We at Insider Monkey have gone over 873 13F filings that hedge funds and prominent investors are required to file by the SEC. The 13F filings show the funds’ and investors’ portfolio positions as of June 30th. In this article, we look at what those funds think of F-star Therapeutics, Inc. (NASDAQ:FSTX) based on that data.

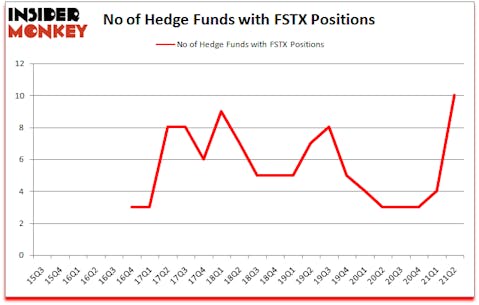

F-star Therapeutics, Inc. (NASDAQ:FSTX) was in 10 hedge funds’ portfolios at the end of June. The all time high for this statistic is 9. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. FSTX investors should be aware of an increase in hedge fund sentiment in recent months. There were 4 hedge funds in our database with FSTX holdings at the end of March. Our calculations also showed that FSTX isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings).

In the eyes of most traders, hedge funds are seen as underperforming, old financial tools of the past. While there are more than 8000 funds trading today, Our researchers look at the moguls of this club, around 850 funds. It is estimated that this group of investors direct bulk of the smart money’s total asset base, and by following their finest equity investments, Insider Monkey has determined various investment strategies that have historically defeated Mr. Market. Insider Monkey’s flagship short hedge fund strategy beat the S&P 500 short ETFs by around 20 percentage points per year since its inception in March 2017. Also, our monthly newsletter’s portfolio of long stock picks returned 185.4% since March 2017 (through August 2021) and beat the S&P 500 Index by more than 79 percentage points. You can download a sample issue of this newsletter on our website.

Nathan Fischel of DAFNA Capital Management

Keeping this in mind we’re going to take a look at the new hedge fund action encompassing F-star Therapeutics, Inc. (NASDAQ:FSTX).

Do Hedge Funds Think FSTX Is A Good Stock To Buy Now?

At the end of the second quarter, a total of 10 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 150% from the first quarter of 2020. The graph below displays the number of hedge funds with bullish position in FSTX over the last 24 quarters. With hedgies’ capital changing hands, there exists a few key hedge fund managers who were increasing their holdings considerably (or already accumulated large positions).

The largest stake in F-star Therapeutics, Inc. (NASDAQ:FSTX) was held by Point72 Asset Management, which reported holding $9.2 million worth of stock at the end of June. It was followed by Rock Springs Capital Management with a $9.1 million position. Other investors bullish on the company included Adage Capital Management, DAFNA Capital Management, and Citadel Investment Group. In terms of the portfolio weights assigned to each position DAFNA Capital Management allocated the biggest weight to F-star Therapeutics, Inc. (NASDAQ:FSTX), around 1.28% of its 13F portfolio. Rock Springs Capital Management is also relatively very bullish on the stock, earmarking 0.18 percent of its 13F equity portfolio to FSTX.

As industrywide interest jumped, key hedge funds have been driving this bullishness. Rock Springs Capital Management, managed by Kris Jenner, Gordon Bussard, Graham McPhail, initiated the most outsized position in F-star Therapeutics, Inc. (NASDAQ:FSTX). Rock Springs Capital Management had $9.1 million invested in the company at the end of the quarter. Phill Gross and Robert Atchinson’s Adage Capital Management also made a $6.9 million investment in the stock during the quarter. The following funds were also among the new FSTX investors: Nathan Fischel’s DAFNA Capital Management, Anand Parekh’s Alyeska Investment Group, and Kamran Moghtaderi’s Eversept Partners.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as F-star Therapeutics, Inc. (NASDAQ:FSTX) but similarly valued. These stocks are Lee Enterprises, Incorporated (NASDAQ:LEE), Evolution Petroleum Corporation (NYSE:EPM), MOGU Inc. (NYSE:MOGU), Genie Energy Ltd (NYSE:GNE), OptiNose, Inc. (NASDAQ:OPTN), Jowell Global Ltd. (NASDAQ:JWEL), and cbdMD, Inc. (NYSE:YCBD). This group of stocks’ market caps match FSTX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LEE | 5 | 22097 | 2 |

| EPM | 13 | 17322 | 4 |

| MOGU | 3 | 17963 | 0 |

| GNE | 8 | 7899 | 1 |

| OPTN | 11 | 11478 | 1 |

| JWEL | 1 | 103 | 0 |

| YCBD | 4 | 398 | -1 |

| Average | 6.4 | 11037 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 6.4 hedge funds with bullish positions and the average amount invested in these stocks was $11 million. That figure was $39 million in FSTX’s case. Evolution Petroleum Corporation (NYSE:EPM) is the most popular stock in this table. On the other hand Jowell Global Ltd. (NASDAQ:JWEL) is the least popular one with only 1 bullish hedge fund positions. F-star Therapeutics, Inc. (NASDAQ:FSTX) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for FSTX is 77.5. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 25.7% in 2021 through September 27th and beat the market again by 6.2 percentage points. Unfortunately FSTX wasn’t nearly as popular as these 5 stocks and hedge funds that were betting on FSTX were disappointed as the stock returned -10.2% since the end of June (through 9/27) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as many of these stocks already outperformed the market since 2019.

Follow F-Star Therapeutics Inc. (NASDAQ:FSTX)

Follow F-Star Therapeutics Inc. (NASDAQ:FSTX)

Receive real-time insider trading and news alerts

Suggested Articles:

Disclosure: None. This article was originally published at Insider Monkey.