Hedge funds and large money managers usually invest with a focus on the long-term horizon and, therefore, short-lived dips or bumps on the charts, usually don’t make them change their opinion towards a company. This time it may be different. During the fourth quarter of 2018 we observed increased volatility and small-cap stocks underperformed the market. Things completely reversed during the first half of 2019. Hedge fund investor letters indicated that they are cutting their overall exposure, closing out some position and doubling down on others. Let’s take a look at the hedge fund sentiment towards US Foods Holding Corp. (NYSE:USFD) to find out whether it was one of their high conviction long-term ideas.

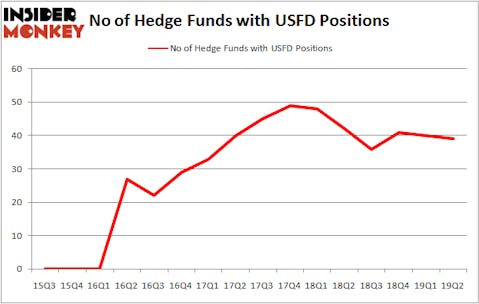

US Foods Holding Corp. (NYSE:USFD) investors should pay attention to a decrease in support from the world’s most elite money managers recently. USFD was in 39 hedge funds’ portfolios at the end of the second quarter of 2019. There were 40 hedge funds in our database with USFD positions at the end of the previous quarter. Our calculations also showed that USFD isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 25.7% through September 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Unlike this former hedge fund manager who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s view the fresh hedge fund action encompassing US Foods Holding Corp. (NYSE:USFD).

What have hedge funds been doing with US Foods Holding Corp. (NYSE:USFD)?

At the end of the second quarter, a total of 39 of the hedge funds tracked by Insider Monkey were long this stock, a change of -3% from the first quarter of 2019. On the other hand, there were a total of 42 hedge funds with a bullish position in USFD a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Eminence Capital held the most valuable stake in US Foods Holding Corp. (NYSE:USFD), which was worth $242.2 million at the end of the second quarter. On the second spot was Sachem Head Capital which amassed $163.6 million worth of shares. Moreover, Holocene Advisors, Palestra Capital Management, and Samlyn Capital were also bullish on US Foods Holding Corp. (NYSE:USFD), allocating a large percentage of their portfolios to this stock.

Because US Foods Holding Corp. (NYSE:USFD) has experienced a decline in interest from the smart money, it’s safe to say that there lies a certain “tier” of hedge funds that elected to cut their full holdings in the second quarter. It’s worth mentioning that Andrew Immerman and Jeremy Schiffman’s Palestra Capital Management cut the largest stake of all the hedgies monitored by Insider Monkey, worth about $91.5 million in stock. Brian J. Higgins’s fund, King Street Capital, also dumped its stock, about $42 million worth. These moves are intriguing to say the least, as aggregate hedge fund interest dropped by 1 funds in the second quarter.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as US Foods Holding Corp. (NYSE:USFD) but similarly valued. These stocks are Gildan Activewear Inc (NYSE:GIL), News Corp (NASDAQ:NWSA), Fortune Brands Home & Security Inc (NYSE:FBHS), and Bruker Corporation (NASDAQ:BRKR). This group of stocks’ market valuations match USFD’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GIL | 24 | 551244 | -3 |

| NWSA | 23 | 351093 | 2 |

| FBHS | 31 | 642699 | 2 |

| BRKR | 27 | 521013 | 2 |

| Average | 26.25 | 516512 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 26.25 hedge funds with bullish positions and the average amount invested in these stocks was $517 million. That figure was $1399 million in USFD’s case. Fortune Brands Home & Security Inc (NYSE:FBHS) is the most popular stock in this table. On the other hand News Corp (NASDAQ:NWSA) is the least popular one with only 23 bullish hedge fund positions. Compared to these stocks US Foods Holding Corp. (NYSE:USFD) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on USFD as the stock returned 14.9% during Q3 and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.