Although the masses and most of the financial media blame hedge funds for their exorbitant fee structure and disappointing performance, these investors have proved to have great stock picking abilities over the years (that’s why their assets under management continue to swell). We believe hedge fund sentiment should serve as a crucial tool of an individual investor’s stock selection process, as it may offer great insights of how the brightest minds of the finance industry feel about specific stocks. After all, these people have access to smartest analysts and expensive data/information sources that individual investors can’t match. So should one consider investing in The Bank of New York Mellon Corporation (NYSE:BK)? The smart money sentiment can provide an answer to this question.

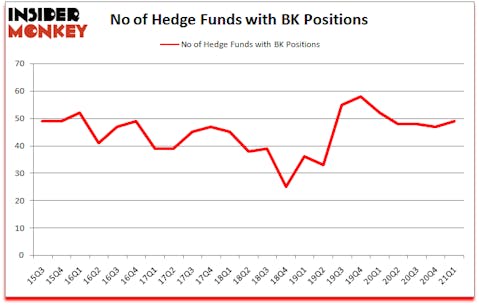

The Bank of New York Mellon Corporation (NYSE:BK) has experienced an increase in hedge fund interest in recent months. The Bank of New York Mellon Corporation (NYSE:BK) was in 49 hedge funds’ portfolios at the end of March. The all time high for this statistic is 58. There were 47 hedge funds in our database with BK positions at the end of the fourth quarter. Our calculations also showed that BK isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings).

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by more than 115 percentage points since March 2017 (see the details here). We have been able to outperform the passive index funds by tracking the moves of corporate insiders and hedge funds, and we believe small investors can benefit a lot from reading hedge fund investor letters and 13F filings.

Gavin Saitowitz of Prelude Capital

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, Federal Reserve has been creating trillions of dollars electronically to keep the interest rates near zero. We believe this will lead to inflation, which is why we are checking out this inflation play. We go through lists like 10 best gold stocks to buy to identify promising stocks. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. With all of this in mind let’s take a glance at the fresh hedge fund action encompassing The Bank of New York Mellon Corporation (NYSE:BK).

Do Hedge Funds Think BK Is A Good Stock To Buy Now?

At the end of the first quarter, a total of 49 of the hedge funds tracked by Insider Monkey were long this stock, a change of 4% from the fourth quarter of 2020. On the other hand, there were a total of 52 hedge funds with a bullish position in BK a year ago. With hedgies’ capital changing hands, there exists a few noteworthy hedge fund managers who were boosting their stakes significantly (or already accumulated large positions).

Among these funds, Berkshire Hathaway held the most valuable stake in The Bank of New York Mellon Corporation (NYSE:BK), which was worth $3421.8 million at the end of the fourth quarter. On the second spot was Yacktman Asset Management which amassed $181.9 million worth of shares. Balyasny Asset Management, AQR Capital Management, and GLG Partners were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position LFL Advisers allocated the biggest weight to The Bank of New York Mellon Corporation (NYSE:BK), around 9.11% of its 13F portfolio. Prana Capital Management is also relatively very bullish on the stock, designating 3.06 percent of its 13F equity portfolio to BK.

As one would reasonably expect, specific money managers were leading the bulls’ herd. Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, initiated the largest position in The Bank of New York Mellon Corporation (NYSE:BK). Arrowstreet Capital had $13.5 million invested in the company at the end of the quarter. Brandon Haley’s Holocene Advisors also initiated a $7.7 million position during the quarter. The following funds were also among the new BK investors: Joshua Nash’s Ulysses Management, Gavin Saitowitz and Cisco J. del Valle’s Prelude Capital (previously Springbok Capital), and Donald Sussman’s Paloma Partners.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as The Bank of New York Mellon Corporation (NYSE:BK) but similarly valued. We will take a look at Cognizant Technology Solutions Corp (NASDAQ:CTSH), DuPont de Nemours Inc (NYSE:DD), Lloyds Banking Group PLC (NYSE:LYG), IHS Markit Ltd. (NYSE:INFO), CrowdStrike Holdings, Inc. (NASDAQ:CRWD), BCE Inc. (NYSE:BCE), and Parker-Hannifin Corporation (NYSE:PH). This group of stocks’ market valuations resemble BK’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CTSH | 33 | 3339212 | -13 |

| DD | 49 | 1720375 | -11 |

| LYG | 5 | 14096 | 0 |

| INFO | 54 | 4093725 | -5 |

| CRWD | 77 | 5257998 | -15 |

| BCE | 10 | 121896 | -3 |

| PH | 43 | 1259967 | -13 |

| Average | 38.7 | 2258181 | -8.6 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 38.7 hedge funds with bullish positions and the average amount invested in these stocks was $2258 million. That figure was $4770 million in BK’s case. CrowdStrike Holdings, Inc. (NASDAQ:CRWD) is the most popular stock in this table. On the other hand Lloyds Banking Group PLC (NYSE:LYG) is the least popular one with only 5 bullish hedge fund positions. The Bank of New York Mellon Corporation (NYSE:BK) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for BK is 62.9. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 17.4% in 2021 through June 18th and beat the market again by 6.1 percentage points. Unfortunately BK wasn’t nearly as popular as these 5 stocks and hedge funds that were betting on BK were disappointed as the stock returned 2.6% since the end of March (through 6/18) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as many of these stocks already outperformed the market since 2019.

Follow Bank Of New York Mellon Corp (NYSE:BK)

Follow Bank Of New York Mellon Corp (NYSE:BK)

Receive real-time insider trading and news alerts

Suggested Articles:

- How to Best Use Insider Monkey To Increase Your Returns

- Billionaire David Abrams’ Top Stock Picks

- 15 largest hosting companies in the world

Disclosure: None. This article was originally published at Insider Monkey.