How do we determine whether Raytheon Company (NYSE:RTN) makes for a good investment at the moment? We analyze the sentiment of a select group of the very best investors in the world, who spend immense amounts of time and resources studying companies. They may not always be right (no one is), but data shows that their consensus long positions have historically outperformed the market when we adjust for known risk factors.

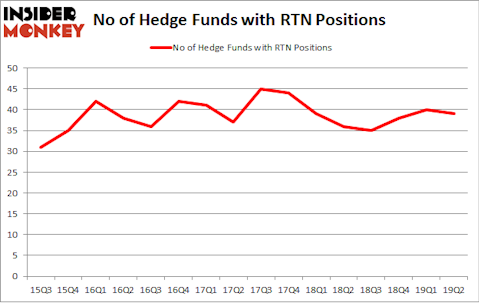

Is Raytheon Company (NYSE:RTN) ready to rally soon? Hedge funds are in a pessimistic mood. The number of long hedge fund bets were trimmed by 1 recently. Our calculations also showed that RTN isn’t among the 30 most popular stocks among hedge funds (see the video at the end of this article). RTN was in 39 hedge funds’ portfolios at the end of the second quarter of 2019. There were 40 hedge funds in our database with RTN positions at the end of the previous quarter.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 25.7% through September 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to check out the latest hedge fund action surrounding Raytheon Company (NYSE:RTN).

How are hedge funds trading Raytheon Company (NYSE:RTN)?

At the end of the second quarter, a total of 39 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -3% from the first quarter of 2019. On the other hand, there were a total of 36 hedge funds with a bullish position in RTN a year ago. With the smart money’s sentiment swirling, there exists an “upper tier” of noteworthy hedge fund managers who were upping their holdings meaningfully (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Eric W. Mandelblatt and Gaurav Kapadia’s Soroban Capital Partners has the most valuable position in Raytheon Company (NYSE:RTN), worth close to $280.4 million, amounting to 4.2% of its total 13F portfolio. The second most bullish fund manager is AQR Capital Management, led by Cliff Asness, holding a $218 million position; the fund has 0.2% of its 13F portfolio invested in the stock. Other hedge funds and institutional investors that hold long positions contain Phill Gross and Robert Atchinson’s Adage Capital Management, Ken Griffin’s Citadel Investment Group and John Overdeck and David Siegel’s Two Sigma Advisors.

Due to the fact that Raytheon Company (NYSE:RTN) has witnessed declining sentiment from the aggregate hedge fund industry, it’s safe to say that there were a few hedgies who sold off their full holdings in the second quarter. It’s worth mentioning that Jim Simons’s Renaissance Technologies dumped the biggest investment of all the hedgies followed by Insider Monkey, valued at an estimated $22.6 million in stock. Michael Kharitonov and Jon David McAuliffe’s fund, Voleon Capital, also dropped its stock, about $17.5 million worth. These transactions are intriguing to say the least, as aggregate hedge fund interest fell by 1 funds in the second quarter.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Raytheon Company (NYSE:RTN) but similarly valued. We will take a look at Las Vegas Sands Corp. (NYSE:LVS), Metlife Inc (NYSE:MET), Kinder Morgan Inc (NYSE:KMI), and Exelon Corporation (NASDAQ:EXC). This group of stocks’ market values match RTN’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LVS | 39 | 1882579 | 2 |

| MET | 26 | 1498576 | -5 |

| KMI | 37 | 1685778 | 1 |

| EXC | 32 | 1990186 | -1 |

| Average | 33.5 | 1764280 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 33.5 hedge funds with bullish positions and the average amount invested in these stocks was $1764 million. That figure was $1609 million in RTN’s case. Las Vegas Sands Corp. (NYSE:LVS) is the most popular stock in this table. On the other hand Metlife Inc (NYSE:MET) is the least popular one with only 26 bullish hedge fund positions. Raytheon Company (NYSE:RTN) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on RTN as the stock returned 13.4% during the third quarter and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.