You probably know from experience that there is not as much information on small-cap companies as there is on large companies. Of course, this makes it really hard and difficult for individual investors to make proper and accurate analysis of certain small-cap companies. However, well-known and successful hedge fund investors like Carl Icahn and George Soros hold the necessary resources and abilities to conduct an extensive stock analysis on small-cap stocks, which enable them to make millions of dollars by identifying potential winners within the small-cap galaxy of stocks. This represents the main reason why Insider Monkey takes notice of the hedge fund activity in these overlooked stocks.

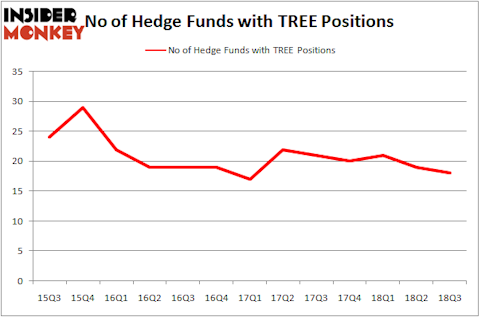

LendingTree, Inc (NASDAQ:TREE) has experienced a decrease in hedge fund sentiment of late. Our calculations also showed that TREE isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s take a look at the fresh hedge fund action encompassing LendingTree, Inc (NASDAQ:TREE).

How are hedge funds trading LendingTree, Inc (NASDAQ:TREE)?

Heading into the fourth quarter of 2018, a total of 18 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -5% from one quarter earlier. By comparison, 20 hedge funds held shares or bullish call options in TREE heading into this year. With hedgies’ sentiment swirling, there exists an “upper tier” of key hedge fund managers who were adding to their holdings significantly (or already accumulated large positions).

Among these funds, Citadel Investment Group held the most valuable stake in LendingTree, Inc (NASDAQ:TREE), which was worth $37.3 million at the end of the third quarter. On the second spot was Alyeska Investment Group which amassed $12.2 million worth of shares. Moreover, PDT Partners, G2 Investment Partners Management, and PAR Capital Management were also bullish on LendingTree, Inc (NASDAQ:TREE), allocating a large percentage of their portfolios to this stock.

Since LendingTree, Inc (NASDAQ:TREE) has faced a decline in interest from the entirety of the hedge funds we track, it’s easy to see that there were a few hedgies who sold off their full holdings heading into Q3. It’s worth mentioning that Christopher James’s Partner Fund Management sold off the largest stake of the “upper crust” of funds monitored by Insider Monkey, comprising about $6 million in stock, and D. E. Shaw’s D E Shaw was right behind this move, as the fund dumped about $1.5 million worth. These bearish behaviors are important to note, as aggregate hedge fund interest was cut by 1 funds heading into Q3.

Let’s also examine hedge fund activity in other stocks similar to LendingTree, Inc (NASDAQ:TREE). We will take a look at NorthWestern Corporation (NYSE:NWE), Nuveen AMT-Free Municipal Credit Income Fund (NYSE:NVG), Sogou Inc. (NYSE:SOGO), and Cedar Fair, L.P. (NYSE:FUN). This group of stocks’ market valuations are similar to TREE’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NWE | 15 | 135790 | 2 |

| NVG | 3 | 571 | -1 |

| SOGO | 6 | 8954 | -3 |

| FUN | 7 | 20776 | -1 |

| Average | 7.75 | 41523 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 7.75 hedge funds with bullish positions and the average amount invested in these stocks was $42 million. That figure was $70 million in TREE’s case. NorthWestern Corporation (NYSE:NWE) is the most popular stock in this table. On the other hand Nuveen AMT-Free Municipal Credit Income Fund (NYSE:NVG) is the least popular one with only 3 bullish hedge fund positions. Compared to these stocks LendingTree, Inc (NASDAQ:TREE) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.