Although the masses and most of the financial media blame hedge funds for their exorbitant fee structure and disappointing performance, these investors have proved to have great stock picking abilities over the years (that’s why their assets under management continue to swell). We believe hedge fund sentiment should serve as a crucial tool of an individual investor’s stock selection process, as it may offer great insights of how the brightest minds of the finance industry feel about specific stocks. After all, these people have access to smartest analysts and expensive data/information sources that individual investors can’t match. So should one consider investing in Symantec Corporation (NASDAQ:SYMC) ? The smart money sentiment can provide an answer to this question.

Symantec Corporation (NASDAQ:SYMC) has experienced a decrease in enthusiasm from smart money lately. SYMC was in 37 hedge funds’ portfolios at the end of the third quarter of 2016. There were 38 hedge funds in our database with SYMC positions at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Northern Trust Corporation (NASDAQ:NTRS), TransDigm Group Incorporated (NYSE:TDG), and Noble Energy, Inc. (NYSE:NBL) to gather more data points.

Follow Gen Digital Inc. (NASDAQ:GEN)

Follow Gen Digital Inc. (NASDAQ:GEN)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

crystal51/Shutterstock.com

How have hedgies been trading Symantec Corporation (NASDAQ:SYMC)?

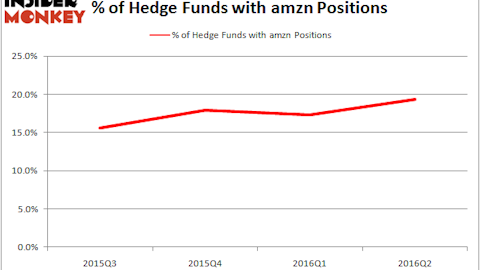

At Q3’s end, a total of 37 of the hedge funds tracked by Insider Monkey were long this stock, down by 3% from the previous quarter. The graph below displays the number of hedge funds with bullish position in SYMC over the last 5 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Paul Singer’s Elliott Management has the number one position in Symantec Corporation (NASDAQ:SYMC), worth close to $301.2 million, accounting for 2.5% of its total 13F portfolio. The second largest stake is held by Andrew Feldstein and Stephen Siderow of Blue Mountain Capital, with a $186.4 million position; 4.3% of its 13F portfolio is allocated to the company. Remaining peers with similar optimism include William B. Gray’s Orbis Investment Management, Jim Simons’ Renaissance Technologies and John Burbank’s Passport Capital. We should note that Orbis Investment Management is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Seeing as Symantec Corporation (NASDAQ:SYMC) has witnessed falling interest from the smart money, we can see that there exists a select few money managers that decided to sell off their positions entirely by the end of the third quarter. Intriguingly, David Greenspan’s Slate Path Capital sold off the largest position of all the hedgies tracked by Insider Monkey, totaling close to $113.1 million in stock, and Philippe Laffont’s Coatue Management was right behind this move, as the fund sold off about $44.2 million worth of shares.

Let’s check out hedge fund activity in other stocks similar to Symantec Corporation (NASDAQ:SYMC). These stocks are Northern Trust Corporation (NASDAQ:NTRS), TransDigm Group Incorporated (NYSE:TDG), Noble Energy, Inc. (NYSE:NBL), and Agilent Technologies Inc. (NYSE:A). This group of stocks’ market valuations resemble SYMC’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NTRS | 30 | 486076 | 3 |

| TDG | 44 | 3477124 | 2 |

| NBL | 33 | 1366115 | -3 |

| A | 41 | 1395703 | 1 |

As you can see these stocks had an average of 37 hedge funds with bullish positions and the average amount invested in these stocks was $1.68 billion. That figure was $1.28 billion in SYMC’s case. TransDigm Group Incorporated (NYSE:TDG) is the most popular stock in this table. On the other hand Northern Trust Corporation (NASDAQ:NTRS) is the least popular one with only 30 bullish hedge fund positions. Symantec Corporation (NASDAQ:SYMC) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard TDG might be a better candidate to consider taking a long position in.

Disclosure: None