designating 3.06 percent of its 13F equity portfolio to WELL.

Seeing as Welltower Inc. (NYSE:WELL) has experienced declining sentiment from the aggregate hedge fund industry, logic holds that there exists a select few hedge funds that decided to sell off their entire stakes heading into Q3. Intriguingly, Stephen DuBois’s Camber Capital Management said goodbye to the largest position of all the hedgies tracked by Insider Monkey, worth close to $58 million in stock. Benjamin A. Smith’s fund, Laurion Capital Management, also sold off its stock, about $12.6 million worth. These transactions are interesting, as aggregate hedge fund interest dropped by 2 funds heading into Q3.

Let’s now take a look at hedge fund activity in other stocks similar to Welltower Inc. (NYSE:WELL). We will take a look at Nutrien Ltd. (NYSE:NTR), KKR & Co Inc. (NYSE:KKR), LyondellBasell Industries NV (NYSE:LYB), Yum! Brands, Inc. (NYSE:YUM), Archer Daniels Midland Company (NYSE:ADM), Hilton Worldwide Holdings Inc (NYSE:HLT), and Zimmer Biomet Holdings Inc (NYSE:ZBH). This group of stocks’ market valuations are similar to WELL’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NTR | 28 | 596869 | -5 |

| KKR | 54 | 5347811 | -2 |

| LYB | 41 | 888236 | -6 |

| YUM | 35 | 652331 | 3 |

| ADM | 41 | 837799 | 7 |

| HLT | 45 | 4558478 | -2 |

| ZBH | 48 | 1785063 | -2 |

| Average | 41.7 | 2095227 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 41.7 hedge funds with bullish positions and the average amount invested in these stocks was $2095 million. That figure was $427 million in WELL’s case. KKR & Co Inc. (NYSE:KKR) is the most popular stock in this table. On the other hand Nutrien Ltd. (NYSE:NTR) is the least popular one with only 28 bullish hedge fund positions. Compared to these stocks Welltower Inc. (NYSE:WELL) is even less popular than NTR. Our overall hedge fund sentiment score for WELL is 24.1. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Hedge funds dodged a bullet by taking a bearish stance towards WELL. Our calculations showed that the top 5 most popular hedge fund stocks returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 24% in 2021 through October 22nd but managed to beat the market again by 1.6 percentage points. Unfortunately WELL wasn’t nearly as popular as these 5 stocks (hedge fund sentiment was very bearish); WELL investors were disappointed as the stock returned -1.8% since the end of the second quarter (through 10/22) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as most of these stocks already outperformed the market since 2019.

Follow Welltower Inc. (NYSE:WELL)

Follow Welltower Inc. (NYSE:WELL)

Receive real-time insider trading and news alerts

Suggested Articles:

- 20 Largest Hotel Chains In The World

- Top 15 Online Shopping Websites in 2020

- 15 Largest Chemical Companies in the World

Disclosure: None. This article was originally published at Insider Monkey.