Is Copa Holdings, S.A. (NYSE:CPA) a good equity to bet on right now? We like to check what the smart money thinks first before doing extensive research. Although there have been several high profile failed hedge fund picks, the consensus picks among hedge fund investors have historically outperformed the market after adjusting for known risk attributes. It’s not surprising given that hedge funds have access to better information and more resources to find the latest market-moving information.

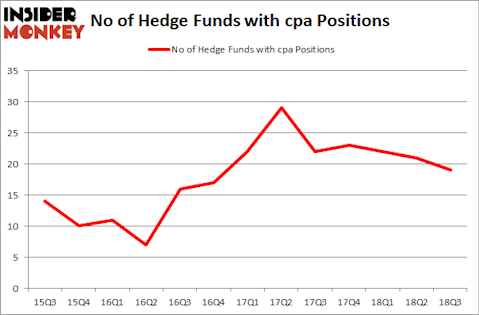

Copa Holdings, S.A. (NYSE:CPA) has seen a decrease in activity from the world’s largest hedge funds lately. CPA was in 19 hedge funds’ portfolios at the end of the third quarter of 2018. There were 21 hedge funds in our database with CPA positions at the end of the previous quarter. Our calculations also showed that cpa isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 6.3% year to date (through December 3rd) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 18 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to go over the key hedge fund action regarding Copa Holdings, S.A. (NYSE:CPA).

What have hedge funds been doing with Copa Holdings, S.A. (NYSE:CPA)?

At Q3’s end, a total of 19 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -10% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in CPA over the last 13 quarters. With the smart money’s capital changing hands, there exists a few notable hedge fund managers who were increasing their stakes considerably (or already accumulated large positions).

More specifically, Renaissance Technologies was the largest shareholder of Copa Holdings, S.A. (NYSE:CPA), with a stake worth $78.3 million reported as of the end of September. Trailing Renaissance Technologies was Orbis Investment Management, which amassed a stake valued at $68.6 million. Polar Capital, Two Sigma Advisors, and Tyvor Capital were also very fond of the stock, giving the stock large weights in their portfolios.

Since Copa Holdings, S.A. (NYSE:CPA) has experienced a decline in interest from hedge fund managers, it’s safe to say that there lies a certain “tier” of hedgies that slashed their entire stakes by the end of the third quarter. It’s worth mentioning that Israel Englander’s Millennium Management dumped the biggest position of the “upper crust” of funds watched by Insider Monkey, valued at about $24 million in stock, and Paul Tudor Jones’s Tudor Investment Corp was right behind this move, as the fund cut about $2.2 million worth. These transactions are intriguing to say the least, as total hedge fund interest dropped by 2 funds by the end of the third quarter.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Copa Holdings, S.A. (NYSE:CPA) but similarly valued. We will take a look at Tribune Media Company (NYSE:TRCO), GreenSky, Inc. (NASDAQ:GSKY), Merit Medical Systems, Inc. (NASDAQ:MMSI), and Simpson Manufacturing Co, Inc. (NYSE:SSD). This group of stocks’ market caps resemble CPA’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TRCO | 39 | 1292684 | 7 |

| GSKY | 20 | 187344 | -5 |

| MMSI | 12 | 278333 | 0 |

| SSD | 17 | 235777 | 2 |

| Average | 22 | 498535 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22 hedge funds with bullish positions and the average amount invested in these stocks was $499 million. That figure was $281 million in CPA’s case. Tribune Media Company (NYSE:TRCO) is the most popular stock in this table. On the other hand Merit Medical Systems, Inc. (NASDAQ:MMSI) is the least popular one with only 12 bullish hedge fund positions. Copa Holdings, S.A. (NYSE:CPA) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard TRCO might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.