There are several ways to beat the market, and investing in small cap stocks has historically been one of them. We like to improve the odds of beating the market further by examining what famous hedge fund operators such as Carl Icahn and George Soros think. Those hedge fund operators make billions of dollars each year by hiring the best and the brightest to do research on stocks, including small cap stocks that big brokerage houses simply don’t cover. Because of Carl Icahn and other elite funds’ exemplary historical records, we pay attention to their small cap picks. In this article, we use hedge fund filing data to analyze ABM Industries, Inc. (NYSE:ABM).

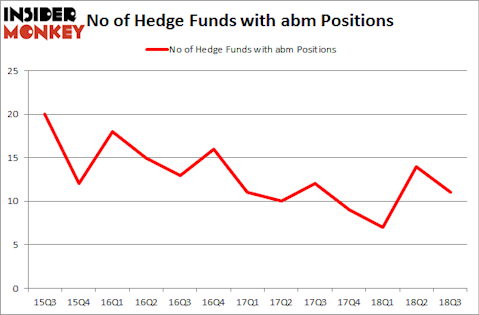

ABM Industries, Inc. (NYSE:ABM) has seen a decrease in enthusiasm from smart money lately. ABM was in 11 hedge funds’ portfolios at the end of September. There were 14 hedge funds in our database with ABM positions at the end of the previous quarter. Our calculations also showed that abm isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to view the recent hedge fund action surrounding ABM Industries, Inc. (NYSE:ABM).

What have hedge funds been doing with ABM Industries, Inc. (NYSE:ABM)?

At the end of the third quarter, a total of 11 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -21% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in ABM over the last 13 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists a select group of notable hedge fund managers who were boosting their holdings considerably (or already accumulated large positions).

The largest stake in ABM Industries, Inc. (NYSE:ABM) was held by Millennium Management, which reported holding $17.6 million worth of stock at the end of September. It was followed by Royce & Associates with a $14.6 million position. Other investors bullish on the company included Marshall Wace LLP, Citadel Investment Group, and Two Sigma Advisors.

Judging by the fact that ABM Industries, Inc. (NYSE:ABM) has faced bearish sentiment from the smart money, it’s easy to see that there is a sect of hedge funds that elected to cut their positions entirely in the third quarter. It’s worth mentioning that Will Cook’s Sunriver Management sold off the biggest stake of the “upper crust” of funds watched by Insider Monkey, valued at an estimated $22 million in stock. Jim Simons’s fund, Renaissance Technologies, also sold off its stock, about $9.3 million worth. These bearish behaviors are interesting, as aggregate hedge fund interest fell by 3 funds in the third quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as ABM Industries, Inc. (NYSE:ABM) but similarly valued. We will take a look at BioTelemetry, Inc. (NASDAQ:BEAT), Globant SA (NYSE:GLOB), Retail Opportunity Investments Corp (NASDAQ:ROIC), and STAAR Surgical Company (NASDAQ:STAA). All of these stocks’ market caps match ABM’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BEAT | 16 | 67760 | 1 |

| GLOB | 17 | 74680 | -2 |

| ROIC | 11 | 15038 | 7 |

| STAA | 24 | 853639 | 9 |

| Average | 17 | 252779 | 3.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17 hedge funds with bullish positions and the average amount invested in these stocks was $253 million. That figure was $61 million in ABM’s case. STAAR Surgical Company (NASDAQ:STAA) is the most popular stock in this table. On the other hand Retail Opportunity Investments Corp (NASDAQ:ROIC) is the least popular one with only 11 bullish hedge fund positions. Compared to these stocks ABM Industries, Inc. (NYSE:ABM) is even less popular than ROIC. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None. This article was originally published at Insider Monkey.