Based on the fact that hedge funds have collectively under-performed the market for several years, it would be easy to assume that their stock picks simply aren’t very good. However, our research shows this not to be the case. In fact, when it comes to their very top picks collectively, they show a strong ability to pick winning stocks. This year hedge funds’ top 30 stock picks easily bested the broader market, at 6.7% compared to 2.6%, despite there being a few duds in there like Facebook (even their collective wisdom isn’t perfect). The results show that there is plenty of merit to imitating the collective wisdom of top investors.

Is Celgene Corporation (NASDAQ:CELG) undervalued? Investors who are in the know are selling. The number of bullish hedge fund bets went down by 1 lately. Our calculations also showed that CELG isn’t among the 30 most popular stocks among hedge funds.

In today’s marketplace there are dozens of signals market participants can use to evaluate their stock investments. A duo of the less utilized signals are hedge fund and insider trading indicators. Our experts have shown that, historically, those who follow the best picks of the elite investment managers can outpace the market by a healthy amount (see the details here).

Let’s check out the new hedge fund action surrounding Celgene Corporation (NASDAQ:CELG).

What have hedge funds been doing with Celgene Corporation (NASDAQ:CELG)?

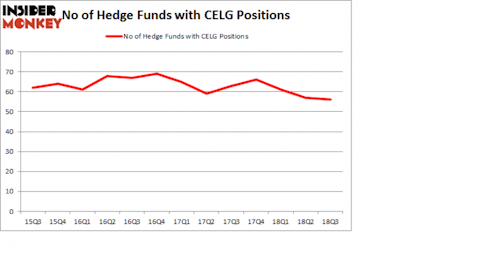

At Q3’s end, a total of 56 of the hedge funds tracked by Insider Monkey were long this stock, a change of -2% from the second quarter of 2018. On the other hand, there were a total of 66 hedge funds with a bullish position in CELG at the beginning of this year. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Due to the fact that Celgene Corporation (NASDAQ:CELG) has faced bearish sentiment from the entirety of the hedge funds we track, it’s safe to say that there lies a certain “tier” of funds that elected to cut their full holdings in the third quarter. It’s worth mentioning that Stephen DuBois’s Camber Capital Management dumped the largest position of all the hedgies tracked by Insider Monkey, worth close to $79.4 million in call options. Israel Englander’s fund, Millennium Management, also dumped its call options, about $25.4 million worth. These moves are important to note, as aggregate hedge fund interest fell by 1 funds in the third quarter.

Let’s go over hedge fund activity in other stocks similar to Celgene Corporation (NASDAQ:CELG). We will take a look at Occidental Petroleum Corporation (NYSE:OXY), Suncor Energy Inc. (NYSE:SU), Enterprise Products Partners L.P. (NYSE:EPD), and Chubb Limited (NYSE:CB). All of these stocks’ market caps resemble CELG’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| OXY | 35 | 1385135 | -7 |

| SU | 36 | 1013082 | 10 |

| EPD | 22 | 333199 | 0 |

| CB | 30 | 526955 | 7 |

| Average | 30.75 | 814593 | 2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 30.75 hedge funds with bullish positions and the average amount invested in these stocks was $815 million. That figure was $3.47 billion in CELG’s case. Suncor Energy Inc. (NYSE:SU) is the most popular stock in this table. On the other hand Enterprise Products Partners L.P. (NYSE:EPD) is the least popular one with only 22 bullish hedge fund positions. Compared to these stocks Celgene Corporation (NASDAQ:CELG) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.