Insider Monkey finished processing more than 700 13F filings made by hedge funds and prominent investors. These filings show these funds’ portfolio positions as of June 30. In this article we are going to take a look at smart money sentiment towards Thomson Reuters Corporation (USA) (NYSE:TRI).

Sentiment is dropping to put it bluntly. Of the leading hedge funds tracked by our custom database that had owned the Thomson Reuters on March 31, 18% of them had sold out of the stock by June 30. Overall hedge fund ownership was also extremely low, as they owned just 0.50% of the company’s shares. We do like Thomson Reuters’ reliable dividend payments, which have currently yield 3.00%. The company has paid out dividends for 25 straight quarters, ranking it 23rd on our list of the 25 Best Dividend Stocks for Retirement.

In the financial world there are tons of gauges investors employ to appraise their stock investments. A duo of the less known gauges are hedge fund and insider trading signals. We have shown that, historically, those who follow the best picks of the best investment managers can outclass the S&P 500 by a healthy margin (see the details here).

Hedge fund activity in Thomson Reuters Corporation (USA) (NYSE:TRI)

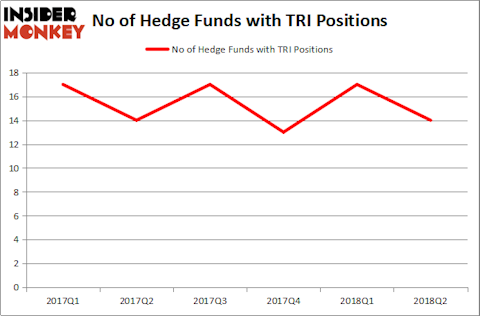

Heading into the fourth quarter of 2018, a total of 14 of the hedge funds tracked by Insider Monkey were bullish on this stock, a decline of 18% from the previous quarter. The graph below displays the number of hedge funds with bullish position in TRI over the last 6 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Millennium Management held the most valuable stake in Thomson Reuters Corporation (USA) (NYSE:TRI), which was worth $53.5 million at the end of the second quarter. On the second spot was D E Shaw, founded by David E. Shaw, which amassed $21.5 million worth of shares. Moreover, IBIS Capital Partners, Prana Capital Management, and Bridgewater Associates were also bullish on Thomson Reuters Corporation (USA) (NYSE:TRI), allocating a large percentage of their portfolios to this stock.

Judging by the fact that Thomson Reuters Corporation (USA) (NYSE:TRI) has experienced declining sentiment from the smart money, it’s easy to see that there was a specific group of fund managers that decided to sell off their positions entirely heading into Q3. At the top of the heap, Greg Poole’s Echo Street Capital Management cut the biggest position of all the hedgies tracked by Insider Monkey, valued at close to $8.9 million in stock, and Solomon Kumin’s Folger Hill Asset Management was right behind this move, as the fund dropped about $4.8 million worth. These moves are interesting, as aggregate hedge fund interest fell by 3 funds heading into Q3.

Let’s check out hedge fund activity in other stocks similar to Thomson Reuters Corporation (USA) (NYSE:TRI). We will take a look at Roper Industries, Inc. (NYSE:ROP), Lam Research Corporation (NASDAQ:LRCX), T. Rowe Price Group, Inc. (NASDAQ:TROW), and Chunghwa Telecom Co., Ltd (ADR) (NYSE:CHT). This group of stocks’ market caps match TRI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ROP | 26 | 926095 | 5 |

| LRCX | 43 | 1430344 | -13 |

| TROW | 25 | 373042 | 0 |

| CHT | 5 | 117540 | 2 |

As you can see these stocks had an average of 25 hedge funds with bullish positions and the average amount invested in these stocks was $712 million. That figure was $140 million in TRI’s case. Lam Research Corporation (NASDAQ:LRCX) is the most popular stock in this table. On the other hand Chunghwa Telecom Co., Ltd (ADR) (NYSE:CHT) is the least popular one with only 5 bullish hedge fund positions. Thomson Reuters Corporation (USA) (NYSE:TRI) is not the least popular stock in this group but hedge fund interest is still below average and there less money invested in it than all but one of those stocks. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard LRCX might be a better candidate to consider a long position in.

Disclosure: None. This article was originally published at Insider Monkey.