Concerns over rising interest rates and expected further rate increases have hit several stocks hard since the end of the third quarter. NASDAQ and Russell 2000 indices are already in correction territory. More importantly, Russell 2000 ETF (IWM) underperformed the larger S&P 500 ETF (SPY) by about 4 percentage points in the first half of the fourth quarter. Hedge funds and institutional investors tracked by Insider Monkey usually invest a disproportionate amount of their portfolios in smaller cap stocks. We have been receiving indications that hedge funds were paring back their overall exposure and this is one of the factors behind the recent movements in major indices. In this article, we will take a closer look at hedge fund sentiment towards FedEx Corporation (NYSE:FDX).

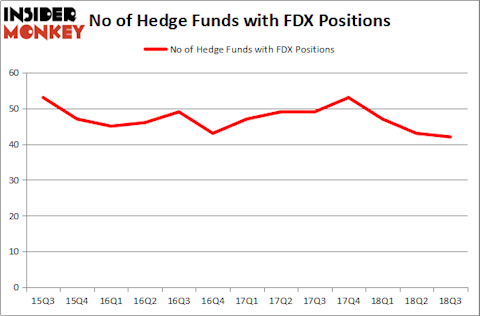

Is FedEx Corporation (NYSE:FDX) ready to rally soon? The best stock pickers are in a bearish mood. The number of long hedge fund positions were trimmed by 1 in recent months. Our calculations also showed that FDX isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 6.3% year to date (through December 3rd) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 18 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to take a gander at the new hedge fund action encompassing FedEx Corporation (NYSE:FDX).

What have hedge funds been doing with FedEx Corporation (NYSE:FDX)?

At the end of the third quarter, a total of 42 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -2% from the second quarter of 2018. By comparison, 53 hedge funds held shares or bullish call options in FDX heading into this year. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Bill & Melinda Gates Foundation Trust held the most valuable stake in FedEx Corporation (NYSE:FDX), which was worth $728.4 million at the end of the third quarter. On the second spot was Greenhaven Associates, which amassed $667.6 million worth of shares. Moreover, Southeastern Asset Management, AQR Capital Management, and Glenview Capital were also bullish on FedEx Corporation (NYSE:FDX), allocating a large percentage of their portfolios to this stock.

Since FedEx Corporation (NYSE:FDX) has faced falling interest from hedge fund managers, it’s safe to say that there is a sect of hedge funds that decided to sell off their full holdings heading into Q3. Intriguingly, Jonathon Jacobson’s Highfields Capital Management dropped the biggest stake of all the hedgies tracked by Insider Monkey, worth an estimated $248.3 million in call options, and Mike Masters’s Masters Capital Management was right behind this move, as the fund dumped about $220.4 million worth. These moves are intriguing to say the least, as total hedge fund interest was cut by 1 funds heading into Q3.

Let’s go over hedge fund activity in other stocks similar to FedEx Corporation (NYSE:FDX). These stocks are Activision Blizzard, Inc. (NASDAQ:ATVI), The PNC Financial Services Group Inc. (NYSE:PNC), Mondelez International Inc (NASDAQ:MDLZ), and Celgene Corporation (NASDAQ:CELG). All of these stocks’ market caps are closest to FDX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ATVI | 74 | 5781502 | 8 |

| PNC | 40 | 3063707 | 0 |

| MDLZ | 46 | 2497943 | 1 |

| CELG | 56 | 3473546 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 54 hedge funds with bullish positions and the average amount invested in these stocks was $3.70 billion. That figure was $3.46 billion in FDX’s case. Activision Blizzard, Inc. (NASDAQ:ATVI) is the most popular stock in this table. On the other hand PNC Financial Services Group Inc. (NYSE:PNC) is the least popular one with only 40 bullish hedge fund positions. FedEx Corporation (NYSE:FDX) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard ATVI might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.