Before we spend days researching a stock idea we’d like to take a look at how hedge funds and billionaire investors recently traded that stock. S&P 500 Index returned about 7.6% during the last 12 months ending November 21, 2016. Most investors don’t notice that less than 49% of the stocks in the index outperformed the index. This means you (or a monkey throwing a dart) have less than an even chance of beating the market by randomly picking a stock. On the other hand, the top 30 mid-cap stocks among the best performing hedge funds had an average return of 18% during the same period. Hedge funds had bad stock picks like everyone else. We are sure you have read about their worst picks, like Valeant, in the media over the past year. So, taking cues from hedge funds isn’t a foolproof strategy, but it seems to work on average. In this article, we will take a look at what hedge funds think about Sempra Energy (NYSE:SRE) .

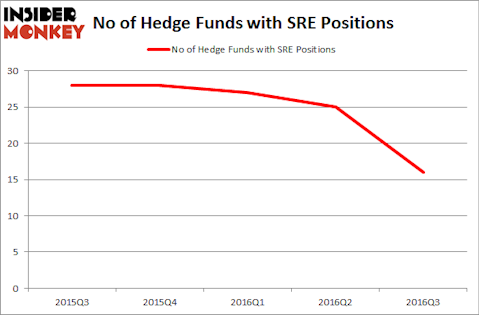

Sempra Energy (NYSE:SRE) has seen a decrease in activity from the world’s largest hedge funds recently. SRE was in 16 hedge funds’ portfolios at the end of September. There were 25 hedge funds in our database with SRE positions at the end of the previous quarter. At the end of this article we will also compare SRE to other stocks including Fresenius Medical Care AG & Co. (ADR) (NYSE:FMS), Health Care REIT, Inc. (NYSE:HCN), and Illumina, Inc. (NASDAQ:ILMN) to get a better sense of its popularity.

Follow Sempra (NYSE:SRE)

Follow Sempra (NYSE:SRE)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

Keeping this in mind, let’s check out the new action surrounding Sempra Energy (NYSE:SRE).

Hedge fund activity in Sempra Energy (NYSE:SRE)

At the end of the third quarter, a total of 16 of the hedge funds tracked by Insider Monkey held long positions in this stock, a drop of 36% from one quarter earlier. By comparison, 28 hedge funds held shares or bullish call options in SRE heading into this year. With hedge funds’ capital changing hands, there exists an “upper tier” of key hedge fund managers who were upping their stakes meaningfully (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Adage Capital Management, led by Phill Gross and Robert Atchinson, holds the most valuable position in Sempra Energy (NYSE:SRE). According to regulatory filings, the fund has a $185.3 million position in the stock, comprising 0.5% of its 13F portfolio. The second largest stake is held by Renaissance Technologies, founded by Jim Simons, with a $183.1 million position; 0.3% of its 13F portfolio is allocated to the stock. Remaining members of the smart money with similar optimism consist of Israel Englander’s Millennium Management, D. E. Shaw’s D E Shaw and Jos Shaver’s Electron Capital Partners. We should note that Electron Capital Partners is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.