Many prominent investors, including Warren Buffett, David Tepper and Stan Druckenmiller, have been cautious regarding the current bull market and missed out as the stock market reached another high in recent weeks. On the other hand, technology hedge funds weren’t timid and registered double digit market beating gains. Financials, energy and industrial stocks initially suffered the most but many of these stocks delivered strong returns since November and hedge funds actually increased their positions in these stocks. In this article we will find out how hedge fund sentiment towards Eaton Corporation plc (NYSE:ETN) changed recently.

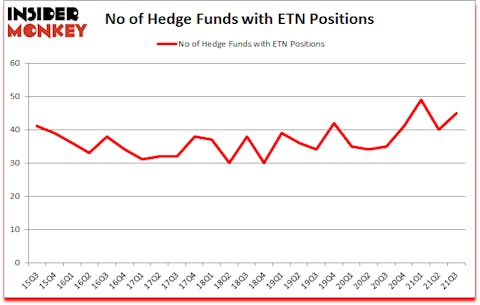

Is Eaton Corporation plc (NYSE:ETN) ready to rally soon? The best stock pickers were in a bullish mood. The number of long hedge fund bets increased by 5 recently. Eaton Corporation plc (NYSE:ETN) was in 45 hedge funds’ portfolios at the end of the third quarter of 2021. The all time high for this statistic is 49. Our calculations also showed that ETN isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings).

Dmitry Balyasny of Balyasny Asset Management

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium prices have more than doubled over the past year, so we go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. With all of this in mind we’re going to take a glance at the key hedge fund action encompassing Eaton Corporation plc (NYSE:ETN).

Do Hedge Funds Think ETN Is A Good Stock To Buy Now?

At the end of the third quarter, a total of 45 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 13% from the second quarter of 2021. On the other hand, there were a total of 35 hedge funds with a bullish position in ETN a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Eaton Corporation plc (NYSE:ETN) was held by Holocene Advisors, which reported holding $242.1 million worth of stock at the end of September. It was followed by Lansdowne Partners with a $183.2 million position. Other investors bullish on the company included AQR Capital Management, Millennium Management, and Balyasny Asset Management. In terms of the portfolio weights assigned to each position Lansdowne Partners allocated the biggest weight to Eaton Corporation plc (NYSE:ETN), around 8.63% of its 13F portfolio. Socorro Asset Management is also relatively very bullish on the stock, earmarking 2.92 percent of its 13F equity portfolio to ETN.

As industrywide interest jumped, some big names have been driving this bullishness. TwinBeech Capital, managed by Jinghua Yan, created the most valuable position in Eaton Corporation plc (NYSE:ETN). TwinBeech Capital had $14.9 million invested in the company at the end of the quarter. Benjamin A. Smith’s Laurion Capital Management also made a $9.5 million investment in the stock during the quarter. The other funds with new positions in the stock are Greg Eisner’s Engineers Gate Manager, Javier Velazquez’s Albar Capital, and Mika Toikka’s AlphaCrest Capital Management.

Let’s now review hedge fund activity in other stocks similar to Eaton Corporation plc (NYSE:ETN). We will take a look at Norfolk Southern Corp. (NYSE:NSC), Dominion Energy Inc. (NYSE:D), America Movil SAB de CV (NYSE:AMX), NIO Inc. (NYSE:NIO), FedEx Corporation (NYSE:FDX), América Móvil, S.A.B. de C.V. (NYSE:AMOV), and Northrop Grumman Corporation (NYSE:NOC). This group of stocks’ market values are closest to ETN’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NSC | 46 | 1049404 | -12 |

| D | 27 | 545194 | -7 |

| AMX | 11 | 167723 | -2 |

| NIO | 30 | 1138194 | -4 |

| FDX | 49 | 1682204 | -12 |

| AMOV | 1 | 300 | 0 |

| NOC | 29 | 910523 | -13 |

| Average | 27.6 | 784792 | -7.1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 27.6 hedge funds with bullish positions and the average amount invested in these stocks was $785 million. That figure was $1090 million in ETN’s case. FedEx Corporation (NYSE:FDX) is the most popular stock in this table. On the other hand América Móvil, S.A.B. de C.V. (NYSE:AMOV) is the least popular one with only 1 bullish hedge fund positions. Eaton Corporation plc (NYSE:ETN) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for ETN is 83.4. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 28.6% in 2021 through November 30th and still beat the market by 5.6 percentage points. Hedge funds were also right about betting on ETN as the stock returned 9% since the end of Q3 (through 11/30) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Eaton Corp Plc (NYSE:ETN)

Follow Eaton Corp Plc (NYSE:ETN)

Receive real-time insider trading and news alerts

Suggested Articles:

- 10 Best Tech Stocks To Invest in Now

- Top 10 Health Insurance Stocks to Buy

- 10 Best Stocks Under $10 in 2021

Disclosure: None. This article was originally published at Insider Monkey.