At the end of February we announced the arrival of the first US recession since 2009 and we predicted that the market will decline by at least 20% in (see why hell is coming). We reversed our stance on March 25th after seeing unprecedented fiscal and monetary stimulus unleashed by the Fed and the Congress. This is the perfect market for stock pickers, now that the stocks are fully valued again. In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. In this article, we will take a closer look at hedge fund sentiment towards ABIOMED, Inc. (NASDAQ:ABMD) at the end of the second quarter and determine whether the smart money was really smart about this stock.

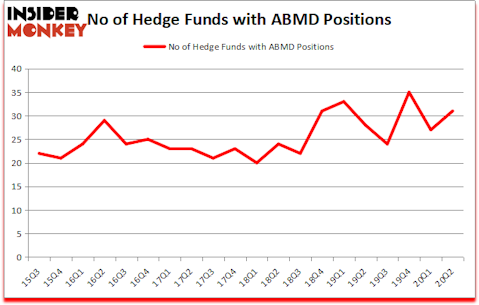

ABIOMED, Inc. (NASDAQ:ABMD) shareholders have witnessed an increase in hedge fund interest recently. ABIOMED, Inc. (NASDAQ:ABMD) was in 31 hedge funds’ portfolios at the end of June. The all time high for this statistics is 35. Our calculations also showed that ABMD isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by 58 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

William Leland Edwards of Palo Alto Investors

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, this “mom” trader turned $2000 into $2 million within 2 years. So, we are checking out her best trade idea of the month. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We go through lists like the 10 most profitable companies in the world to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. Keeping this in mind let’s analyze the latest hedge fund action surrounding ABIOMED, Inc. (NASDAQ:ABMD).

How have hedgies been trading ABIOMED, Inc. (NASDAQ:ABMD)?

Heading into the third quarter of 2020, a total of 31 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 15% from the previous quarter. By comparison, 28 hedge funds held shares or bullish call options in ABMD a year ago. With hedge funds’ positions undergoing their usual ebb and flow, there exists a select group of key hedge fund managers who were upping their holdings substantially (or already accumulated large positions).

Among these funds, Renaissance Technologies held the most valuable stake in ABIOMED, Inc. (NASDAQ:ABMD), which was worth $543.5 million at the end of the third quarter. On the second spot was Palo Alto Investors which amassed $118.9 million worth of shares. Adage Capital Management, AQR Capital Management, and Citadel Investment Group were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Palo Alto Investors allocated the biggest weight to ABIOMED, Inc. (NASDAQ:ABMD), around 7.14% of its 13F portfolio. Aubrey Capital Management is also relatively very bullish on the stock, setting aside 2.38 percent of its 13F equity portfolio to ABMD.

Now, some big names were breaking ground themselves. Falcon Edge Capital, managed by Richard Gerson and Navroz D. Udwadia, established the biggest position in ABIOMED, Inc. (NASDAQ:ABMD). Falcon Edge Capital had $20 million invested in the company at the end of the quarter. Ken Griffin’s Citadel Investment Group also made a $7.9 million investment in the stock during the quarter. The other funds with new positions in the stock are Andrew Dalrymple and Barry McCorkell’s Aubrey Capital Management, Ben Levine, Andrew Manuel and Stefan Renold’s LMR Partners, and Lee Ainslie’s Maverick Capital.

Let’s now review hedge fund activity in other stocks similar to ABIOMED, Inc. (NASDAQ:ABMD). These stocks are Pool Corporation (NASDAQ:POOL), KB Financial Group, Inc. (NYSE:KB), Alteryx, Inc. (NYSE:AYX), Gartner Inc (NYSE:IT), Trimble Inc. (NASDAQ:TRMB), VICI Properties Inc. (NYSE:VICI), and Citizens Financial Group Inc (NYSE:CFG). This group of stocks’ market caps are closest to ABMD’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| POOL | 35 | 492145 | 2 |

| KB | 6 | 36329 | -1 |

| AYX | 48 | 1612975 | 5 |

| IT | 32 | 1302132 | 0 |

| TRMB | 26 | 979865 | 6 |

| VICI | 51 | 1573468 | 15 |

| CFG | 47 | 841328 | 1 |

| Average | 35 | 976892 | 4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 35 hedge funds with bullish positions and the average amount invested in these stocks was $977 million. That figure was $824 million in ABMD’s case. VICI Properties Inc. (NYSE:VICI) is the most popular stock in this table. On the other hand KB Financial Group, Inc. (NYSE:KB) is the least popular one with only 6 bullish hedge fund positions. ABIOMED, Inc. (NASDAQ:ABMD) is not the least popular stock in this group but hedge fund interest is still below average. Our overall hedge fund sentiment score for ABMD is 63.3. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 23.8% in 2020 through September 14th and still beat the market by 17.6 percentage points. A small number of hedge funds were also right about betting on ABMD as the stock returned 14.1% since the end of June (through September 14th) and outperformed the market by an even larger margin.

Follow Abiomed Inc (NASDAQ:NASD)

Follow Abiomed Inc (NASDAQ:NASD)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.