Out of thousands of stocks that are currently traded on the market, it is difficult to determine those that can really generate strong returns. Hedge funds and institutional investors spend millions of dollars on analysts with MBAs and PhDs, who are industry experts and well connected to other industry and media insiders on top of that. Individual investors can piggyback the hedge funds employing these talents and can benefit from their vast resources and knowledge in that way. We analyze quarterly 13F filings of over 700 hedge funds and, by looking at the smart money sentiment that surrounds a stock, we can determine whether it has potential to beat the market over the long-term. Therefore, let’s take a closer look at what smart money thinks about The Providence Service Corporation (NASDAQ:PRSC).

Is The Providence Service Corporation (NASDAQ:PRSC) worth your attention right now? Money managers are getting less bullish. The number of bullish hedge fund positions shrunk by 1 lately. Our calculations also showed that prsc isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s check out the recent hedge fund action regarding The Providence Service Corporation (NASDAQ:PRSC).

How are hedge funds trading The Providence Service Corporation (NASDAQ:PRSC)?

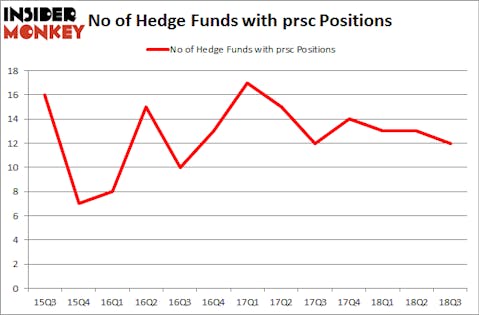

At Q3’s end, a total of 12 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -8% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in PRSC over the last 13 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Coliseum Capital was the largest shareholder of The Providence Service Corporation (NASDAQ:PRSC), with a stake worth $82.4 million reported as of the end of September. Trailing Coliseum Capital was Renaissance Technologies, which amassed a stake valued at $70.5 million. Alta Fundamental Advisers, Prosight Capital, and Millennium Management were also very fond of the stock, giving the stock large weights in their portfolios.

Judging by the fact that The Providence Service Corporation (NASDAQ:PRSC) has faced declining sentiment from hedge fund managers, it’s easy to see that there was a specific group of funds that slashed their entire stakes in the third quarter. It’s worth mentioning that Benjamin A. Smith’s Laurion Capital Management dumped the biggest investment of all the hedgies tracked by Insider Monkey, valued at about $0.4 million in stock. Dmitry Balyasny’s fund, Balyasny Asset Management, also dumped its stock, about $0.2 million worth. These moves are important to note, as total hedge fund interest fell by 1 funds in the third quarter.

Let’s now review hedge fund activity in other stocks similar to The Providence Service Corporation (NASDAQ:PRSC). We will take a look at United Financial Bancorp, Inc. (NASDAQ:UBNK), Adecoagro SA (NYSE:AGRO), Comtech Telecommunications Corp. (NASDAQ:CMTL), and Franklin Street Properties Corp. (NYSE:FSP). All of these stocks’ market caps match PRSC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| UBNK | 13 | 65660 | -1 |

| AGRO | 16 | 188658 | -1 |

| CMTL | 14 | 150226 | -1 |

| FSP | 7 | 23067 | 0 |

| Average | 12.5 | 106903 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.5 hedge funds with bullish positions and the average amount invested in these stocks was $107 million. That figure was $182 million in PRSC’s case. Adecoagro SA (NYSE:AGRO) is the most popular stock in this table. On the other hand Franklin Street Properties Corp. (NYSE:FSP) is the least popular one with only 7 bullish hedge fund positions. The Providence Service Corporation (NASDAQ:PRSC) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard AGRO might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.