World-class money managers like Ken Griffin and Barry Rosenstein only invest their wealthy clients’ money after undertaking a rigorous examination of any potential stock. They are particularly successful in this regard when it comes to small-cap stocks, which their peerless research gives them a big information advantage on when it comes to judging their worth. It’s not surprising then that they generate their biggest returns from these stocks and invest more of their money in these stocks on average than other investors. It’s also not surprising then that we pay close attention to these picks ourselves and have built a market-beating investment strategy around them.

Is Spirit Realty Capital Inc (NYSE:SRC) a buy, sell, or hold? Money managers are taking a pessimistic view. The number of bullish hedge fund bets dropped by 8 in recent months. Our calculations also showed that SRC isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 6.3% year to date (through December 3rd) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 18 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to analyze the fresh hedge fund action regarding Spirit Realty Capital Inc (NYSE:SRC).

What have hedge funds been doing with Spirit Realty Capital Inc (NYSE:SRC)?

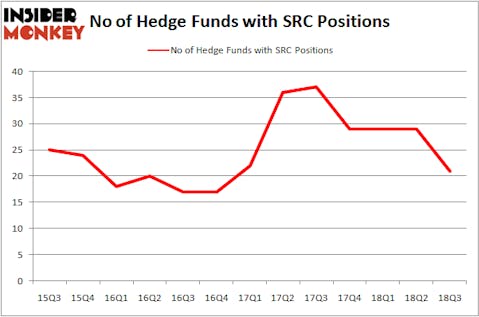

At the end of the third quarter, a total of 21 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -28% from the previous quarter. The graph below displays the number of hedge funds with bullish position in SRC over the last 13 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Scopia Capital held the most valuable stake in Spirit Realty Capital Inc (NYSE:SRC), which was worth $150.7 million at the end of the third quarter. On the second spot was Knighthead Capital which amassed $72.8 million worth of shares. Moreover, Arrowstreet Capital, Renaissance Technologies, and Permian Investment Partners were also bullish on Spirit Realty Capital Inc (NYSE:SRC), allocating a large percentage of their portfolios to this stock.

Because Spirit Realty Capital Inc (NYSE:SRC) has witnessed a decline in interest from the aggregate hedge fund industry, we can see that there exists a select few hedgies that elected to cut their positions entirely heading into Q3. It’s worth mentioning that Michael Weinstock’s Monarch Alternative Capital dumped the biggest position of the “upper crust” of funds watched by Insider Monkey, totaling about $42.9 million in stock, and John Orrico’s Water Island Capital was right behind this move, as the fund cut about $12.6 million worth. These moves are intriguing to say the least, as total hedge fund interest fell by 8 funds heading into Q3.

Let’s now review hedge fund activity in other stocks similar to Spirit Realty Capital Inc (NYSE:SRC). We will take a look at Zynga Inc (NASDAQ:ZNGA), Blueprint Medicines Corporation (NASDAQ:BPMC), Eastgroup Properties Inc (NYSE:EGP), and Signet Jewelers Limited (NYSE:SIG). This group of stocks’ market caps resemble SRC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ZNGA | 26 | 614239 | 3 |

| BPMC | 27 | 614433 | 3 |

| EGP | 5 | 17676 | -3 |

| SIG | 26 | 383109 | 3 |

| Average | 21 | 407364 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21 hedge funds with bullish positions and the average amount invested in these stocks was $407 million. That figure was $466 million in SRC’s case. Blueprint Medicines Corporation (NASDAQ:BPMC) is the most popular stock in this table. On the other hand Eastgroup Properties Inc (NYSE:EGP) is the least popular one with only 5 bullish hedge fund positions. Spirit Realty Capital Inc (NYSE:SRC) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard BPMC might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.