We can judge whether Alleghany Corporation (NYSE:Y) is a good investment right now by following the lead of some of the best investors in the world and piggybacking their ideas. There’s no better way to get these firms’ immense resources and analytical capabilities working for us than to follow their lead into their best ideas. While not all of these picks will be winners, research shows that these picks historically outperformed the market when we factor in known risk factors.

Is Alleghany Corporation (NYSE:Y) a good investment today? The best stock pickers are in a pessimistic mood. The number of bullish hedge fund bets were cut by 3 in recent months. Our calculations also showed that y isn’t among the 30 most popular stocks among hedge funds. Y was in 21 hedge funds’ portfolios at the end of September. There were 24 hedge funds in our database with Y holdings at the end of the previous quarter.

In the 21st century investor’s toolkit there are several tools shareholders can use to assess their holdings. Two of the less utilized tools are hedge fund and insider trading interest. Our researchers have shown that, historically, those who follow the best picks of the top money managers can trounce their index-focused peers by a significant amount (see the details here).

Let’s take a look at the fresh hedge fund action surrounding Alleghany Corporation (NYSE:Y).

Hedge fund activity in Alleghany Corporation (NYSE:Y)

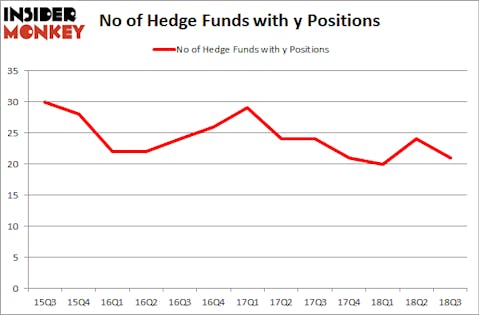

At the end of the third quarter, a total of 21 of the hedge funds tracked by Insider Monkey were long this stock, a change of -13% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in Y over the last 13 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists a few noteworthy hedge fund managers who were boosting their holdings significantly (or already accumulated large positions).

The largest stake in Alleghany Corporation (NYSE:Y) was held by Royce & Associates, which reported holding $94.7 million worth of stock at the end of September. It was followed by Polar Capital with a $88.6 million position. Other investors bullish on the company included AQR Capital Management, Lomas Capital Management, and Millennium Management.

Due to the fact that Alleghany Corporation (NYSE:Y) has faced declining sentiment from the aggregate hedge fund industry, it’s safe to say that there was a specific group of money managers who sold off their entire stakes in the third quarter. Interestingly, Martin Whitman’s Third Avenue Management dropped the biggest position of all the hedgies watched by Insider Monkey, comprising about $40.7 million in stock. Greg Poole’s fund, Echo Street Capital Management, also said goodbye to its stock, about $7.2 million worth. These moves are important to note, as total hedge fund interest fell by 3 funds in the third quarter.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Alleghany Corporation (NYSE:Y) but similarly valued. We will take a look at Lamb Weston Holdings, Inc. (NYSE:LW), Zions Bancorporation, National Association (NASDAQ:ZION), W.R. Berkley Corporation (NYSE:WRB), and Torchmark Corporation (NYSE:TMK). This group of stocks’ market valuations resemble Y’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LW | 34 | 909479 | 5 |

| ZION | 32 | 797532 | -2 |

| WRB | 17 | 425023 | 1 |

| TMK | 21 | 762817 | -2 |

| Average | 26 | 723713 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 26 hedge funds with bullish positions and the average amount invested in these stocks was $724 million. That figure was $366 million in Y’s case. Lamb Weston Holdings, Inc. (NYSE:LW) is the most popular stock in this table. On the other hand W.R. Berkley Corporation (NYSE:WRB) is the least popular one with only 17 bullish hedge fund positions. Alleghany Corporation (NYSE:Y) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard LW might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.