It is already common knowledge that individual investors do not usually have the necessary resources and abilities to properly research an investment opportunity. As a result, most investors pick their illusory “winners” by making a superficial analysis and research that leads to poor performance on aggregate. Since stock returns aren’t usually symmetrically distributed and index returns are more affected by a few outlier stocks (i.e. the FAANG stocks dominating and driving S&P 500 Index’s returns in recent years), more than 50% of the constituents of the Standard and Poor’s 500 Index underperform the benchmark. Hence, if you randomly pick a stock, there is more than 50% chance that you’d fail to beat the market. At the same time, the 20 most favored S&P 500 stocks by the hedge funds monitored by Insider Monkey generated an outperformance of more than 8 percentage points so far in 2019. Of course, hedge funds do make wrong bets on some occasions and these get disproportionately publicized on financial media, but piggybacking their moves can beat the broader market on average. That’s why we are going to go over recent hedge fund activity in Conn’s, Inc. (NASDAQ:CONN).

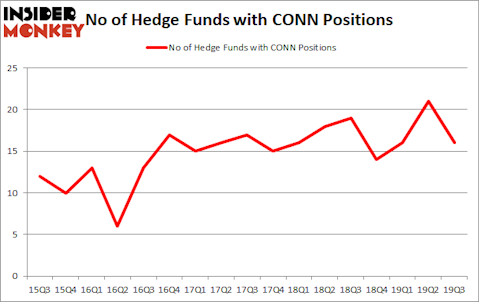

Conn’s, Inc. (NASDAQ:CONN) has experienced a decrease in hedge fund sentiment of late. CONN was in 16 hedge funds’ portfolios at the end of the third quarter of 2019. There were 21 hedge funds in our database with CONN positions at the end of the previous quarter. Our calculations also showed that CONN isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the eyes of most shareholders, hedge funds are viewed as worthless, old investment vehicles of the past. While there are over 8000 funds with their doors open at the moment, Our researchers hone in on the bigwigs of this club, around 750 funds. These hedge fund managers command the majority of the smart money’s total asset base, and by keeping track of their matchless investments, Insider Monkey has determined many investment strategies that have historically outrun Mr. Market. Insider Monkey’s flagship short hedge fund strategy exceeded the S&P 500 short ETFs by around 20 percentage points annually since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We also rely on the best performing hedge funds‘ buy/sell signals. We’re going to take a look at the latest hedge fund action regarding Conn’s, Inc. (NASDAQ:CONN).

What have hedge funds been doing with Conn’s, Inc. (NASDAQ:CONN)?

At the end of the third quarter, a total of 16 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -24% from the previous quarter. The graph below displays the number of hedge funds with bullish position in CONN over the last 17 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Conn’s, Inc. (NASDAQ:CONN) was held by Anchorage Advisors, which reported holding $65.9 million worth of stock at the end of September. It was followed by Marshall Wace with a $14.6 million position. Other investors bullish on the company included Arrowstreet Capital, Buckingham Capital Management, and Interval Partners. In terms of the portfolio weights assigned to each position Anchorage Advisors allocated the biggest weight to Conn’s, Inc. (NASDAQ:CONN), around 3.78% of its 13F portfolio. Buckingham Capital Management is also relatively very bullish on the stock, dishing out 1.17 percent of its 13F equity portfolio to CONN.

Judging by the fact that Conn’s, Inc. (NASDAQ:CONN) has faced declining sentiment from the entirety of the hedge funds we track, we can see that there lies a certain “tier” of hedge funds who sold off their entire stakes last quarter. Interestingly, Ken Grossman and Glen Schneider’s SG Capital Management said goodbye to the largest stake of the “upper crust” of funds watched by Insider Monkey, worth about $6.8 million in stock, and John Overdeck and David Siegel’s Two Sigma Advisors was right behind this move, as the fund dumped about $1.1 million worth. These moves are interesting, as aggregate hedge fund interest dropped by 5 funds last quarter.

Let’s check out hedge fund activity in other stocks similar to Conn’s, Inc. (NASDAQ:CONN). These stocks are Mobileiron Inc (NASDAQ:MOBL), AK Steel Holding Corporation (NYSE:AKS), Costamare Inc (NYSE:CMRE), and Target Hospitality Corp. (NASDAQ:TH). All of these stocks’ market caps are closest to CONN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MOBL | 17 | 127698 | 0 |

| AKS | 13 | 27000 | -1 |

| CMRE | 11 | 26252 | 1 |

| TH | 20 | 63509 | 3 |

| Average | 15.25 | 61115 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.25 hedge funds with bullish positions and the average amount invested in these stocks was $61 million. That figure was $134 million in CONN’s case. Target Hospitality Corp. (NASDAQ:TH) is the most popular stock in this table. On the other hand Costamare Inc (NYSE:CMRE) is the least popular one with only 11 bullish hedge fund positions. Conn’s, Inc. (NASDAQ:CONN) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Unfortunately CONN wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on CONN were disappointed as the stock returned -11.8% during the fourth quarter (through the end of November) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Disclosure: None. This article was originally published at Insider Monkey.