Hedge funds and large money managers usually invest with a focus on the long-term horizon and, therefore, short-lived dips on the charts, usually don’t make them change their opinion towards a company. The second half of 2015 and the first few months of this year was a stressful period for hedge funds. However, things have been taking a turn for the better in the second half of this year. Small-cap stocks which hedge funds are usually overweight outperformed the market by double digits and it may be a good time to pay attention to hedge funds’ picks before it is too late. In this article we are going to analyze the hedge fund sentiment towards Twenty-First Century Fox Inc (NASDAQ:FOX) to find out whether it was one of their high conviction long-term ideas.

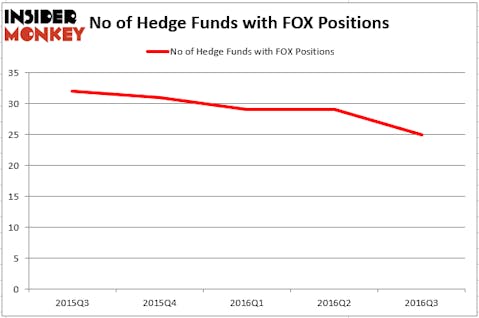

Twenty-First Century Fox Inc (NASDAQ:FOX) investors should pay attention to a decrease in hedge fund interest recently. There were 29 hedge funds in our database with FOX holdings at the end of the previous quarter. At the end of this article we will also compare FOX to other stocks including Prudential Public Limited Company (ADR) (NYSE:PUK), Las Vegas Sands Corp. (NYSE:LVS), and Kimberly Clark Corp (NYSE:KMB) to get a better sense of its popularity.

Follow Twenty-First Century Fox Inc. (NASDAQ:TFCF,TFCFA)

Follow Twenty-First Century Fox Inc. (NASDAQ:TFCF,TFCFA)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

corund/Shutterstock.com

Keeping this in mind, we’re going to take a look at the new action surrounding Twenty-First Century Fox Inc (NASDAQ:FOX).

What does the smart money think about Twenty-First Century Fox Inc (NASDAQ:FOX)?

Heading into the fourth quarter of 2016, a total of 25 of the hedge funds tracked by Insider Monkey held long positions in this stock, a drop of 14% from the second quarter of 2016. By comparison, 31 hedge funds held shares or bullish call options in FOX heading into this year. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, ValueAct Capital, led by Jeffrey Ubben, holds the largest position in Twenty-First Century Fox Inc (NASDAQ:FOX). According to regulatory filings, the fund has a $1.25 billion position in the stock, comprising 10.8% of its 13F portfolio. Sitting at the No. 2 spot is Boykin Curry of Eagle Capital Management, with a $776 million position; the fund has 3.3% of its 13F portfolio invested in the stock. Some other hedge funds and institutional investors that hold long positions encompass Donald Yacktman’s Yacktman Asset Management, William Duhamel’s Route One Investment Company and Ric Dillon’s Diamond Hill Capital. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Judging by the fact that Twenty-First Century Fox Inc (NASDAQ:FOX) has weathered a decline in interest from the smart money, we can see that there is a sect of fund managers who were dropping their full holdings by the end of the third quarter. At the top of the heap, David Tepper’s Appaloosa Management LP cut the largest investment of all the investors watched by Insider Monkey, worth an estimated $29.6 million in stock, and Panayotis Takis Sparaggis’s Alkeon Capital Management was right behind this move, as the fund sold off about $24.1 million worth of FOX shares.

Let’s now take a look at hedge fund activity in other stocks similar to Twenty-First Century Fox Inc (NASDAQ:FOX). We will take a look at Prudential Public Limited Company (ADR) (NYSE:PUK), Las Vegas Sands Corp. (NYSE:LVS), Kimberly Clark Corp (NYSE:KMB), and Monsanto Company (NYSE:MON). This group of stocks’ market values are similar to FOX’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PUK | 9 | 19569 | 1 |

| LVS | 31 | 659604 | 8 |

| KMB | 29 | 1420992 | 7 |

| MON | 77 | 3675899 | -10 |

As you can see these stocks had an average of 37 hedge funds with bullish positions and the average amount invested in these stocks was $1.44 billion. That figure was $3.62 billion in FOX’s case. Monsanto Company (NYSE:MON) is the most popular stock in this table. On the other hand Prudential Public Limited Company (ADR) (NYSE:PUK) is the least popular one with only 9 bullish hedge fund positions. Twenty-First Century Fox Inc (NASDAQ:FOX) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard MON might be a better candidate to consider taking a long position in.

Disclosure: none.