Before we spend countless hours researching a company, we like to analyze what insiders, hedge funds and billionaire investors think of the stock first. This is a necessary first step in our investment process because our research has shown that the elite investors’ consensus returns have been exceptional. In the following paragraphs, we find out what the billionaire investors and hedge funds think of Falcon Minerals Corporation (NASDAQ:FLMN).

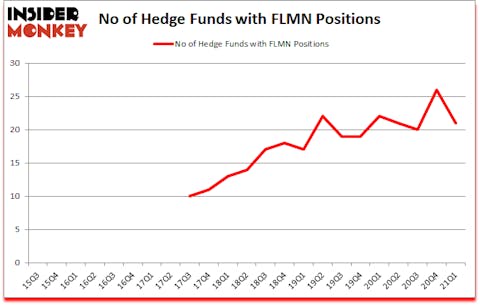

Falcon Minerals Corporation (NASDAQ:FLMN) has experienced a decrease in hedge fund interest of late. Falcon Minerals Corporation (NASDAQ:FLMN) was in 21 hedge funds’ portfolios at the end of March. The all time high for this statistic is 26. There were 26 hedge funds in our database with FLMN holdings at the end of December. Our calculations also showed that FLMN isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings).

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s monthly stock picks returned 206.8% since March 2017 and outperformed the S&P 500 ETFs by more than 115 percentage points (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, Chuck Schumer recently stated that marijuana legalization will be a Senate priority. So, we are checking out this under the radar stock that will benefit from this. We go through lists like the 10 best battery stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. With all of this in mind let’s take a peek at the fresh hedge fund action encompassing Falcon Minerals Corporation (NASDAQ:FLMN).

Do Hedge Funds Think FLMN Is A Good Stock To Buy Now?

At Q1’s end, a total of 21 of the hedge funds tracked by Insider Monkey were long this stock, a change of -19% from the previous quarter. The graph below displays the number of hedge funds with bullish position in FLMN over the last 23 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists a select group of key hedge fund managers who were upping their holdings considerably (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Nantahala Capital Management, managed by Wilmot B. Harkey and Daniel Mack, holds the number one position in Falcon Minerals Corporation (NASDAQ:FLMN). Nantahala Capital Management has a $12.1 million position in the stock, comprising 0.4% of its 13F portfolio. On Nantahala Capital Management’s heels is Robert Pohly of Samlyn Capital, with a $10.3 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Other hedge funds and institutional investors that are bullish include Leon Cooperman’s Omega Advisors, Ken Grossman and Glen Schneider’s SG Capital Management and Marc Lisker, Glenn Fuhrman and John Phelan’s MSDC Management. In terms of the portfolio weights assigned to each position SG Capital Management allocated the biggest weight to Falcon Minerals Corporation (NASDAQ:FLMN), around 0.53% of its 13F portfolio. Omega Advisors is also relatively very bullish on the stock, setting aside 0.42 percent of its 13F equity portfolio to FLMN.

Because Falcon Minerals Corporation (NASDAQ:FLMN) has faced bearish sentiment from hedge fund managers, we can see that there exists a select few hedgies that decided to sell off their entire stakes by the end of the first quarter. It’s worth mentioning that David Harding’s Winton Capital Management said goodbye to the largest investment of the “upper crust” of funds monitored by Insider Monkey, worth close to $0.2 million in stock, and Nick Thakore’s Diametric Capital was right behind this move, as the fund sold off about $0.1 million worth. These bearish behaviors are interesting, as aggregate hedge fund interest was cut by 5 funds by the end of the first quarter.

Let’s now review hedge fund activity in other stocks similar to Falcon Minerals Corporation (NASDAQ:FLMN). These stocks are NewAge Inc (NASDAQ:NBEV), Athersys, Inc. (NASDAQ:ATHX), Spruce Biosciences, Inc. (NASDAQ:SPRB), MEI Pharma Inc (NASDAQ:MEIP), Old Second Bancorp Inc. (NASDAQ:OSBC), Fulcrum Therapeutics, Inc. (NASDAQ:FULC), and ASA Gold and Precious Metals Ltd (NYSE:ASA). All of these stocks’ market caps resemble FLMN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NBEV | 7 | 18274 | 2 |

| ATHX | 7 | 1251 | 2 |

| SPRB | 8 | 84132 | -3 |

| MEIP | 17 | 61724 | 1 |

| OSBC | 7 | 15330 | -2 |

| FULC | 17 | 86329 | 0 |

| ASA | 6 | 12413 | -1 |

| Average | 9.9 | 39922 | -0.1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 9.9 hedge funds with bullish positions and the average amount invested in these stocks was $40 million. That figure was $43 million in FLMN’s case. MEI Pharma Inc (NASDAQ:MEIP) is the most popular stock in this table. On the other hand ASA Gold and Precious Metals Ltd (NYSE:ASA) is the least popular one with only 6 bullish hedge fund positions. Compared to these stocks Falcon Minerals Corporation (NASDAQ:FLMN) is more popular among hedge funds. Our overall hedge fund sentiment score for FLMN is 74.2. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 23.8% in 2021 through July 16th and still beat the market by 7.7 percentage points. Unfortunately FLMN wasn’t nearly as popular as these 5 stocks and hedge funds that were betting on FLMN were disappointed as the stock returned 8% since the end of the first quarter (through 7/16) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as most of these stocks already outperformed the market since 2019.

Follow Str Sub Inc. (NASDAQ:NONE)

Follow Str Sub Inc. (NASDAQ:NONE)

Receive real-time insider trading and news alerts

Suggested Articles:

- Top 15 Serial Entrepreneurs In The World

- 13 Biggest Gay Pride Parades in the World

- 16 Best Space Stocks To Buy Now

Disclosure: None. This article was originally published at Insider Monkey.