Is Alexion Pharmaceuticals, Inc. (NASDAQ:ALXN) a good equity to bet on right now? We like to check what the smart money thinks first before doing extensive research on a given stock. Although there have been several high profile failed hedge fund picks, the consensus picks among hedge fund investors have historically outperformed the market after adjusting for known risk attributes. It’s not surprising given that hedge funds have access to better information and more resources to predict the winners in the stock market.

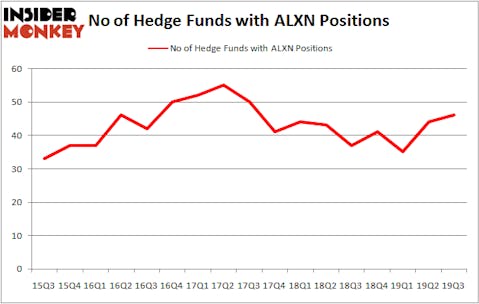

Is Alexion Pharmaceuticals, Inc. (NASDAQ:ALXN) undervalued? The best stock pickers are in an optimistic mood. The number of long hedge fund bets inched up by 2 lately. Our calculations also showed that ALXN isn’t among the 30 most popular stocks among hedge funds. ALXN was in 46 hedge funds’ portfolios at the end of the third quarter of 2019. There were 44 hedge funds in our database with ALXN positions at the end of the previous quarter.

According to most stock holders, hedge funds are perceived as underperforming, outdated investment vehicles of years past. While there are more than 8000 funds in operation at the moment, Our experts look at the top tier of this club, about 750 funds. These money managers control bulk of the hedge fund industry’s total asset base, and by tracking their finest stock picks, Insider Monkey has revealed several investment strategies that have historically defeated the market. Insider Monkey’s flagship short hedge fund strategy beat the S&P 500 short ETFs by around 20 percentage points annually since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Samuel Isaly of OrbiMed Advisors

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. Let’s review the new hedge fund action surrounding Alexion Pharmaceuticals, Inc. (NASDAQ:ALXN).

What have hedge funds been doing with Alexion Pharmaceuticals, Inc. (NASDAQ:ALXN)?

Heading into the fourth quarter of 2019, a total of 46 of the hedge funds tracked by Insider Monkey were long this stock, a change of 5% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards ALXN over the last 17 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Baker Bros. Advisors held the most valuable stake in Alexion Pharmaceuticals, Inc. (NASDAQ:ALXN), which was worth $808.8 million at the end of the third quarter. On the second spot was Renaissance Technologies which amassed $279.1 million worth of shares. Iridian Asset Management, OrbiMed Advisors, and D E Shaw were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Palo Alto Investors allocated the biggest weight to Alexion Pharmaceuticals, Inc. (NASDAQ:ALXN), around 6.25% of its portfolio. Baker Bros. Advisors is also relatively very bullish on the stock, designating 5.5 percent of its 13F equity portfolio to ALXN.

With a general bullishness amongst the heavyweights, some big names have been driving this bullishness. Partner Fund Management, managed by Christopher James, established the most outsized position in Alexion Pharmaceuticals, Inc. (NASDAQ:ALXN). Partner Fund Management had $141.7 million invested in the company at the end of the quarter. Jeremy Green’s Redmile Group also made a $113.8 million investment in the stock during the quarter. The other funds with brand new ALXN positions are Ian Simm’s Impax Asset Management, Efrem Kamen’s Pura Vida Investments, and Matthew Halbower’s Pentwater Capital Management.

Let’s now review hedge fund activity in other stocks similar to Alexion Pharmaceuticals, Inc. (NASDAQ:ALXN). We will take a look at Kellogg Company (NYSE:K), The Hartford Financial Services Group Inc (NYSE:HIG), Stanley Black & Decker, Inc. (NYSE:SWK), and Snap Inc. (NYSE:SNAP). This group of stocks’ market valuations match ALXN’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| K | 27 | 629331 | -1 |

| HIG | 32 | 848897 | 2 |

| SWK | 26 | 1040404 | -1 |

| SNAP | 52 | 2118425 | 7 |

| Average | 34.25 | 1159264 | 1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 34.25 hedge funds with bullish positions and the average amount invested in these stocks was $1159 million. That figure was $2582 million in ALXN’s case. Snap Inc. (NYSE:SNAP) is the most popular stock in this table. On the other hand Stanley Black & Decker, Inc. (NYSE:SWK) is the least popular one with only 26 bullish hedge fund positions. Alexion Pharmaceuticals, Inc. (NASDAQ:ALXN) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 34.7% in 2019 through November 22nd and outperformed the S&P 500 ETF (SPY) by 8.5 percentage points. Hedge funds were also right about betting on ALXN as the stock returned 13.4% during the fourth quarter (through 11/22) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.