The financial regulations require hedge funds and wealthy investors that exceeded the $100 million holdings threshold to file a report that shows their positions at the end of every quarter. Even though it isn’t the intention, these filings to a certain extent level the playing field for ordinary investors. The latest round of 13F filings disclosed the funds’ positions on March 31st. We at Insider Monkey have made an extensive database of more than 866 of those established hedge funds and famous value investors’ filings. In this article, we analyze how these elite funds and prominent investors traded Best Buy Co., Inc. (NYSE:BBY) based on those filings.

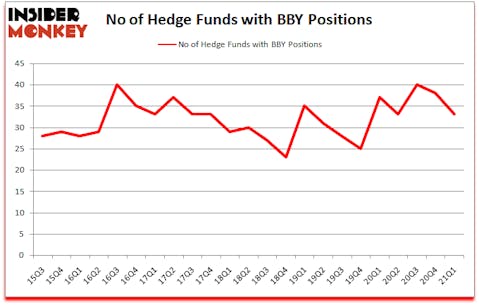

Best Buy Co., Inc. (NYSE:BBY) shareholders have witnessed a decrease in activity from the world’s largest hedge funds recently. Best Buy Co., Inc. (NYSE:BBY) was in 33 hedge funds’ portfolios at the end of March. The all time high for this statistic is 40. Our calculations also showed that BBY isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings).

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s monthly stock picks returned 206.8% since March 2017 and outperformed the S&P 500 ETFs by more than 115 percentage points (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Ken Heebner of Capital Growth Management

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium mining is one of the fastest growing industries right now, so we are checking out stock pitches like this emerging lithium stock. We go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. With all of this in mind we’re going to check out the recent hedge fund action regarding Best Buy Co., Inc. (NYSE:BBY).

Do Hedge Funds Think BBY Is A Good Stock To Buy Now?

At the end of the first quarter, a total of 33 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -13% from the fourth quarter of 2020. The graph below displays the number of hedge funds with bullish position in BBY over the last 23 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, AQR Capital Management held the most valuable stake in Best Buy Co., Inc. (NYSE:BBY), which was worth $407.5 million at the end of the fourth quarter. On the second spot was Two Sigma Advisors which amassed $190.6 million worth of shares. Alyeska Investment Group, Citadel Investment Group, and Millennium Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Capital Growth Management allocated the biggest weight to Best Buy Co., Inc. (NYSE:BBY), around 2.94% of its 13F portfolio. L2 Asset Management is also relatively very bullish on the stock, earmarking 2.77 percent of its 13F equity portfolio to BBY.

Seeing as Best Buy Co., Inc. (NYSE:BBY) has experienced bearish sentiment from hedge fund managers, we can see that there was a specific group of hedgies that slashed their full holdings heading into Q2. At the top of the heap, Philippe Laffont’s Coatue Management sold off the largest position of the 750 funds tracked by Insider Monkey, comprising close to $124 million in stock. Joe DiMenna’s fund, ZWEIG DIMENNA PARTNERS, also sold off its stock, about $14.2 million worth. These bearish behaviors are intriguing to say the least, as total hedge fund interest fell by 5 funds heading into Q2.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Best Buy Co., Inc. (NYSE:BBY) but similarly valued. These stocks are Waste Connections, Inc. (NYSE:WCN), ResMed Inc. (NYSE:RMD), KKR & Co Inc. (NYSE:KKR), Old Dominion Freight Line, Inc. (NASDAQ:ODFL), Unity Software Inc. (NYSE:U), Ball Corporation (NYSE:BLL), and Lennar Corporation (NYSE:LEN). This group of stocks’ market caps are similar to BBY’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WCN | 31 | 822237 | -4 |

| RMD | 25 | 313736 | -2 |

| KKR | 56 | 4542794 | 2 |

| ODFL | 40 | 865894 | -10 |

| U | 39 | 6694278 | 7 |

| BLL | 38 | 1407192 | -6 |

| LEN | 49 | 1570352 | -3 |

| Average | 39.7 | 2316640 | -2.3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 39.7 hedge funds with bullish positions and the average amount invested in these stocks was $2317 million. That figure was $958 million in BBY’s case. KKR & Co Inc. (NYSE:KKR) is the most popular stock in this table. On the other hand ResMed Inc. (NYSE:RMD) is the least popular one with only 25 bullish hedge fund positions. Best Buy Co., Inc. (NYSE:BBY) is not the least popular stock in this group but hedge fund interest is still below average. Our overall hedge fund sentiment score for BBY is 37.7. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 22.8% in 2021 through July 2nd and surpassed the market again by 6 percentage points. Unfortunately BBY wasn’t nearly as popular as these 5 stocks (hedge fund sentiment was quite bearish); BBY investors were disappointed as the stock returned 1.4% since the end of March (through 7/2) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as most of these stocks already outperformed the market in 2021.

Follow Best Buy Co Inc (NYSE:BBY)

Follow Best Buy Co Inc (NYSE:BBY)

Receive real-time insider trading and news alerts

Suggested Articles:

- How to Best Use Insider Monkey To Increase Your Returns

- 15 Fastest-Growing Fintech Companies

- Stephen Mandel’s Lone Pine Loves These 10 Stocks

Disclosure: None. This article was originally published at Insider Monkey.