The government requires hedge funds and wealthy investors with a certain portfolio size to file a report that shows their equity positions at the end of every quarter. Even though it isn’t the intention, these filings level the playing field for ordinary investors. The latest round of 13F filings discloses the funds’ positions on June 30. We at Insider Monkey have made an extensive database of more than 700 of those elite funds and prominent investors’ filings. In this article, we analyze how these elite funds and prominent investors traded Tiffany & Co. (NYSE:TIF) based on those filings.

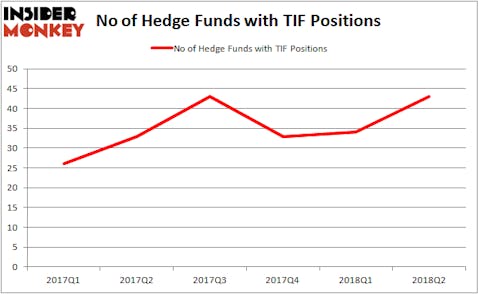

After a decline at the end of 2017, hedge funds have been jumping back into Tiffany with reckless abandon in 2018. Hedge fund ownership of the stock rose by 30% in the first-half of the year, which included new positions being opened in Q2 by the likes of George Soros’ Soros Fund Management (16,800 shares). Israel Englander’s Millennium Management (1.96 million shares) and Barry Rosenstein’s JANA Partners (1.76 million shares) were also major shareholders, pushing Tiffany into 18th spot among the 25 Stocks Billionaires Are Piling On. Tiffany has a big opportunity in China, where the luxury goods market expanded by 20% in 2017, compared to just 4% growth in Europe and 5% growth in the Americas. Status-conscious Chinese millennials are driving the increase in spending, with jewelry being among the leading growth categories.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 17.4% year to date and outperformed the market by more than 14 percentage points this year. This strategy also outperformed the market by 3 percentage points in the fourth quarter despite the market volatility (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

What have hedge funds been doing with Tiffany & Co. (NYSE:TIF)?

At Q3’s end, a total of 43 of the hedge funds tracked by Insider Monkey were bullish on this stock, a 26% surge from the previous quarter. On the other hand, there were 43 hedge funds with a bullish position in TIF at the end of September 2017, so hedge fund ownership has been flat during that time. Let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Israel Englander’s Millennium Management was the largest shareholder of Tiffany & Co. (NYSE:TIF), with a stake worth $257.3 million reported as of the end of June. Trailing Millennium Management was JANA Partners, which had amassed a stake valued at $231.6 million. Thunderbird Partners, Manikay Partners, and Hitchwood Capital Management were also very fond of the stock, giving it large weighting in their 13F portfolios.

With general bullishness amongst the heavyweights, key money managers were breaking ground themselves. Thunderbird Partners, managed by David Fear, established a new position in Tiffany & Co. (NYSE:TIF) valued at $57.4 million at the end of the second quarter. James Crichton’s Hitchwood Capital Management also initiated a $121.1 million position during the quarter. The following funds were also among the new TIF investors: Andrew Immerman and Jeremy Schiffman’s Palestra Capital Management, Ernest Chow and Jonathan Howe’s Sensato Capital Management, and Guy Shahar’s DSAM Partners.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Tiffany & Co. (NYSE:TIF) but similarly valued. We will take a look at E TRADE Financial Corporation (NASDAQ:ETFC), CGI Group Inc. (USA) (NYSE:GIB), Mohawk Industries, Inc. (NYSE:MHK), and KLA-Tencor Corporation (NASDAQ:KLAC). This group of stocks’ market caps match TIF’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ETFC | 32 | 1303102 | 0 |

| GIB | 11 | 197456 | 1 |

| MHK | 46 | 2733526 | 9 |

| KLAC | 26 | 631769 | -3 |

As you can see these stocks had an average of 29 hedge funds with bullish positions and the average amount invested in these stocks was $1.22 billion. That figure was $1.61 billion in TIF’s case. Mohawk Industries, Inc. (NYSE:MHK) is the most popular stock in this table. On the other hand CGI Group Inc. (USA) (NYSE:GIB) is the least popular one with only 11 bullish hedge fund positions. Tiffany & Co. (NYSE:TIF) is not the most popular stock in this group but hedge fund interest is still above average and rising fast. It’s also popular among the wealthiest smart money managers, who have decades of successful investing experience under their belts. In this regard, TIF might be a good candidate to consider a long position in.

Disclosure: None. This article was originally published at Insider Monkey.