The 700+ hedge funds and famous money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the third quarter, which unveil their equity positions as of September 30. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund portfolios. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards PPL Corporation (NYSE:PPL).

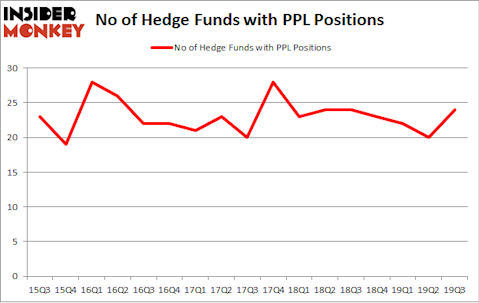

Is PPL Corporation (NYSE:PPL) a sound investment now? Money managers are taking an optimistic view. The number of long hedge fund bets improved by 4 recently. Our calculations also showed that PPL isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings). PPL was in 24 hedge funds’ portfolios at the end of the third quarter of 2019. There were 20 hedge funds in our database with PPL holdings at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Today there are plenty of signals investors have at their disposal to appraise publicly traded companies. A pair of the less known signals are hedge fund and insider trading moves. We have shown that, historically, those who follow the best picks of the top fund managers can outperform the market by a significant amount (see the details here).

Phill Gross of Adage Capital Management

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. Let’s take a gander at the fresh hedge fund action regarding PPL Corporation (NYSE:PPL).

How have hedgies been trading PPL Corporation (NYSE:PPL)?

At Q3’s end, a total of 24 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 20% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards PPL over the last 17 quarters. With hedgies’ sentiment swirling, there exists a select group of key hedge fund managers who were upping their holdings meaningfully (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Renaissance Technologies has the biggest position in PPL Corporation (NYSE:PPL), worth close to $180.6 million, comprising 0.2% of its total 13F portfolio. Sitting at the No. 2 spot is Zimmer Partners, managed by Stuart J. Zimmer, which holds a $132.7 million position; 1.4% of its 13F portfolio is allocated to the company. Remaining hedge funds and institutional investors that are bullish include David E. Shaw’s D E Shaw, Cliff Asness’s AQR Capital Management and Phill Gross and Robert Atchinson’s Adage Capital Management. In terms of the portfolio weights assigned to each position Covalis Capital allocated the biggest weight to PPL Corporation (NYSE:PPL), around 29.91% of its portfolio. Blackstart Capital is also relatively very bullish on the stock, designating 3.32 percent of its 13F equity portfolio to PPL.

As one would reasonably expect, some big names were breaking ground themselves. Millennium Management, managed by Israel Englander, established the biggest call position in PPL Corporation (NYSE:PPL). Millennium Management had $15.8 million invested in the company at the end of the quarter. Brian Olson, Baehyun Sung, and Jamie Waters’s Blackstart Capital also made a $6.3 million investment in the stock during the quarter. The other funds with brand new PPL positions are David Harding’s Winton Capital Management, Dmitry Balyasny’s Balyasny Asset Management, and Joel Greenblatt’s Gotham Asset Management.

Let’s go over hedge fund activity in other stocks similar to PPL Corporation (NYSE:PPL). We will take a look at United Airlines Holdings, Inc. (NASDAQ:UAL), Royal Caribbean Cruises Ltd. (NYSE:RCL), KKR & Co Inc. (NYSE:KKR), and Synchrony Financial (NYSE:SYF). All of these stocks’ market caps are similar to PPL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| UAL | 46 | 7090686 | -1 |

| RCL | 45 | 1672773 | -1 |

| KKR | 41 | 3227093 | 5 |

| SYF | 43 | 2375436 | -3 |

| Average | 43.75 | 3591497 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 43.75 hedge funds with bullish positions and the average amount invested in these stocks was $3591 million. That figure was $516 million in PPL’s case. United Airlines Holdings, Inc. (NASDAQ:UAL) is the most popular stock in this table. On the other hand KKR & Co Inc. (NYSE:KKR) is the least popular one with only 41 bullish hedge fund positions. Compared to these stocks PPL Corporation (NYSE:PPL) is even less popular than KKR. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. A small number of hedge funds were also right about betting on PPL, though not to the same extent, as the stock returned 8.1% during the fourth quarter (through 11/30) and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.