Russell 2000 ETF (IWM) lagged the larger S&P 500 ETF (SPY) by more than 10 percentage points since the end of the third quarter of 2018 as investors first worried over the possible ramifications of rising interest rates and the escalation of the trade war with China. The hedge funds and institutional investors we track typically invest more in smaller-cap stocks than an average investor (i.e. only about 60% S&P 500 constituents were among the 500 most popular stocks among hedge funds), and we have seen data that shows those funds paring back their overall exposure. Those funds cutting positions in small-caps is one reason why volatility has increased. In the following paragraphs, we take a closer look at what hedge funds and prominent investors think of Potbelly Corp (NASDAQ:PBPB) and see how the stock is affected by the recent hedge fund activity.

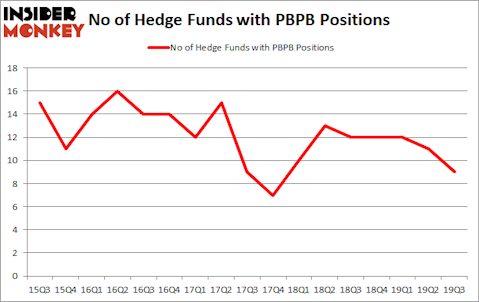

Potbelly Corp (NASDAQ:PBPB) was in 9 hedge funds’ portfolios at the end of the third quarter of 2019. PBPB has experienced a decrease in support from the world’s most elite money managers lately. There were 11 hedge funds in our database with PBPB holdings at the end of the previous quarter. Our calculations also showed that PBPB isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

If you’d ask most investors, hedge funds are viewed as unimportant, outdated investment vehicles of the past. While there are over 8000 funds in operation at the moment, Our experts look at the upper echelon of this club, around 750 funds. It is estimated that this group of investors administer the lion’s share of the smart money’s total capital, and by tracking their matchless picks, Insider Monkey has found many investment strategies that have historically outperformed the market. Insider Monkey’s flagship short hedge fund strategy defeated the S&P 500 short ETFs by around 20 percentage points a year since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Jim Simons of Renaissance Technologies

We leave no stone unturned when looking for the next great investment idea. For example Discover is offering this insane cashback card, so we look into shorting the stock. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We even check out this option genius’ weekly trade ideas. This December we recommended Adams Energy based on an under-the-radar fund manager’s investor letter and the stock gained 20 percent. Let’s take a glance at the key hedge fund action encompassing Potbelly Corp (NASDAQ:PBPB).

What have hedge funds been doing with Potbelly Corp (NASDAQ:PBPB)?

At the end of the third quarter, a total of 9 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -18% from the second quarter of 2019. On the other hand, there were a total of 12 hedge funds with a bullish position in PBPB a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Renaissance Technologies, holds the number one position in Potbelly Corp (NASDAQ:PBPB). Renaissance Technologies has a $8.3 million position in the stock, comprising less than 0.1%% of its 13F portfolio. The second largest stake is held by Ancora Advisors, managed by Frederick DiSanto, which holds a $5.1 million position; 0.2% of its 13F portfolio is allocated to the stock. Other hedge funds and institutional investors that are bullish include Arnaud Ajdler’s Engine Capital, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital and Bradley Louis Radoff’s Fondren Management. In terms of the portfolio weights assigned to each position Fondren Management allocated the biggest weight to Potbelly Corp (NASDAQ:PBPB), around 1.31% of its 13F portfolio. Engine Capital is also relatively very bullish on the stock, dishing out 0.88 percent of its 13F equity portfolio to PBPB.

Due to the fact that Potbelly Corp (NASDAQ:PBPB) has experienced a decline in interest from the entirety of the hedge funds we track, we can see that there lies a certain “tier” of hedge funds that decided to sell off their positions entirely in the third quarter. Interestingly, Jorge Paulo Lemann’s 3G Capital dropped the biggest investment of the “upper crust” of funds watched by Insider Monkey, totaling about $4.5 million in stock, and John Overdeck and David Siegel’s Two Sigma Advisors was right behind this move, as the fund dropped about $0.4 million worth. These moves are intriguing to say the least, as total hedge fund interest was cut by 2 funds in the third quarter.

Let’s go over hedge fund activity in other stocks similar to Potbelly Corp (NASDAQ:PBPB). We will take a look at Second Sight Medical Products Inc (NASDAQ:EYES), Sachem Capital Corp. (NYSE:SACH), Taseko Mines Limited (NYSE:TGB), and Assertio Therapeutics, Inc. (NASDAQ:ASRT). All of these stocks’ market caps are similar to PBPB’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EYES | 1 | 21 | -1 |

| SACH | 3 | 2541 | 1 |

| TGB | 4 | 5045 | 0 |

| ASRT | 12 | 18154 | 1 |

| Average | 5 | 6440 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 5 hedge funds with bullish positions and the average amount invested in these stocks was $6 million. That figure was $21 million in PBPB’s case. Assertio Therapeutics, Inc. (NASDAQ:ASRT) is the most popular stock in this table. On the other hand Second Sight Medical Products Inc (NASDAQ:EYES) is the least popular one with only 1 bullish hedge fund positions. Potbelly Corp (NASDAQ:PBPB) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Hedge funds were also right about betting on PBPB as the stock returned 16.1% during the fourth quarter (through the end of November) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.