There are several ways to beat the market, and investing in small cap stocks has historically been one of them. We like to improve the odds of beating the market further by examining what famous hedge fund operators such as Carl Icahn and George Soros think. Those hedge fund operators make billions of dollars each year by hiring the best and the brightest to do research on stocks, including small cap stocks that big brokerage houses simply don’t cover. Because of Carl Icahn and other elite funds’ exemplary historical records, we pay attention to their small cap picks. In this article, we use hedge fund filing data to analyze C.H. Robinson Worldwide, Inc. (NASDAQ:CHRW).

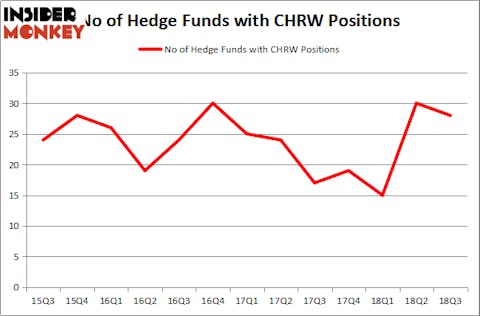

C.H. Robinson Worldwide, Inc. (NASDAQ:CHRW) was in 28 hedge funds’ portfolios at the end of the third quarter of 2018. CHRW investors should pay attention to a decrease in hedge fund sentiment of late, as there were 30 smart money investors in our database long the stock at the end of the previous quarter. Aside from the fact that the company is slowly losing some of its second quarter holders, we should mention that it is also not one of the 30 stocks billionaires are crazy about: Insider Monkey billionaire stock index). So, what does that mean? That the stock is not worth buying? Absolutely not. This is not enough data for us to decide if the company is a good buy, which is why we’ll continue with our analysis further.

In the financial world there are many tools market participants can use to grade publicly traded companies. Some of the best tools are hedge fund and insider trading moves. We have shown that, historically, those who follow the best picks of the top investment managers can beat the broader indices by a significant amount (see the details here).

We were thoroughly collecting more data about the company, when we stumbled upon RiverPark – Wedgewood Fund’ third quarter 2018 report, in which RiverPark shares its opinion on it, being one of its new positions. We bring you that part from the report:

“We purchased an initial position in C.H. Robinson in the third quarter and made a small addition to our position soon afterward. C.H. Robinson is a transportation broker whose largest business is full truckload (TL) trucking, with smaller businesses in less-than-truckload (LTL) trucking, intermodal (generally truck trailers or ocean shipping containers carried on railcars), and other forms of transportation. Robinson does not transport goods itself but provides value by matching demand from shipping customers with supply from transportation providers, or “carriers.” In Robinson’s case, those are usually small truckers who do not run sophisticated operations of their own. We had been monitoring C.H. Robinson for a period of nearly two years, as we had foreseen a long-term imbalance developing between truckload supply and demand, and we have expected Robinson to benefit eventually.

Long-haul truckers have been experiencing difficulties in recruiting drivers for many years. There are multiple reasons for this, some of them due to the changing nature of the American workforce over time. Among the most relevant factors specific to the trucking industry, we would note the unattractive lifestyle endured by long-haul drivers, who spend long hours on the road and suffer extended periods of time away from their families and homes. Furthermore, a resurgence of heavy industry in the U.S., driven especially by the emergence of the domestic energy industry, has created competition for this pool of labor, and laws preventing young workers from getting their Commercial Drivers Licenses until 21 years of age, which in turn has siphoned off many potential truckers into other trades, as high school graduates consider employment options at 18.

Compounding these problems, successive regulations restricting drivers’ “hours of service” (HOS) over the past fifteen years have further reduced the driving capacity of each existing driver.

The watershed event which focused our attention upon C.H. Robinson, however, was the requirement for all trucking companies to deploy electronic logging devices (ELDs) to track drivers’ hours, which came into effect at the end of 2017. While most large truckers had been using ELDs for some time; a very significant portion of the industry, however – perhaps as much as 80% – was not. Furthermore, our research over time has revealed that trucking companies that switched from paper logging to electronic logging in the past have found that the vast majority of their truckers (in fact, we always were told “100% of them”) had been in violation of HOS rules. This effectively meant that although the HOS regulations had not changed, companies which went from self-reported paper logs to automatic electronic logs suffered an effective loss of capacity – i.e. less hours per driver – when HOS were tracked accurately with the electronic devices. Our research has suggested that this caused a significant reduction in effective U.S. truckload capacity industry-wide, basically overnight, with our best estimate being a reduction of perhaps 5%-8%. While this may not sound like much to the casual reader, we would point out that much lower reductions in capacity of 1%-2%, due to previous HOS adjustment – which, remember, were skirted by the vast majority of the industry using paper logs – had caused major disruptions as recently as 2014. We also note that trucking comprises over 80% of domestic freight volumes, meaning that any reduction in trucking capacity is a very meaningful change for the entire US economy.”

On the next page, you can read more RiverPark’s thoughts on the company, as well as the rest of our analysis.

“In actuality, the ELD mandate has seen companies in a broad array of industries, from retailers to consumer products companies to heavy manufacturers, suddenly scrambling to find anyone with capacity to carry their goods, while finding that their shipping costs were rising dramatically when they did secure a carrier. Throughout 2018, it has been nearly impossible to listen to any quarterly earnings call with a company shipping any sort of product without hearing complaints about difficult shipping conditions. The spot market, where customers arrange for real-time, one-off shipments as needed, has been especially hard hit, with pricing running over +20% higher year- over-year for the last few quarters, at times approaching even +30%. Contract pricing – where customers will agree routes and prices, usually for an annual period – also has been very strong, in some cases reaching double-digit percentage gains. C.H. Robinson, as a transportation broker whose largest business is in long-haul trucking, would seem to be an obvious beneficiary of these market trends.

Investors noted the rising spot pricing in the truckload industry, which actually started moving a few quarters before the ELD deadline and jumped into C.H. Robinson much earlier than we had expected, and, indeed, earlier than it made much sense. Then, as the company proceeded to badly miss reported earnings for several quarters, while trucking industry fundamentals around it seemed very strong, the market suddenly became disenchanted with the company, causing its stock to take a roughly -20% hit in an otherwise surging market. This was the point when we finally became interested, because we think the market has missed a few things about this business model.

First, as we have seen in prior periods with a sudden reduction in truckload capacity, Robinson’s pricing philosophy generally sees them taking a significant margin hit for a period of time as trucking capacity tightens, plus the concomitant rise in spot pricing. Robinson favors annual contracts with their customers, while their costs (mostly spot) rise immediately, meaning there is a mismatch between rising spot pricing they are paying to trucking providers, and the contractual pricing they are receiving from their customers. This is why the company was not able to keep up with investors’ expectations as truckload fundamentals strengthened in front of the ELD deadline. We, on the other hand, had been expecting this cost/pricing mismatch, as we had experienced it in prior cycles, as illustrated below.

Second, after a great run in most stocks across the trucking industry (despite the shorter-term pullback seen for C.H. Robinson), many investors now seem to be taking their gains, with a broad narrative about the cycle being as good as it can get. We do not believe this narrative, especially as it pertains to C.H. Robinson, for two primary reasons:

- We believe the most important driver of the shortage of supply vs demand in the trucking industry is not cyclical strength (i.e. demand); we believe the most important driver of the supply/demand imbalance is secular in nature (i.e. a significant and immediate reduction in supply caused by the ELD mandate, which will take years to rebalance in any meaningful way). While rising demand definitely has played a part in the imbalance, and while economic weakness would be unhelpful, we see the industrial economy strengthening in the near term, if anything. More importantly, long-haul trucking holds the vast majority of share of U.S. transportation volumes, and we believe that only small bits of this volume can find its way to other modes of transportation, such as rail or air, without a major rethinking and overhaul of domestic supply chains. In short, we believe a supply/demand imbalance is here to stay for the foreseeable future in long-haul trucking, and this should lead to pricing strength, improving margins and returns, and sustained solid earnings growth across the industry.

- Robinson hasn’t even enjoyed the benefits of the tightening trucking market yet; in fact, has only managed to get on the right side of the cost/pricing equation in the most recent quarter, as the table above illustrates – and the benefits will begin appearing now. As annual contracts with outdated pricing roll off and are renegotiated at higher, current market pricing, Robinson finally will see margins, earnings, and cash flow growth rebounding. Furthermore, while we expect trucking providers to continue to enjoy rising pricing power, we expect pricing to rise at a lesser rate, meaning that Robinson most likely will enjoy a period during which the pricing they are charging to customers will be rising at a significantly greater rate than the pricing they are paying to their trucking

With valuation sitting only at roughly average historical levels, in comparison to the broad market trading at elevated historical levels, and with company fundamentals only inflecting positively just now and looking to remain healthy for the foreseeable future, we view C.H. Robinson is an attractive home for our clients’ capital.”

Continuing further with our analysis of the company, we’ll now take a glance at the latest hedge fund action encompassing C.H. Robinson Worldwide, Inc. (NASDAQ:CHRW).

What have hedge funds been doing with C.H. Robinson Worldwide, Inc. (NASDAQ:CHRW)?

At the end of the third quarter, a total of 28 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -7% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards CHRW over the last 13 quarters. With the smart money’s capital changing hands, there exists a select group of noteworthy hedge fund managers who were adding to their stakes considerably (or already accumulated large positions).

The largest stake in C.H. Robinson Worldwide, Inc. (NASDAQ:CHRW) was held by Luminus Management, which reported holding $84.3 million worth of stock at the end of September. It was followed by AQR Capital Management with a $70.3 million position. Other investors bullish on the company included Anchor Bolt Capital, Millennium Management, and Renaissance Technologies.

Since C.H. Robinson Worldwide, Inc. (NASDAQ:CHRW) has faced falling interest from hedge fund managers, we can see that there were a few money managers that elected to cut their full holdings last quarter. It’s worth mentioning that Anand Parekh’s Alyeska Investment Group dumped the biggest stake of the 700 funds watched by Insider Monkey, comprising an estimated $7.6 million in stock. Robert Pohly’s fund, Samlyn Capital, also dumped its stock, about $5 million worth. These moves are intriguing to say the least, as total hedge fund interest dropped by 2 funds last quarter.

Let’s also examine hedge fund activity in other stocks similar to C.H. Robinson Worldwide, Inc. (NASDAQ:CHRW). We will take a look at United Rentals, Inc. (NYSE:URI), Eastman Chemical Company (NYSE:EMN), CDW Corporation (NASDAQ:CDW), and Yum China Holdings, Inc. (NYSE:YUMC). This group of stocks’ market valuations are similar to CHRW’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| URI | 48 | 1131355 | 8 |

| EMN | 25 | 455394 | -2 |

| CDW | 28 | 627369 | 8 |

| YUMC | 26 | 386742 | 6 |

As you can see these stocks had an average of 32 hedge funds with bullish positions and the average amount invested in these stocks was $650 million. That figure was $458 million in CHRW’s case. United Rentals, Inc. (NYSE:URI) is the most popular stock in this table. On the other hand Eastman Chemical Company (NYSE:EMN) is the least popular one with only 25 bullish hedge fund positions. C.H. Robinson Worldwide, Inc. (NASDAQ:CHRW) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard URI might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.