“Value has performed relatively poorly since the 2017 shift, but we believe challenges to the S&P 500’s dominance are mounting and resulting active opportunities away from the index are growing. At some point, this fault line will break, likely on the back of rising rates, and all investors will be reminded that the best time to diversify away from the winners is when it is most painful. The bargain of capturing long-term value may be short-term pain, but enough is eventually enough and it comes time to harvest the benefits.,” said Clearbridge Investments in its market commentary. We aren’t sure whether long-term interest rates will top 5% and value stocks outperform growth, but we follow hedge fund investor letters to understand where the markets and stocks might be going. That’s why we believe it would be worthwhile to take a look at the hedge fund sentiment on The Ultimate Software Group, Inc. (NASDAQ:ULTI) in order to identify whether reputable and successful top money managers continue to believe in its potential.

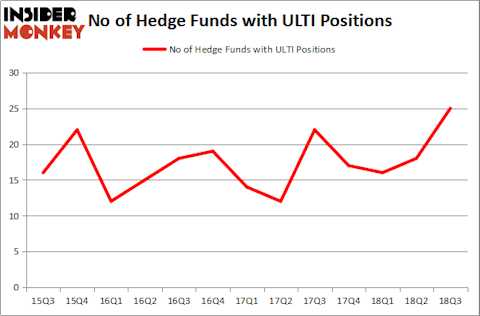

The Ultimate Software Group, Inc. (NASDAQ:ULTI) investors should pay attention to an increase in hedge fund sentiment in recent months. ULTI was in 25 hedge funds’ portfolios at the end of the third quarter of 2018. There were 18 hedge funds in our database with ULTI positions at the end of the previous quarter. Our calculations also showed that ULTI isn’t among the 30 most popular stocks among hedge funds.

In the 21st century investor’s toolkit there are tons of methods stock market investors employ to assess their holdings. A pair of the less known methods are hedge fund and insider trading sentiment. We have shown that, historically, those who follow the best picks of the top investment managers can outpace the broader indices by a solid amount (see the details here).

We’re going to analyze the new hedge fund action regarding The Ultimate Software Group, Inc. (NASDAQ:ULTI).

How have hedgies been trading The Ultimate Software Group, Inc. (NASDAQ:ULTI)?

At Q3’s end, a total of 25 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 39% from the previous quarter. By comparison, 17 hedge funds held shares or bullish call options in ULTI heading into this year. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Millennium Management held the most valuable stake in The Ultimate Software Group, Inc. (NASDAQ:ULTI), which was worth $84 million at the end of the third quarter. On the second spot was Balyasny Asset Management which amassed $80.6 million worth of shares. Moreover, Alyeska Investment Group, Holocene Advisors, and Columbus Circle Investors were also bullish on The Ultimate Software Group, Inc. (NASDAQ:ULTI), allocating a large percentage of their portfolios to this stock.

With a general bullishness amongst the heavyweights, some big names have been driving this bullishness. Holocene Advisors, managed by Brandon Haley, created the largest position in The Ultimate Software Group, Inc. (NASDAQ:ULTI). Holocene Advisors had $58.4 million invested in the company at the end of the quarter. Principal Global Investors’s Columbus Circle Investors also made a $34.9 million investment in the stock during the quarter. The other funds with brand new ULTI positions are Peter Muller’s PDT Partners, John Overdeck and David Siegel’s Two Sigma Advisors, and D. E. Shaw’s D E Shaw.

Let’s check out hedge fund activity in other stocks similar to The Ultimate Software Group, Inc. (NASDAQ:ULTI). We will take a look at BanColombia S.A. (NYSE:CIB), Molson Coors Brewing Company (NYSE:TAP), Alliant Energy Corporation (NYSE:LNT), and Cabot Oil & Gas Corporation (NYSE:COG). All of these stocks’ market caps are closest to ULTI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CIB | 5 | 101550 | 0 |

| TAP | 31 | 557374 | 12 |

| LNT | 20 | 327530 | 4 |

| COG | 28 | 1032899 | 3 |

| Average | 21 | 504838 | 4.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21 hedge funds with bullish positions and the average amount invested in these stocks was $505 million. That figure was $439 million in ULTI’s case. Molson Coors Brewing Company (NYSE:TAP) is the most popular stock in this table. On the other hand BanColombia S.A. (NYSE:CIB) is the least popular one with only 5 bullish hedge fund positions. The Ultimate Software Group, Inc. (NASDAQ:ULTI) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard TAP might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.