How do you pick the next stock to invest in? One way would be to spend days of research browsing through thousands of publicly traded companies. However, an easier way is to look at the stocks that smart money investors are collectively bullish on. Hedge funds and other institutional investors usually invest large amounts of capital and have to conduct due diligence while choosing their next pick. They don’t always get it right, but, on average, their stock picks historically generated strong returns after adjusting for known risk factors. With this in mind, let’s take a look at the recent hedge fund activity surrounding argenx SE (NASDAQ:ARGX).

argenx SE (NASDAQ:ARGX) shareholders have witnessed a decrease in support from the world’s most elite money managers in recent months. Our calculations also showed that ARGX isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s take a peek at the recent hedge fund action regarding argenx SE (NASDAQ:ARGX).

What does smart money think about argenx SE (NASDAQ:ARGX)?

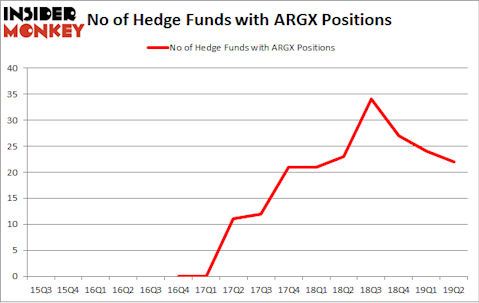

Heading into the third quarter of 2019, a total of 22 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -8% from the first quarter of 2019. The graph below displays the number of hedge funds with bullish position in ARGX over the last 16 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Redmile Group was the largest shareholder of argenx SE (NASDAQ:ARGX), with a stake worth $151.3 million reported as of the end of March. Trailing Redmile Group was Baker Bros. Advisors, which amassed a stake valued at $144.3 million. venBio Select Advisor, EcoR1 Capital, and Driehaus Capital were also very fond of the stock, giving the stock large weights in their portfolios.

Judging by the fact that argenx SE (NASDAQ:ARGX) has faced a decline in interest from the entirety of the hedge funds we track, we can see that there was a specific group of hedge funds that decided to sell off their positions entirely heading into Q3. Intriguingly, Mark Lampert’s Biotechnology Value Fund / BVF Inc dropped the largest investment of the “upper crust” of funds monitored by Insider Monkey, comprising about $10.1 million in stock, and Nick Thakore’s Diametric Capital was right behind this move, as the fund sold off about $0.3 million worth. These transactions are important to note, as total hedge fund interest dropped by 2 funds heading into Q3.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as argenx SE (NASDAQ:ARGX) but similarly valued. These stocks are Avalara, Inc. (NYSE:AVLR), Companhia Energetica de Minas Gerais (NYSE:CIG), Cousins Properties Incorporated (NYSE:CUZ), and Synovus Financial Corp. (NYSE:SNV). All of these stocks’ market caps are similar to ARGX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AVLR | 40 | 1166665 | 13 |

| CIG | 8 | 49080 | -1 |

| CUZ | 22 | 220870 | 0 |

| SNV | 36 | 703965 | -5 |

| Average | 26.5 | 535145 | 1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 26.5 hedge funds with bullish positions and the average amount invested in these stocks was $535 million. That figure was $792 million in ARGX’s case. Avalara, Inc. (NYSE:AVLR) is the most popular stock in this table. On the other hand Companhia Energetica de Minas Gerais (NYSE:CIG) is the least popular one with only 8 bullish hedge fund positions. argenx SE (NASDAQ:ARGX) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately ARGX wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); ARGX investors were disappointed as the stock returned -19.5% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks (view the video below) among hedge funds as many of these stocks already outperformed the market so far in 2019.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.