We know that hedge funds generate strong, risk-adjusted returns over the long run, therefore imitating the picks that they are collectively bullish on can be a profitable strategy for retail investors. With billions of dollars in assets, smart money investors have to conduct complex analyses, spend many resources and use tools that are not always available for the general crowd. This doesn’t mean that they don’t have occasional colossal losses; they do (like Melvin Capital’s recent GameStop losses). However, it is still a good idea to keep an eye on hedge fund activity. With this in mind, as the current round of 13F filings has just ended, let’s examine the smart money sentiment towards Franchise Group, Inc. (NASDAQ:FRG).

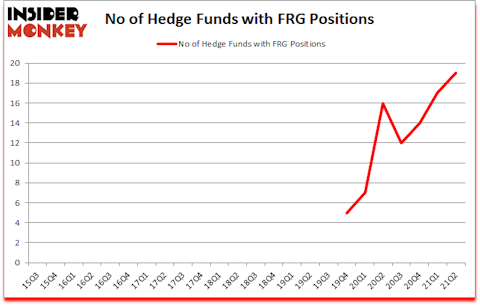

Is Franchise Group, Inc. (NASDAQ:FRG) a superb investment now? The best stock pickers were becoming hopeful. The number of bullish hedge fund positions rose by 2 in recent months. Franchise Group, Inc. (NASDAQ:FRG) was in 19 hedge funds’ portfolios at the end of the second quarter of 2021. The all time high for this statistic was previously 17. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. Our calculations also showed that FRG isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings). There were 17 hedge funds in our database with FRG holdings at the end of March.

In the financial world there are many metrics market participants employ to appraise their stock investments. Two of the most underrated metrics are hedge fund and insider trading indicators. Our experts have shown that, historically, those who follow the top picks of the best money managers can trounce the S&P 500 by a very impressive margin (see the details here). Also, our monthly newsletter’s portfolio of long stock picks returned 185.4% since March 2017 (through August 2021) and beat the S&P 500 Index by more than 79 percentage points. You can download a sample issue of this newsletter on our website.

David Harding of Winton Capital Management

With all of this in mind we’re going to take a gander at the new hedge fund action encompassing Franchise Group, Inc. (NASDAQ:FRG).

Do Hedge Funds Think FRG Is A Good Stock To Buy Now?

At Q2’s end, a total of 19 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 12% from one quarter earlier. By comparison, 16 hedge funds held shares or bullish call options in FRG a year ago. With hedge funds’ sentiment swirling, there exists an “upper tier” of notable hedge fund managers who were adding to their holdings significantly (or already accumulated large positions).

The largest stake in Franchise Group, Inc. (NASDAQ:FRG) was held by Cannell Capital, which reported holding $28.7 million worth of stock at the end of June. It was followed by Ophir Asset Management with a $25.6 million position. Other investors bullish on the company included Arrowstreet Capital, Portolan Capital Management, and Kent Lake Capital. In terms of the portfolio weights assigned to each position Cannell Capital allocated the biggest weight to Franchise Group, Inc. (NASDAQ:FRG), around 4.6% of its 13F portfolio. Ophir Asset Management is also relatively very bullish on the stock, setting aside 4.5 percent of its 13F equity portfolio to FRG.

As one would reasonably expect, key hedge funds have jumped into Franchise Group, Inc. (NASDAQ:FRG) headfirst. Portolan Capital Management, managed by George McCabe, created the most outsized position in Franchise Group, Inc. (NASDAQ:FRG). Portolan Capital Management had $6.1 million invested in the company at the end of the quarter. Robert Joseph Caruso’s Select Equity Group also initiated a $0.5 million position during the quarter. The following funds were also among the new FRG investors: Paul Tudor Jones’s Tudor Investment Corp, David Harding’s Winton Capital Management, and Matthew Hulsizer’s PEAK6 Capital Management.

Let’s also examine hedge fund activity in other stocks similar to Franchise Group, Inc. (NASDAQ:FRG). These stocks are Uniqure NV (NASDAQ:QURE), Kosmos Energy Ltd (NYSE:KOS), FARO Technologies, Inc. (NASDAQ:FARO), Extreme Networks, Inc (NASDAQ:EXTR), Houghton Mifflin Harcourt Co (NASDAQ:HMHC), IAMGOLD Corporation (NYSE:IAG), and Broadmark Realty Capital Inc. (NYSE:BRMK). This group of stocks’ market caps resemble FRG’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| QURE | 28 | 302552 | 3 |

| KOS | 17 | 71037 | 9 |

| FARO | 13 | 169071 | -1 |

| EXTR | 20 | 158359 | -5 |

| HMHC | 21 | 206768 | -4 |

| IAG | 19 | 124352 | -3 |

| BRMK | 12 | 91152 | 0 |

| Average | 18.6 | 160470 | -0.1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.6 hedge funds with bullish positions and the average amount invested in these stocks was $160 million. That figure was $94 million in FRG’s case. Uniqure NV (NASDAQ:QURE) is the most popular stock in this table. On the other hand Broadmark Realty Capital Inc. (NYSE:BRMK) is the least popular one with only 12 bullish hedge fund positions. Franchise Group, Inc. (NASDAQ:FRG) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for FRG is 58.9. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 24% in 2021 through October 22nd and still beat the market by 1.6 percentage points. Hedge funds were also right about betting on FRG as the stock returned 9.3% since the end of Q2 (through 10/22) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Franchise Group Inc. (NASDAQ:FRG FRGAP)

Follow Franchise Group Inc. (NASDAQ:FRG FRGAP)

Receive real-time insider trading and news alerts

Suggested Articles:

- 10 Best Bank Stocks To Buy Now

- 25 Best Caribbean islands to visit during COVID

- Top 10 Value Stocks to Invest In According to ValueAct Capital

Disclosure: None. This article was originally published at Insider Monkey.